Companies and Brands

What to Look For in Keurig Green Mountain Earnings

Published:

Last Updated:

For the year to date, shares of Keurig Green Mountain Inc. (NASDAQ: GMCR) have lost more than 16% of their value and trade much closer to their 52-week low of $90.35 than to the 52-week high of $158.87. The coffee roaster, seller and maker of the Keurig single-cup brewing system reports fiscal second-quarter earnings after markets close on Wednesday, and analysts are expecting earnings per share (EPS) of $1.05 on revenues of $1.15 billion. In the same period a year ago, the company posted EPS of $1.08 on revenues of $1.1 billion.

The share price currently is about what it was in late February of 2014 following the announcement by Coca-Cola that it was acquiring a significant stake in the Keurig. It has gotten some bounces since then, when it reported better-than-expected earnings per share in the three quarters before seeing a reversal at the end of its first quarter of fiscal 2015.

What has been missing are signs of growth in the stock price as the company introduces new products that should juice revenues and profits. The lingering effects of the massive recall of 7 million mini-brewers last December are not helping the stock either.

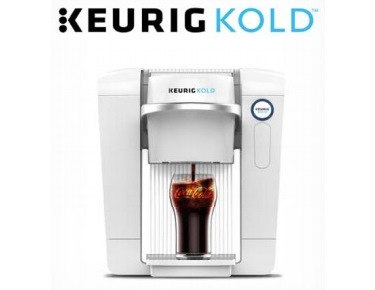

The company’s Keurig Kold system is due to hit North American retail shelves this fall with a lineup of cold beverages from Coca-Cola, Dr Pepper, Canada Dry and others. Keurig thinks that the market for this type of device is worth more than $50 billion in sales, about 10 times the volume for hot-drink brewing devices. That potential market will be competing with the convenience of buying the beverages already mixed and ready to drink in cans and bottles. Keurig had better hope that the market is as big as it thinks or there will be more trouble ahead.

ALSO READ: SodaStream Earnings Pop and Fizzle

Neither Keurig nor analysts that follow the company expect a lot from the second fiscal quarter. The company has already said that it expects sales to grow faster in the second half of its fiscal year, and the company expects some boost in its fourth quarter from sales of the Keurig Kold system. Keurig-watchers should pay particular attention to what the company has to say here. If it lowers its expectations, well, a word to the wise.

Shares traded flat just before noon on Wednesday, at $110.00 in a 52-week range of $109.44 to $158.87. The consensus price target on the stock is $139.50 and the high target is $175.00.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.