Companies and Brands

What the Drop in Gun Stocks Means for Gun Demand Under Trump Over Clinton

Published:

Last Updated:

For years there has been a driving force behind the gun trade, more than fears of terrorism and mass shootings. That force has been the fear of much more restricted gun control. President Obama was not successful in his gun control efforts despite the years of gun control rhetoric. There was a stronger belief that Hillary Clinton would been more successful in gun control efforts. After all, Bill Clinton was able to get more gun control. With Donald Trump as president, and with his endorsement by the Nation Rifle Association, the fears of much more restrictive gun control are likely to take a breather in or after 2017. The end result, with some caveats, is likely to be less and less of a gun-craze fueling demand.

24/7 Wall St. has tracked aspects of the gun trade for years. The recent stock price pullbacks in the gun stocks have caught some analysts and investors by surprise. Frankly, it shouldn’t have been a shock at all.

Gun control efforts have continued in California, and that may continue unless executive orders at the federal level change that. 24/7 Wall St. recently tracked the 10 hardest states to buy a gun and the easiest states to buy guns, as well as the 10 states with the most gun violence and the 10 states with the least gun violence.

When Smith & Wesson Holding Corp. (NASDAQ: SWHC) reported its quarterly earnings after the markets closed on Thursday, you already should have assumed that the craze was going to be less ahead. Again, taking the fear out of gun buyers means that they will become far more measured and less rushed to go buy more guns and more ammunition each time there is a shooting incident or on each report of terrorism. If you do not believe this to be true, go do a Google search for “gun salesman of the century” and see what comes up. Hint: it’s not a salesman at the top gun-maker.

Smith & Wesson’s earnings were $0.68 per share on $233.5 million in revenue. The Thomson Reuters consensus estimates had called for $0.56 per share and revenue of $227.61 million. In the same period of last year, the gun maker reported $0.25 in EPS and revenue of $143.24 million. The reason for such a large jump was that Hillary Clinton had dominated the polls that whole quarter, and there was a fear that the Clinton era of gun control would be more likely than President Obama’s efforts. Again, demand pressure.

As for guidance, Smith & Wesson said that it expects earnings to be in the range of $0.52 to $0.57 per share and revenues between $230 million to $240 million for the current quarter. The consensus estimates were $0.59 in EPS and $237.74 million in revenue.

Over the past week, shares of Smith & Wesson dropped by more than 11%, with the stock down 12% at $21.10 on Friday’s close. It has a consensus price target of $28.44 and a 52-week range of $18.42 to $31.19. The shares were trading at $28.45 on November 8, but it was a $3 stock in mid-2011.

If anyone was all that surprised by Friday’s drop, it may be a lack of understanding about the metrics that now drive and have been driving gun demand in recent months and years.

Sturm, Ruger & Co. Inc. (NYSE: RGR) is as closely tied to Smith & Wesson as any company out there. They have the exact same business model, and the market cap of $953 million compares with the $1.2 billion of Smith & Wesson. Again, these companies are almost interchangeable for investors. Shares of Sturm Ruger were down 5.7% at $50.25 on Friday, with a 52-week range of $47.15 to $78.09 and a consensus price target of closer to $80. On a dividend adjusted basis, Sturm Ruger shares were trading at $64.40 on November 8. Its chart shows that it was a $22 stock back in the first half of 2011.

Vista Outdoor Inc. (NYSE: VSTO) has been diversifying itself ahead of and after its split with Alliant/Orbital. This is the largest maker of ammunition in the United States, supplying law enforcement, military, government and consumers with an endless array of ammunition brands. Vista Outdoor shares closed down just 0.4% at $39.66 on Friday, versus a November 8 price of $38.94. The 52-week range is $37.00 to $53.91, and the consensus analyst target is $49.10.

Some of Vista Outdoor’s brands include the following: Federal Premium, Speer, American Eagle, Blazer, CCI, Estate Cartridge, Stevens, Fusion, Savage Arms, Savage Range Systems, Force on Force and Independence.

Olin Corp. (NYSE: OLN) is another company with shares often tied to the gun trade. Olin closed down 1% at $25.94 on Friday. It has a $4.3 billion market cap, a 52-week trading range of $12.29 to $26.93 and a consensus price target of $25.70. What is different about Olin shares, versus pure gun trade stocks, is that they were trading at $22.45 on November 8. Olin is considered a chemical products maker, but one of its three segments is guns focused: Chlor Alkali Products and Vinyls, Epoxy and Winchester.

