Companies and Brands

Earnings Previews: Airbnb, AMD, Coterra Energy, Occidental Petroleum

Published:

Last Updated:

The three major U.S. equity indexes closed higher again Friday. The Dow Jones Industrial Average added 0.97%, the S&P 500 rose 1.42%, and the Nasdaq Composite closed up 1.88%. Nine of 11 sectors, led by energy (up 4.3%) and consumer cyclicals (up 3.9%) closed higher while consumer staples (down 0.8%) and healthcare (down 0.3%) were the only sectors to close lower. The Dow added 3% last week and the Standard & Poor’s 500 and the Nasdaq both added more than 4%. The non-farm payrolls report for July will be released Friday. Economists currently expect payrolls to rise by 250,000, down sharply from June’s total of 372,000. The unemployment rate is expected to come in unchanged at 3.6%. All three major indexes are trading lower in Monday’s premarket session.

Before markets opened Monday morning, ON Semiconductor reported better-than-expected results on both the top and bottom lines. The chipmaker also raised third-quarter earnings and revenue guidance. On the downside, operating margins and net income dipped sequentially. The stock traded down more than 6% in Monday’s premarket.

After markets close today, Activision Blizzard, Devon Energy, Diamondback Energy, and Williams will be reporting quarterly results.

Here are our previews of BP, Caterpillar, JetBlue, and Marathon Petroleum, all four set to report results before markets open Tuesday morning.

After markets close on Tuesday, these four companies will release their quarterly earnings reports.

Over the past 12 months, shares of vacation rental provider Airbnb Inc. (NASDAQ: ABNB) have declined by 22.7%. Since posting a 52-week high in mid-November, the shares are down about 46%. The company may be struggling, but it had a cash hoard of around $3.2 billion at the end of the first quarter, and its quarterly revenue totals have steadily been improving since the disastrous second quarter of 2020.

Of 41 brokerages covering the stock, 22 have a Hold rating on the shares while 16 have either a Buy or Strong Buy rating. At a current price of around $111.00, the upside potential based on a median price target of $165.00 is 49%. At the high price target of $250, the upside potential is 125%.

Second-quarter revenue is forecast at $2.1 billion, up 39.4% sequentially and up 56.7% year over year. Airbnb is expected to post earnings per share (EPS) of $0.52, better than the prior quarter’s loss of $0.01 per share and the year-ago loss of $0.11 per share. For the full year, analysts are looking for EPS of $2.66, far better than the year-ago loss of $0.37, on revenue of $8.19 billion, up 36.6%.

Airbnb stock trades at a multiple of 41.7 times expected 2022 EPS, 38.9 times estimated 2023 earnings of $2.86, and 29.9 times estimated 2024 earnings of $3.72 per share. The stock’s 52-week range is $86.71 to $212.58. The company does not pay a dividend and total shareholder return over the past year is negative 22.7%.

