Nike Inc. (NYSE: NKE) released its fiscal third-quarter financial results on Thursday after the close of trading. The company had very strong earnings, but they would have been far better had currency issues not weighed on revenues. The sports apparel giant reported $0.89 in earnings per share (EPS) on $7.46 billion in revenue, compared to Thomson Reuters consensus estimates of $0.84 in EPS on $7.62 billion in revenue. In the same quarter of the previous year, the sports apparel giant posted EPS of $0.76 and revenue of $6.97 billion. 24/7 Wall St. wanted to see whether analysts were changing their views here.

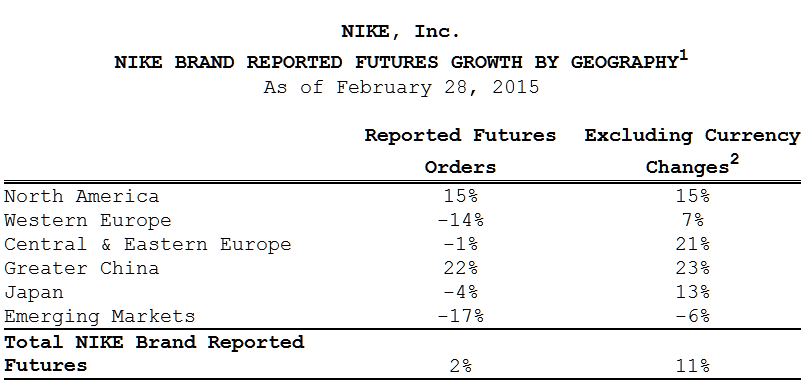

The key statistic from the report was that worldwide futures orders scheduled for delivery between March 2015 and July 2015 were up only 2%, but they would have been up 11% excluding currency changes (FX). On the next page, 24/7 Wall St. included a full table detailing what played into this discrepancy.

In our own 2015 Bull and Bear Case for Nike, we noted that Nike’s consensus analyst price target was $102.00 at the time — and this would have implied upside of 6.1% this year. That is now going to be a higher consensus price target from the looks of it. Following the release of earnings, analysts made the following calls on the future of Nike.

ALSO READ: 6 Big Dividend Hikes Expected Soon

Credit Suisse

Credit Suisse sees the underlying demand for this sports apparel giant as healthy, and currency headwinds, while strong, are being effectively managed. The firm continues to see ample opportunity for Nike to drive sustainable EPS growth at a teen’s rate, as high-single digit revenue growth is combined with margin expansion led by the global roll-out of category offense.

With revenues re-accelerating and significant progress made on restructuring initiatives, Credit Suisse believes the continued recovery in profitability is likely over the next 12 to 18 months. Should Nike see a return to peak operating margin in these regions, there is potential for 100 to 150 basis contribution to total company operating margin and $0.40 to $0.60 in incremental earnings per share.

In terms of the domestic scene, growth is expected to accelerate in upcoming quarters, although continued inventory flow challenges are expected to affect revenue and margins in the region for the next two quarters. Credit Suisse views this headwind as temporary and expects a rebound to double-digit growth going forward.

Credit Suisse reiterated an Outperform rating for Nike and raised its price target to $106 from $99, implying an upside of about 4%. In terms of its other estimates, the 2015 fiscal year revenue estimates were moved up from $30.365 billion to $30.232 billion, while EPS estimates remained at $3.53. The 2016 fiscal year estimates were increased to $3.98 in EPS and $31.880 billion revenue from $3.83 in EPS and $31.034 billion in revenue.

ALSO READ: 6 Dream Mergers That Ought to Happen

Merrill Lynch

Bank of America Merrill Lynch noted the discrepancy, and also that Nike’s gross margin continues to look favorable (excluding FX), supported by rising average selling prices and a favorable mix shift. The firm also sees global futures remaining strong on share gains in North America and Western Europe, as well as accelerating growth in China.

Growth in futures was led by continued strength in North America (+15%), Western Europe (+7%), Central/Eastern Europe (+21%) and an acceleration in China (+23%). The firm believes Nike is managing its FX exposure through hedging programs and working with partners to source in local currencies, which should reduce pressure on Nike’s earnings. As a result, Merrill Lynch maintains its Buy rating for Nike and raised its price target to $115 from $110, implying upside of nearly 13% from current prices.

Canaccord Genuity

Canaccord Genuity analyst, Camilo Lyon, maintained a hold rating and increased the price target to $96 from $93, implying a downside of 6%, and he also said:

While overall demand continues to be robust (particularly in basketball, sportswear, and parts of running), we are less inclined to be aggressive on the stock at 25x forward earnings (we prefer FL, and UA whose FX exposure is minimal). That said, in the current FX environment, companies that have strong core growth are being rewarded despite FX pressures on reported results — NKE falls into this camp.

Sterne Agee

The analysts at Sterne Agee decided to only maintain a Neutral rating. They called Nike a great company, but also said that the stock is fairly valued. The report said:

As demonstrated by the 11% (FX neutral) futures orders, Nike continues to take share. Continued elevated investments and FX pressures keep us sidelined. Valuation of over 26 times our 2016 EPS estimate is fair and we do not see much upside to the stock at this time. We expect the stock to remain range bound for some time. Foot Locker is the better way to capture Nike’s strength, as Foot Locker has the ability to curate the best of all athletic brands. Raising 2015 from $3.42 to $3.50 due to the third quarter beat. Maintaining 2016 EPS of $3.85.

Elsewhere

- Janney Capital Markets reiterated a Buy rating for Nike and raised its price target to $110 from $100.

- Telsey Advisory maintained a Market Perform rating for Nike and lowered its price target to $106 from $109.

Nike shares had a consensus analyst price target of $102.24, but again that is likely to rise once all of the higher analyst targets start to get factored into the equation. Shares of Nike were up 4.5% at $102.70 Friday morning, in a 52-week trading range of $70.60 to $99.76.

ALSO READ: Stifel Calls a Bottom in These 5 Oil Stocks

Are You Still Paying With a Debit Card?

The average American spends $17,274 on debit cards a year, and it’s a HUGE mistake. First, debit cards don’t have the same fraud protections as credit cards. Once your money is gone, it’s gone. But more importantly you can actually get something back from this spending every time you swipe.

Issuers are handing out wild bonuses right now. With some you can earn up to 5% back on every purchase. That’s like getting a 5% discount on everything you buy!

Our top pick is kind of hard to imagine. Not only does it pay up to 5% back, it also includes a $200 cash back reward in the first six months, a 0% intro APR, and…. $0 annual fee. It’s quite literally free money for any one that uses a card regularly. Click here to learn more!

Flywheel Publishing has partnered with CardRatings to provide coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.