Companies and Brands

China Moves to Cut Smoking, Cigarette Advertising

Published:

Last Updated:

Draft legislation has been published on the State Council’s website, presumably for public comment. A proposed ban would prohibit smoking in indoor public places and “outdoor living spaces” in schools, colleges, women’s and children’s hospitals, and fitness venues. Smoking outdoors would be allowed only in designated areas. The proposed legislation also bans the sale of cigarettes to minors through vending machines and would eliminate some smoking scenes from movies and TV shows.

The Asia-Pacific region is the largest market in the world for tobacco products, both in terms of volume and revenues, and China is expected to be the leading contributor to those sales. China’s state-controlled China National Tobacco Company (CNTC) held 43% of the global market for cigarettes in 2013. Philip Morris International Inc. (NYSE: PM) was the largest privately held cigarette seller with 14% of the global market.

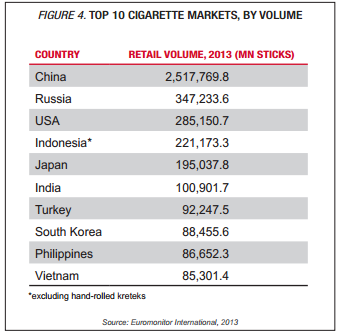

Sales of cigarettes in China totaled $205 billion in 2013, nearly 10-times the $27 billion spent on cigarettes in the second-largest market, Russia. The country signed the World Health Organization’s framework convention on tobacco control in 2003, which requires a “comprehensive ban on all tobacco advertising, promotion, and sponsorship.” One reason for China’s delay in adopting stricter prohibitions on tobacco advertising and smoking is that the government raked in nearly $132 billion from tobacco sales last year. The chart below shows the vast gap between China and the other nine top cigarette markets.

Philip Morris in 2005 signed a 10-year agreement with CNTC to distribute its best-selling Marlboro brand in China. That has done little to help PM’s sales in China, where CNTC is reported to have a 98% market share. Marlboro sales are further damaged by counterfeiters.

Given that the government is looking to crack down on smoking, chances that Philip Morris will see a boost in its share of the Chinese market are pretty low. In fact, it would not be a big surprise if the company’s deal with CNTC were allowed to fade away.

ALSO READ: How Will Philip Morris Sales Look Next Year?

Credit card companies are pulling out all the stops, with the issuers are offering insane travel rewards and perks.

We’re talking huge sign-up bonuses, points on every purchase, and benefits like lounge access, travel credits, and free hotel nights. For travelers, these rewards can add up to thousands of dollars in flights, upgrades, and luxury experiences every year.

It’s like getting paid to travel — and it’s available to qualified borrowers who know where to look.

We’ve rounded up some of the best travel credit cards on the market. Click here to see the list. Don’t miss these offers — they won’t be this good forever.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.