Companies and Brands

More Than Half in Marijuana Industry Concerned About Trump Administration

Published:

Last Updated:

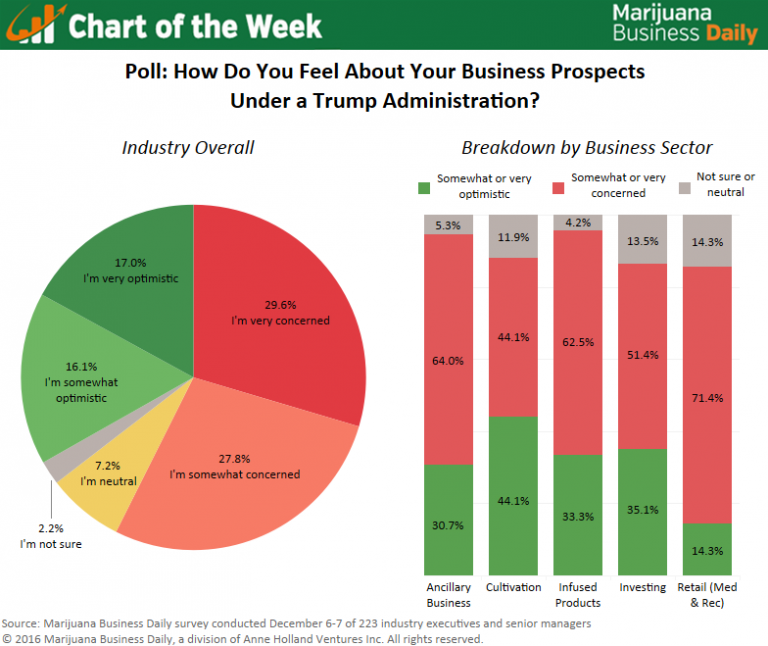

The election of Donald Trump and his subsequent nominees to several key posts in his incoming administration have raised a lot of concerns in the marijuana industry. According to a recent online survey, more than half (57.4%) of industry players are “somewhat” or “very” concerned about their business prospects under a Trump administration. More than half that total (30%) are “very” concerned.

About a third of respondents to the online survey conducted by Marijuana Business Daily say they are “somewhat” (16.1%) or “very” (17%) optimistic about their prospects. That correlates with a pre-election poll of industry executives in which 32% said they planned to vote for Trump.

Among the various industry sectors, growers were evenly split: they represent the most upbeat (44%) group, but an equal percentage were also pessimistic. Retailers (71.4%) were the most pessimistic. Just 14.3% of retailers are optimistic.

The industry also got a bit of good news last week with the enactment of the continuing resolution that will keep the federal government running through April 2017. Included in the measure was an extension of the Rohrabacher-Farr amendment that prohibits the federal government from spending any funds to interfere with state medical marijuana programs.

While the reprieve from a possible change in enforcement if Alabama Senator Jeff Sessions is confirmed as Trump’s attorney general may be only temporary, at least it gives medical marijuana advocates some time to marshal their forces. Representative Dana Rohrabacher (R-CA) has said he is confident that the amendment will be renewed by Congress. He also hopes that Congress will extend the protection to recreational marijuana laws as well.

Here’s a chart from Marijuana Business Daily showing the results of its latest survey:

Let’s face it: If your money is just sitting in a checking account, you’re losing value every single day. With most checking accounts offering little to no interest, the cash you worked so hard to save is gradually being eroded by inflation.

However, by moving that money into a high-yield savings account, you can put your cash to work, growing steadily with little to no effort on your part. In just a few clicks, you can set up a high-yield savings account and start earning interest immediately.

There are plenty of reputable banks and online platforms that offer competitive rates, and many of them come with zero fees and no minimum balance requirements. Click here to see if you’re earning the best possible rate on your money!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.