Companies and Brands

Ford Family Gets $42 Million, GM Management $3 Million

Published:

24/7 Wall St. asked Ford management to tell us how much the Ford family makes from the dividends on the shares they own. They declined. Based on their proxy and the shares owned by Ford Estates, the payment is about $42 million a year. GM’s management and board also own shares in the other large U.S. car company. Based on proxy calculation, their payout is about $3 million in aggregate a year. (These American industries have the highest union membership.)

[in-text-ad]

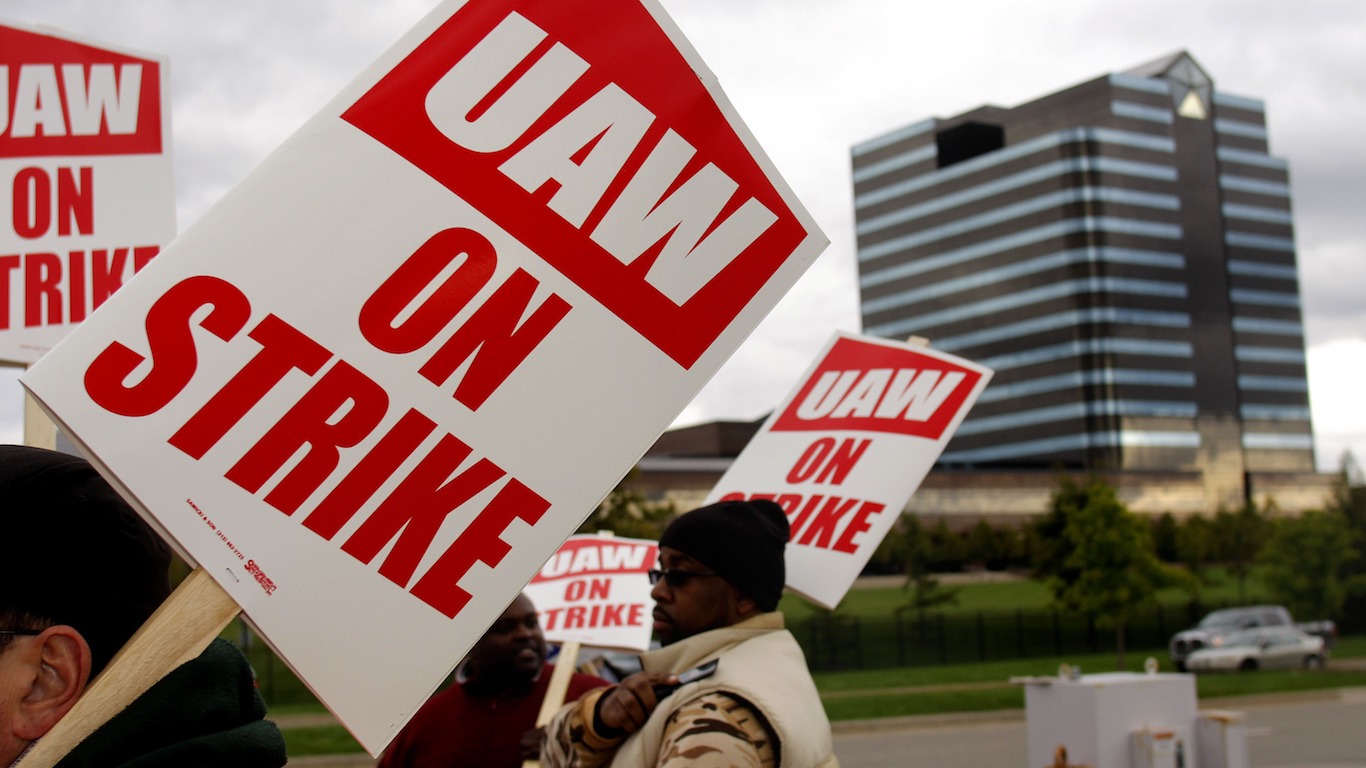

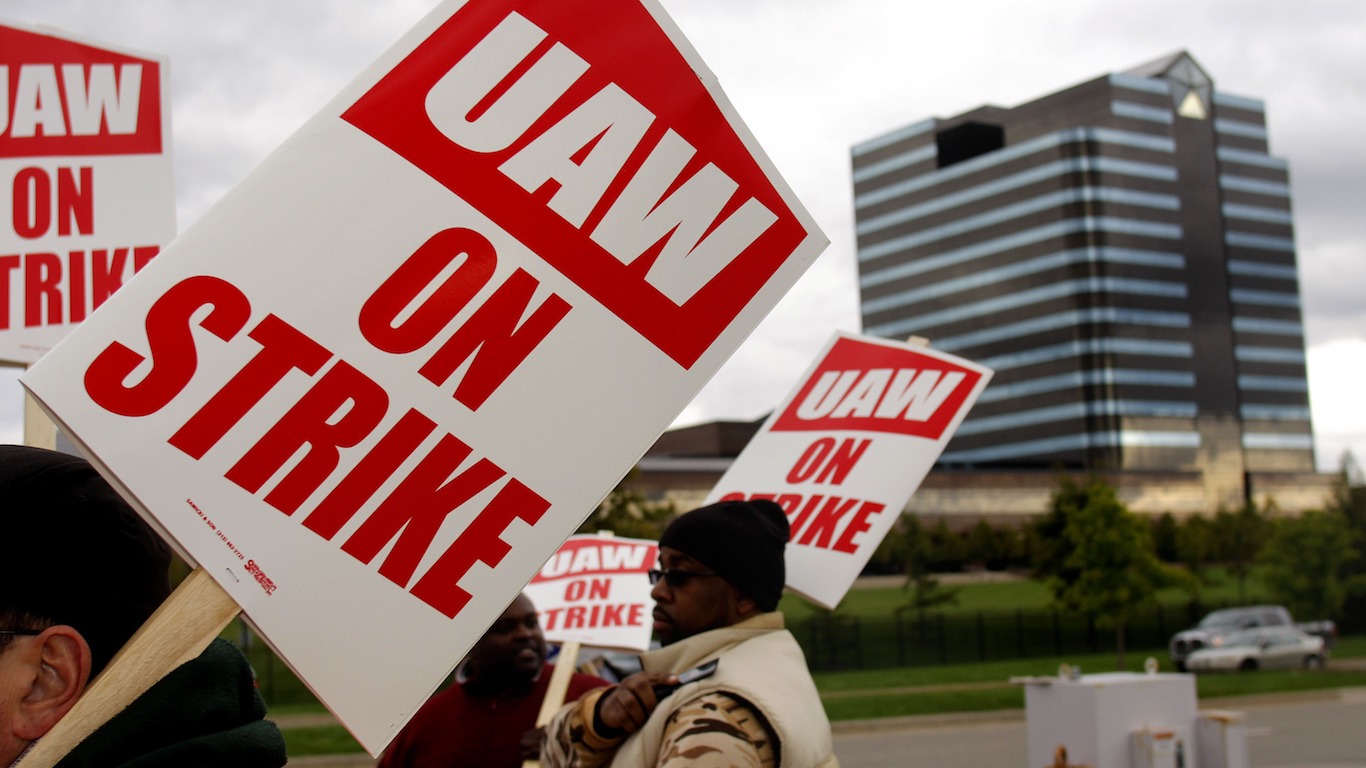

None of this would matter under conditions other than the current UAW strike. UAW President Shawn Fain is angry at everything. This will give him one more reason to throw a fit.

In the scheme of things, what management at either company earns in compensation and dividend payouts means very little. Even if management were to forgo salaries and waived dividends, the financial effects of the strike would change very little.

The issue with the UAW strike, as far as management is concerned, is the two companies’ shareholders. The argument that public corporations are run for their employees and customers is only partially true. Ford and GM are public companies. Their boards and management act on that basis. The public may distrust large corporate boards, but in general, their guardrails for behavior are narrow.

What is the basis on which boards act? In this case, a gamble. The longer the strike, the bigger the drag on short-term earnings and perhaps market share. The bigger the payout to the unions, the more long-term earnings and capital spending are undermined. Two cups. Two poisons.

Big company CEOs make a great deal of money. In the case of the UAW strike, in terms of GM and Ford, the sums are not large enough to matter, no matter what Fain says.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.