Companies and Brands

CannTrust Investors Hazy After Secondary Offering

Published:

Last Updated:

CannTrust Holdings Inc. (NYSE: CTST) shares dropped on Thursday after the firm announced the pricing of its secondary offering. The company intends to price its 36.36 million shares at $5.50 per share, with an overallotment option for an additional 5.45 million shares. At this price, the entire offering is valued up to roughly $230 million.

Out of the 36.36 million shares being sold, 30.90 million are being sold by the company, while 5.45 million are being sold by selling shareholders.

The underwriters for the offering are Merrill Lynch, Citigroup, Credit Suisse, RBC Capital Markets, Jefferies and Canaccord Genuity.

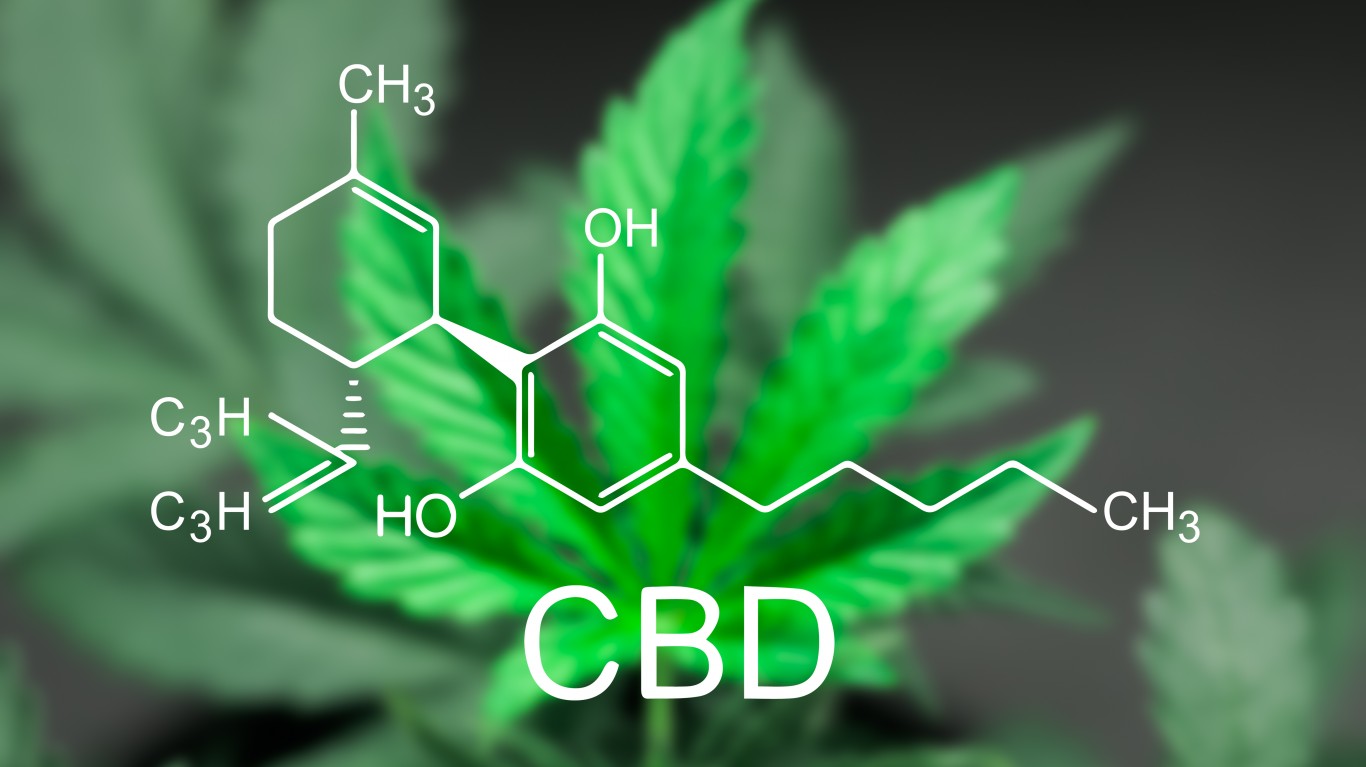

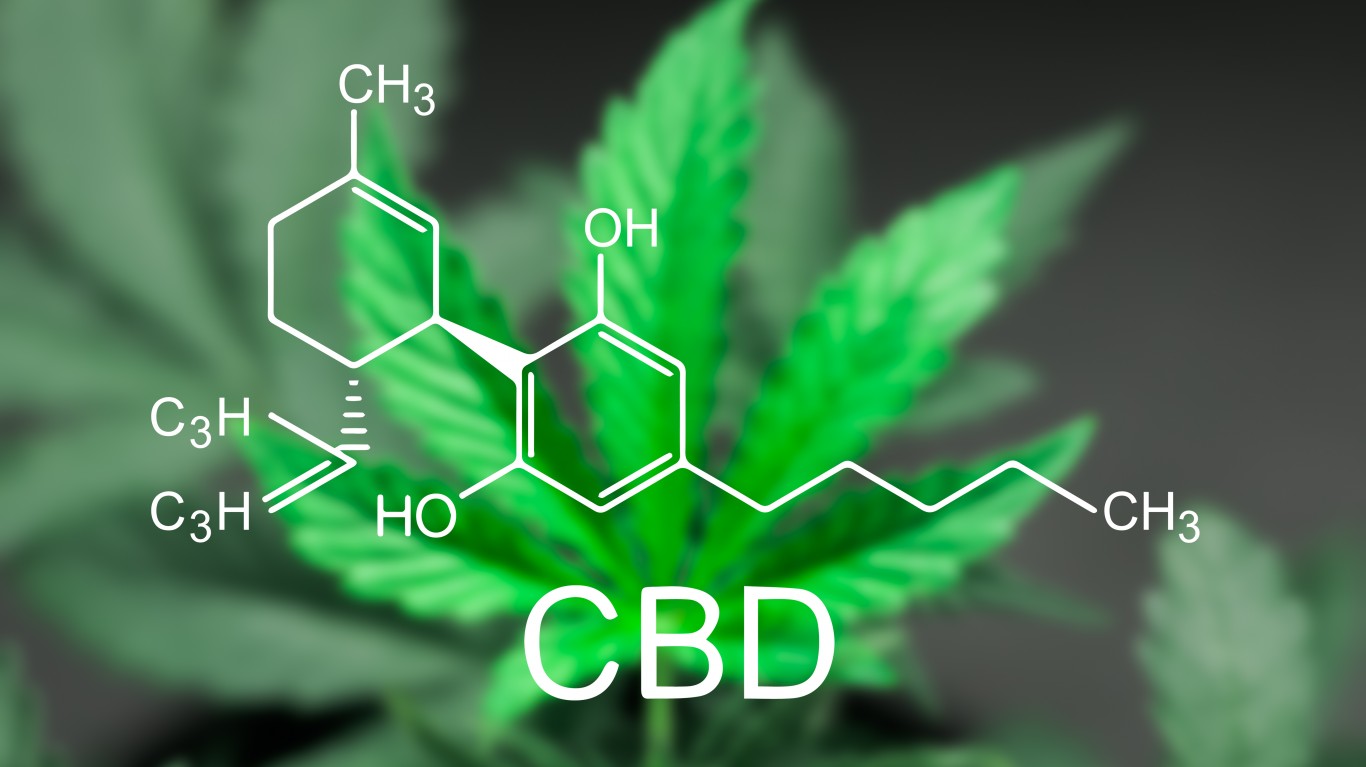

For some quick background: CannTrust is a federally regulated licensed producer of medical and recreational cannabis in Canada. Founded by pharmacists, CannTrust brings more than 40 years of pharmaceutical and health care experience to the medical cannabis industry and serves more than 69,000 medical patients with its dried, extract and capsule products.

CannTrust intends to use the net proceeds of the offering for general corporate purposes, including cultivation and facility expansion, expanded outdoor growing, international expansion, enhanced extraction capacity, upgrades for GMP Certification and biosynthesis development.

Excluding Thursday’s move, CannTrust had outperformed the broad markets, with the stock up about 33.5% year to date.

Shares of CannTrust were last seen down about 12% at $5.66, in a post-IPO range of $4.76 to $10.17.

After two decades of reviewing financial products I haven’t seen anything like this. Credit card companies are at war, handing out free rewards and benefits to win the best customers.

A good cash back card can be worth thousands of dollars a year in free money, not to mention other perks like travel, insurance, and access to fancy lounges.

Our top pick today pays up to 5% cash back, a $200 bonus on top, and $0 annual fee. Click here to apply before they stop offering rewards this generous.

Flywheel Publishing has partnered with CardRatings for our coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.