Companies and Brands

3 Pressures for Etsy Act as a Trifecta of Gloom

Published:

Last Updated:

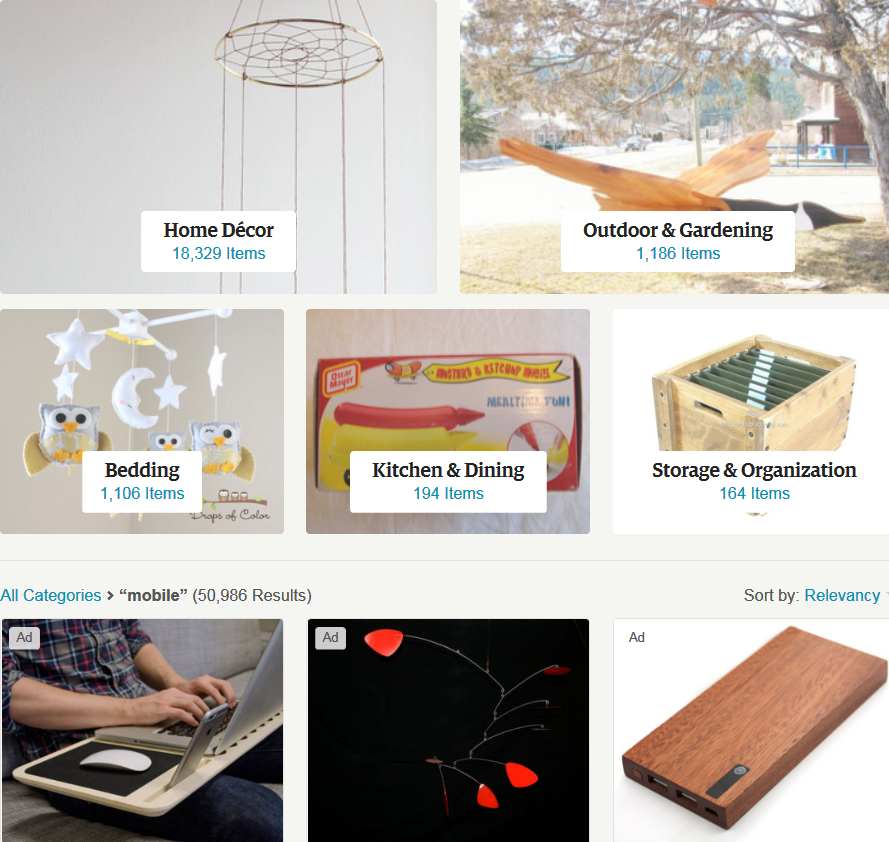

Etsy Inc. (NASDAQ: ETSY) is a well-run company, with a great outlet for those who make crafts and hand-made goods, that simplifies tasks for many people who create things. Unfortunately, it has three serious problems. Some of those problems have been known and might be in the share price already.

Amazon.com Inc. (NASDAQ: AMZN) has been a thorn in Etsy’s side. Amazon was always a potential threat, but it now it has formally launched the Handmade service on the Amazon retail network.

Amazon said that Handmade at Amazon is its new store on Amazon.com for invited artisans to sell their handcrafted goods. It allows for an Artisan Profile page, and gives craft-makers the ability to have product pages and e-commerce sales. Despite an initial public offering from Etsy, Jeff Bezos and Amazon are generally considered more than formidable when it comes to competing for business.

Another issue facing Etsy is a lock-up expiration that is taking place this week. Almost 56 million shares of Etsy’s common stock are being made available for sale. Some 22 million or so of those shares are held by officers, directors and large holders of the stock.

The only good news for Etsy and other post-IPOs is that there is rarely an all-out exodus from the stock. That being said, Etsy shares have been gutted since its IPO with a loss of about half.

The third issue impacting Etsy is a trend of negative analyst calls. The boutique firm Monness Crespi & Hardt initiated analyst coverage on Etsy with a dismal “Sell” rating on Monday. The firm also issued a downside price target of $10.00.

At the end of September, Wedbush Securities maintained its “Underperform” rating, a “Sell” equivalent call elsewhere, with an even less-appealing $9.00 price target.

All of this is not exactly the trifecta that Etsy’s shareholders would want to deal with in a very short period of a few days. Etsy shares were down 7.7% at $12.79 in mid-day trading on Monday. The stock’s consensus analyst price target is closer to $16.00 and its 52-week range is $11.85 to $37.74.

The only good news here is that the Etsy short interest has actually shrunk. Etsy had some 8.09 million shares listed in its short interest as of September 30, down from a peak of more than 10.5 million shares in mid-July.

After two decades of reviewing financial products I haven’t seen anything like this. Credit card companies are at war, handing out free rewards and benefits to win the best customers.

A good cash back card can be worth thousands of dollars a year in free money, not to mention other perks like travel, insurance, and access to fancy lounges.

Our top pick today pays up to 5% cash back, a $200 bonus on top, and $0 annual fee. Click here to apply before they stop offering rewards this generous.

Flywheel Publishing has partnered with CardRatings for our coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.