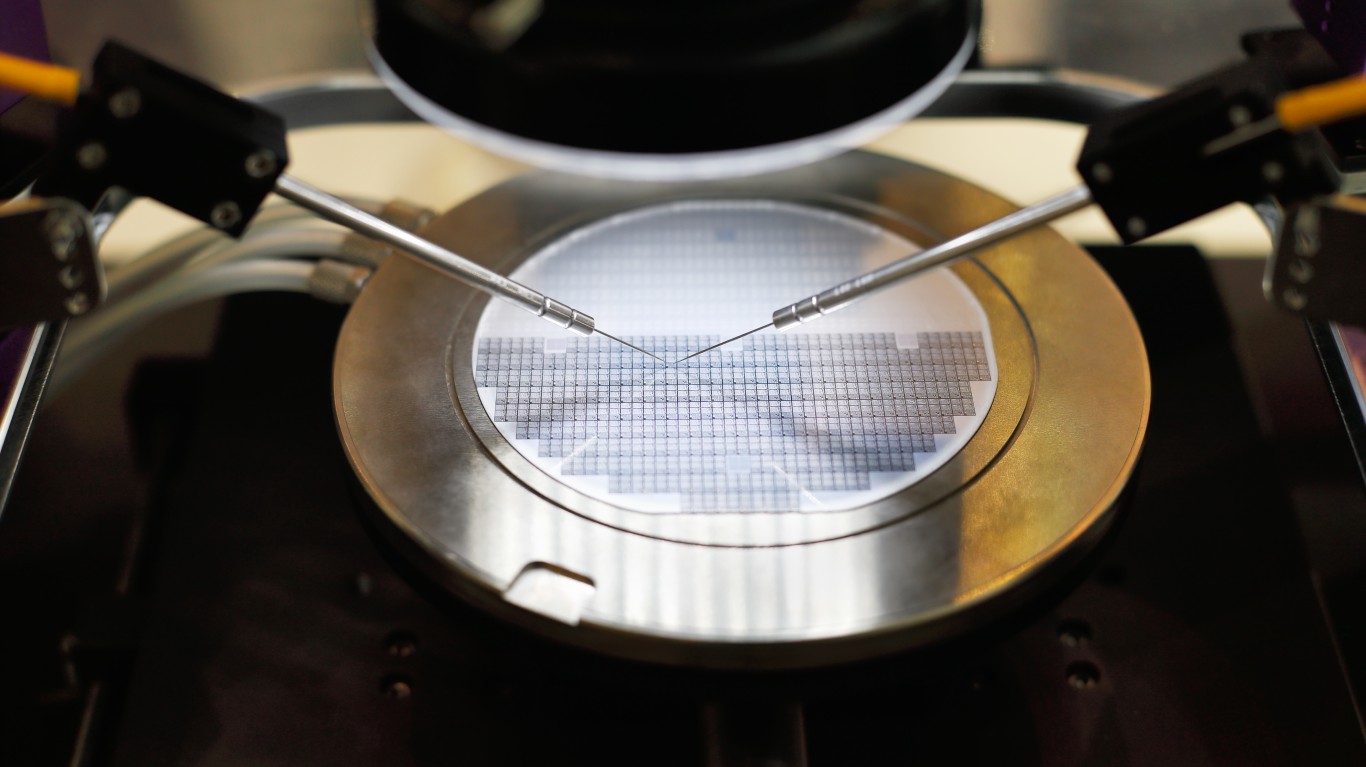

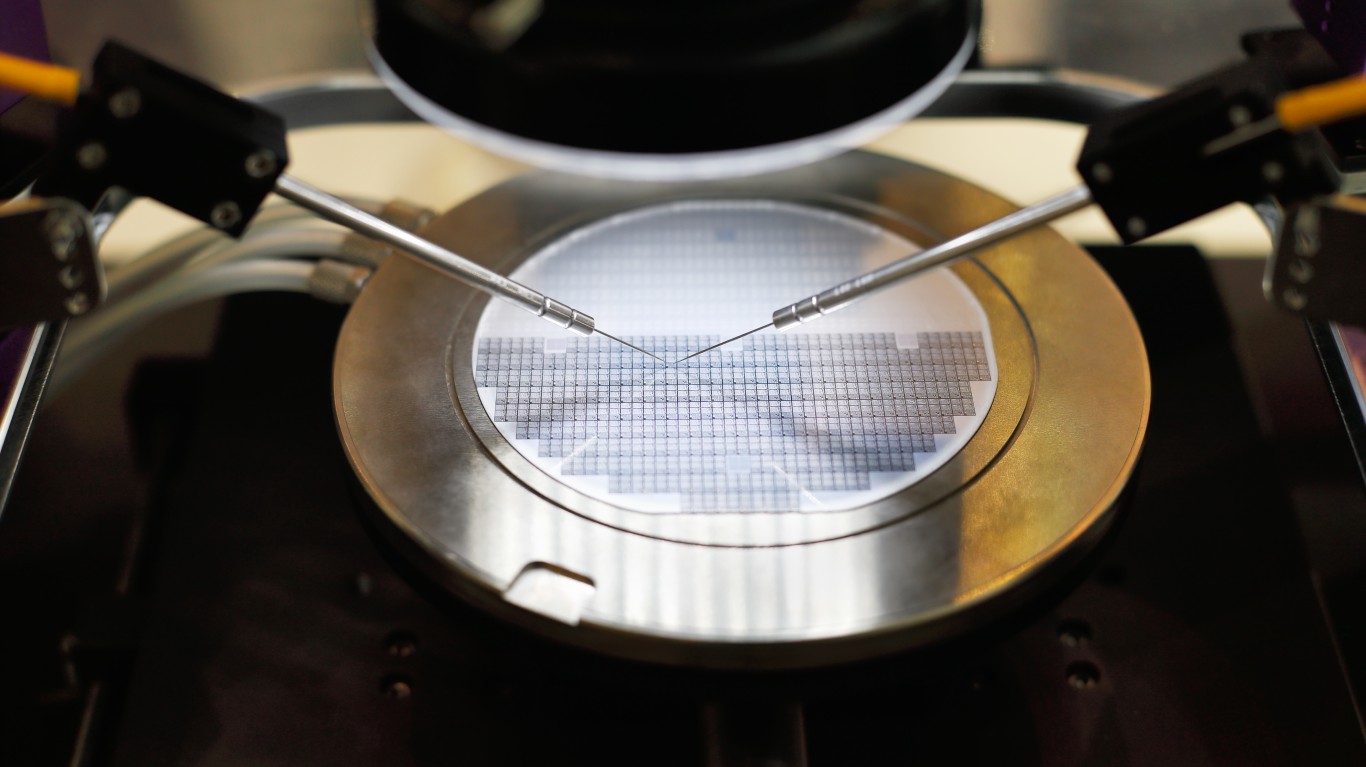

In the past 12 months, shares of chipmaker Advanced Micro Devices Inc. (NASDAQ: AMD) have slipped by about 3.5%. Since reaching a 52-week high in late November, the stock plummeted by 54% to post a 52-week low one month ago. In July, the shares rose by more than 28%. AMD, unlike long-time rival Intel, is not expected to benefit from the $52 billion federal investment in semiconductor chipmaking that Congress has approved and President Biden is expected to sign. AMD, Nvidia, and Qualcomm have no fabs and no plans to build any. On Friday, AMD’s market cap of $153.1 billion topped Intel’s $149.1 billion.