Cabela’s Inc. (NYSE: CAB) had been a gun trade stock for years, but now it is in a pending merger with Bass Pro Shops. At $62.84, Cabela’s shares have a 52-week range of $38.90 to $63.60.

What investors should likely prepare for is that the consensus analyst targets of gun stocks should be coming down. Keep in mind that if a Wall Street analyst covering gun stocks lives in or around New York City, there is a real good chance he or she cannot even legally buy a gun with ease.

Before thinking that the gun stocks will die off or face endless wrecks ahead, keep in mind that these stocks are generally well off their highs already. We would still expect that there would again be surges in these stocks around incidents of terrorism or mass shootings.

Again, Trump is considered very gun-friendly and the NRA backed him. That means that the gun-buying portion of the public’s insatiable demand may have just been given a reason (Clinton’s loss and Obama’s departure) to slow down some of the endless gun purchases. Also, you don’t hear much about doomsday preppers any more (and preppers made for a multi-billion economic footprint in years past). We have even heard gun and ammunition sellers talk about a return to more normal demand trends without the massive surges in demand that led to shortages and price hikes. This likely means more normalized margins for gun and ammo makers ahead.

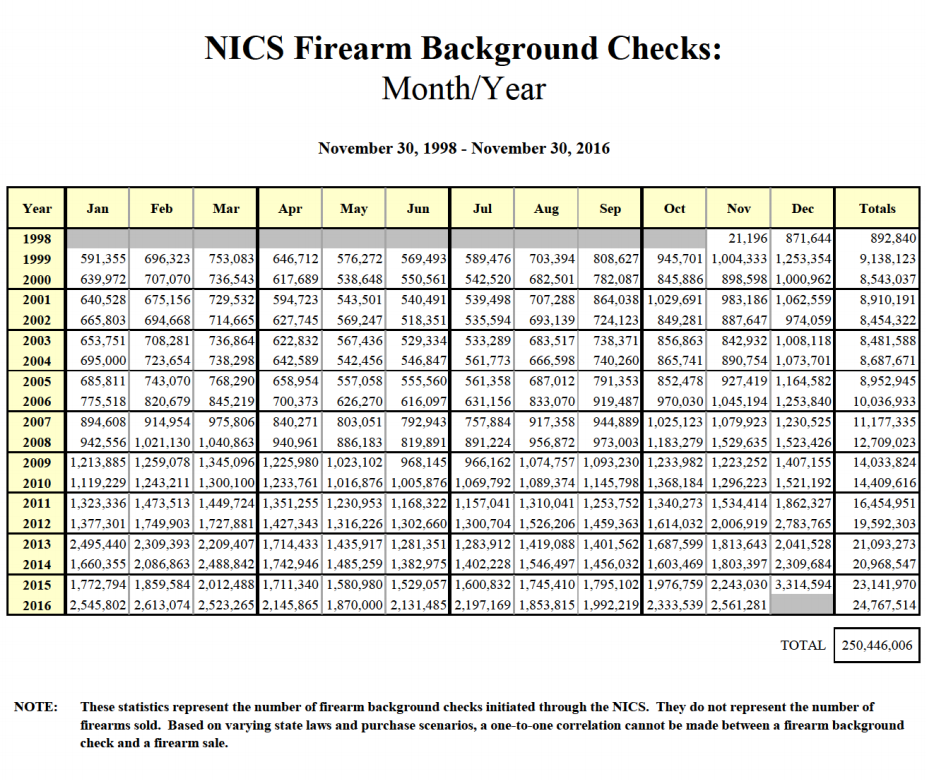

Firearm background checks were up massively in November and October and have been much stronger in the Obama years than in the Bush years (see FBI chart below on background checks, even though these do not correlate one-on-one with total numbers of guns sold). That demand is likely to abate in the months or quarters ahead.

More evidence for lower gun demand is that so few gun owners own a massive portion of all guns. One study showed that just 3% of gun owners own almost half of the guns.

Even if there are terror attacks or more mass shootings, the craze demand trends that were in place over the Obama years could easily take a breather after 2017. One serious caveat that could keep gun demand high is if gun prices drop handily from supply gluts. A second caveat would be a drastic rise in crime or if protesters end up turning more toward insurrection.

Stay tuned.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.