Companies and Brands

A Single Tiny Change on Nutrition Labels Could Save Many Lives

Published:

Last Updated:

Nearly a million cases of heart disease and diabetes could be prevented by the implementation of one small change on food ingredient labels.

According to a study published Monday in Circulation, a journal of the American Heart Association, a proposed change to the U.S. Food and Drug Administration’s policy for labeling the sugar content of foods could prevent an estimated 354,400 instances of cardiovascular disease and 599,300 cases of diabetes — a disease whose warning signs too many people ignore — between now and 2037. This would result in a savings of $31 billion in health care costs or $61.9 billion in overall societal costs (including lost productivity and informal care costs).

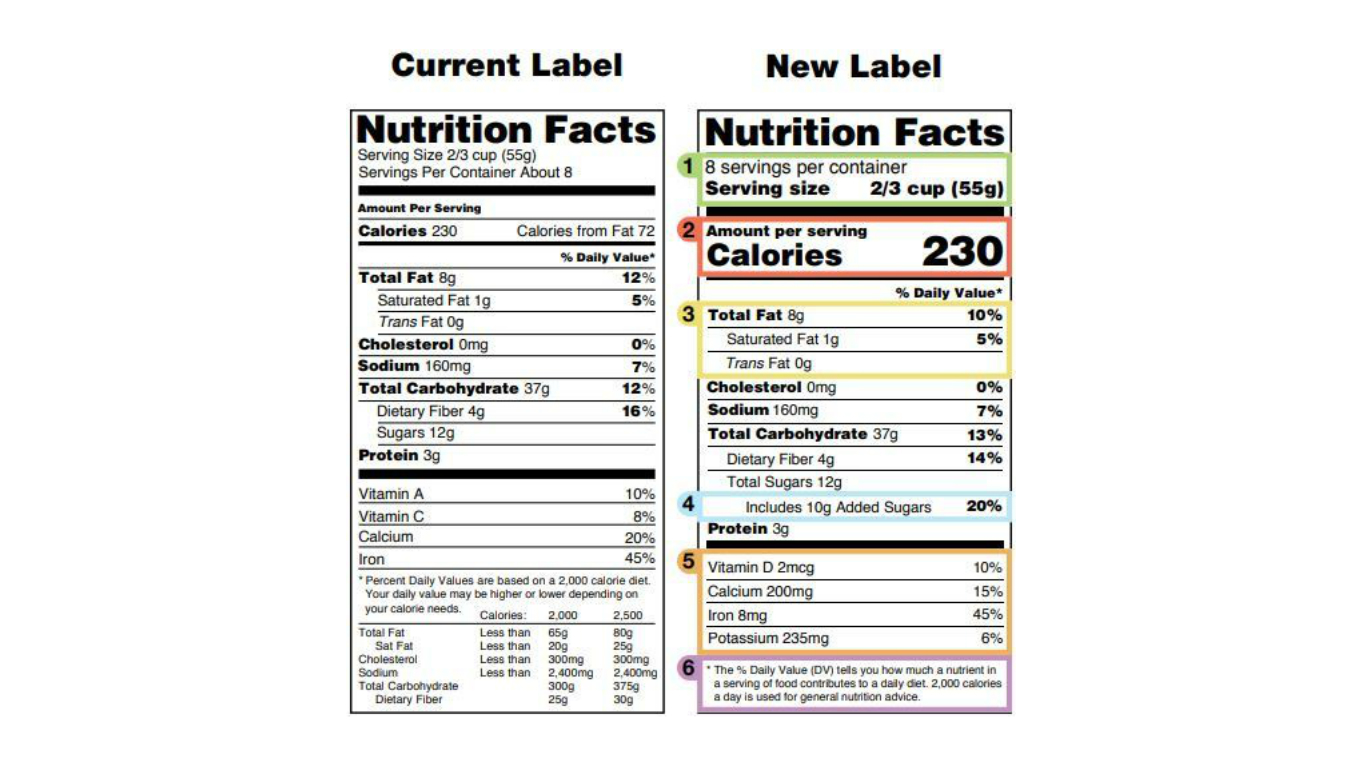

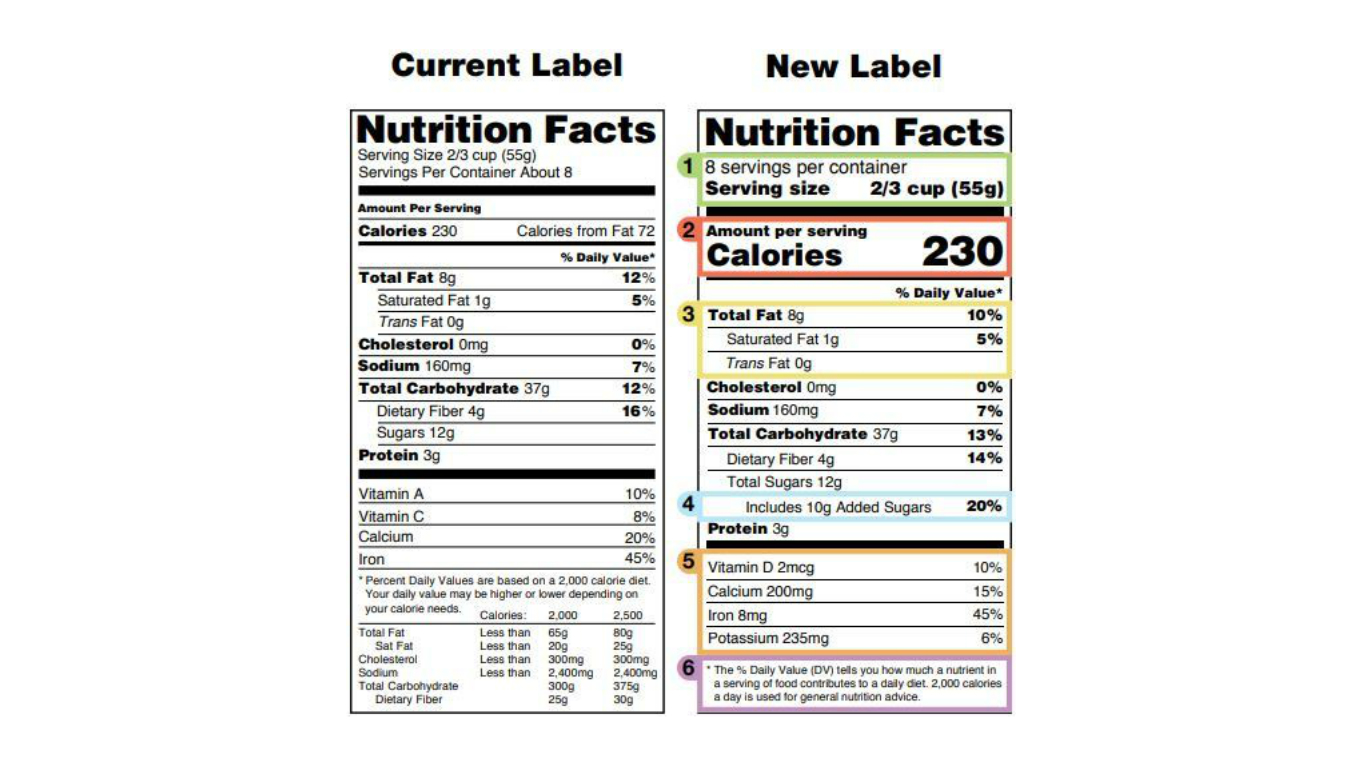

Achieving this result would be very simple: The FDA proposal merely adds one line to existing nutrition labels, under the Total Carbohydrates heading. Current labels list total sugars. The new line would call out added sugars, which might come from a variety of sources including high-fructose corn syrup, lactose, malt syrup, molasses, or honey as well as raw sugar. Sugar consumption is one of the most dangerous things experts link to the development of heart disease.

Renata Micha, one of the authors of the report, told HealthDay that adding the new information to nutrition labels might offer further health benefits by encouraging manufacturers to reduce the amount of sugar they add to their products.

The new labels would include other changes, as well: Serving sizes would be updated and both serving sizes and calories would appear in larger, bolder type; daily values would be updated; and the nutrients required to be listed would change.

The bad news? For unspecified reasons, the FDA has delayed implementation of the new labels until 2020.

After two decades of reviewing financial products I haven’t seen anything like this. Credit card companies are at war, handing out free rewards and benefits to win the best customers.

A good cash back card can be worth thousands of dollars a year in free money, not to mention other perks like travel, insurance, and access to fancy lounges.

Our top pick today pays up to 5% cash back, a $200 bonus on top, and $0 annual fee. Click here to apply before they stop offering rewards this generous.

Flywheel Publishing has partnered with CardRatings for our coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.