There are 39 analysts covering AMD and 26 have rated the stock a Buy or Strong Buy while another 12 have a Hold rating on the shares. At a current price of around $94.50, the upside potential to a median price target of $120.00 is 27%. At the high price target of $200.00, the upside potential is 112%.

Consensus estimates call for second-quarter revenue of $6.53 billion, up 10.9% sequentially and up 69.6% year over year. Estimated adjusted EPS of $1.04 is down 8.3% sequentially and up 65% year over year. For the full 2022 fiscal year, analysts’ current consensus estimates call for EPS of $4.35, up 56%, on revenue of $26.21 billion, up 59.5%.

AMD stock trades at a multiple of 21.7 times expected 2022 EPS, 19.4 times estimated 2023 earnings of $4.87, and 16 times estimated 2024 earnings of $5.90 per share. The stock’s 52-week range is $71.60 to $164.46. AMD does not pay a dividend and total shareholder return over the past year is negative 8.2%.

Shares of natural-gas producer Coterra Energy Inc. (NYSE: CTRA) have added 63.8% to their value over the past 12 months. At their peak in early June, shares were up almost 150%. Demand for natural gas has skyrocketed in Europe as the continent sprints to replace reduced supply from Russia before the winter heating season begins. In addition, analysts expect Coterra to share the bulk of its free cash flow ($1.05 billion in the first quarter) with investors through dividends and share buybacks.

Of the 26 brokerages covering the stock, 13 rate the shares a Hold, and 12 have a Buy or Strong Buy rating. At a current price of around $30.60, the upside potential based on a median price target of $35.00 is 14.4%. At the high price target of $46.00, the upside potential is 50.3%.

Second-quarter revenue is forecast at $2.23 billion, up 32.8% sequentially and up by a massive 587% year over year. Adjusted EPS is pegged at $1.28, up 26.3% sequentially and up 392% year over year. For the full 2022 fiscal year, analysts currently expect Coterra to report EPS of $4.78, up 112.4%, on revenue of $8.51 billion, an increase of 146.8%.

The company’s stock trades at a multiple of 6.4 times expected 2022 EPS, 7.8 times estimated 2023 earnings of $3.95, and 10.2 times estimated 2024 earnings of $2.98 per share. The stock’s 52-week range is $14.28 to $36.55. Coterra pays an annual dividend of $0.60 (yield of 1.96%). Total shareholder return for the past year is 110%.

Like virtually every other oil producer, shares of Occidental Petroleum Corp. (NYSE: OXY) have posted a big gain (145.5%) over the past 12 months because of the soaring price of crude. Oxy also benefits as one of Warren Buffett favorite’s. Berkshire Hathaway now owns almost 20% of Occidental. The company has applied some of its windfall of the past year to reducing its long-term debt by $10 billion. It still owes about $25.7 billion to repay borrowing to acquire Anadarko in 2019.

Of the 27 brokerages covering the stock, 14 rate the shares a Hold, and 10 have a Buy or Strong Buy rating. At a current price of around $65.80, the upside potential based on a median price target of $70.00 is 6.4%. At the high price target of $105.00, the upside potential is 59.6%.

Second-quarter revenue is forecast at $9.81 billion, up 15% sequentially and up 63.3% year over year. Adjusted EPS is pegged at $3.03, up 42.9% sequentially and a gigantic 847% year over year. For the full 2022 fiscal year, analysts expect Oxy to report EPS of $10.59, up 315%, on revenue of $36.39 billion, a gain of 38.3%.

Occidental stock trades at a multiple of 6.2 times expected 2022 EPS, 8.1 times estimated 2023 earnings of $8.09, and 12.3 times estimated 2024 earnings of $6.34 per share. The stock’s 52-week range is $21.62 to $74.04. Occidental pays an annual dividend of $0.52 (yield of 0.79%). Total shareholder return for the past year is 146.8%.

Let’s face it: If your money is just sitting in a checking account, you’re losing value every single day. With most checking accounts offering little to no interest, the cash you worked so hard to save is gradually being eroded by inflation.

However, by moving that money into a high-yield savings account, you can put your cash to work, growing steadily with little to no effort on your part. In just a few clicks, you can set up a high-yield savings account and start earning interest immediately.

There are plenty of reputable banks and online platforms that offer competitive rates, and many of them come with zero fees and no minimum balance requirements. Click here to see if you’re earning the best possible rate on your money!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.