Companies and Brands

This Company Paid the Price for a Scandal With $74 Billion Lost

Published:

While we all hope that businesses large and small are out in the world doing the best job possible to be scandal-free, it’s simply not reality. Instead, companies often cut corners or have executives who look for the easy road to navigate lousy PR, poor quarterly numbers, and bloated executive pay. With this in mind, let’s look at some companies ruined by massive scandals.

At the time of Bernie Madoff’s arrest, his investment securities business was the 6th largest market maker among S&P 500 stocks. The arrest ruined the company and wiped out billions of shareholder value.

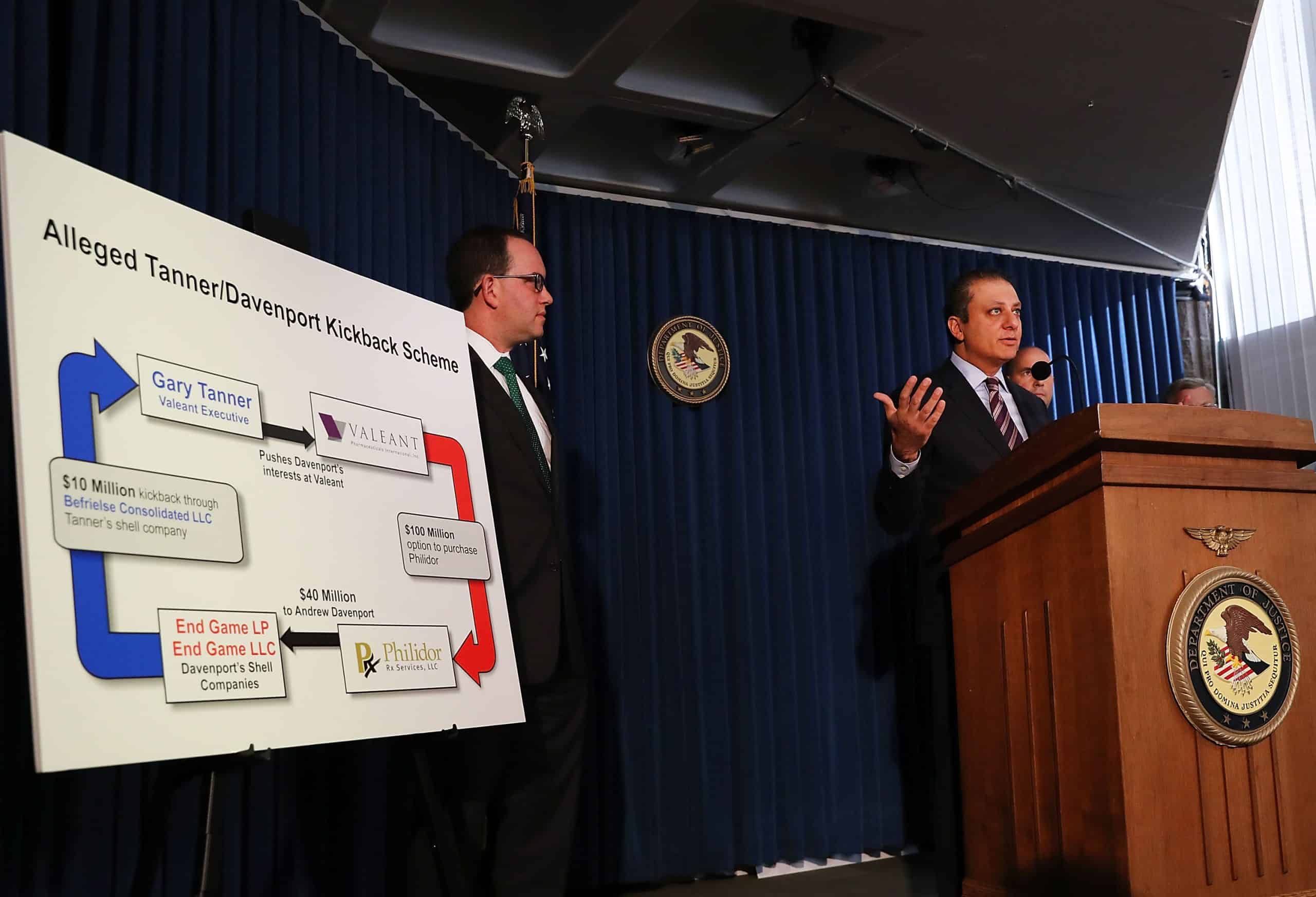

The SEC investigated a major pharmaceutical brand, Valeant, for manipulating the market by buying up competitors to drive up the price of its drugs. The company saw its stock price drop 90 percent and had to rebrand completely to avoid public anger.

One of the world’s largest dairy and food companies, Italian giant Parmalat, was sold off in pieces after a $20 billion hole was found in its accounting records. The CEO was convicted of fraud and sentenced to 18 years in prison.

A cable television giant for many years, Adelphia Communications Corporation went under in 2002 after it was discovered the founding family was misusing funds for personal luxury purchases. The company would later be sold off to Time Warner Cable.

One of England’s oldest merchant banks, Barings Bank, went under in 1995 after suffering hundreds of millions of losses due to fraudulent investments. The bank would later be sold for one pound or $1.31 in American currency.

Bear Stearns was a major victim of the collapse of subprime mortgage housing. This scandal caused the housing market to collapse and ripple throughout the world’s financial sectors.

The investment bank giant Lehman Brothers filed for bankruptcy in 2008 after betting heavily on risky subprime mortgages caused by banks lending money to those who couldn’t afford the payments.

In 2002, the first signs of scandal appeared after the SEC discovered the insurance company’s earnings were falsely inflated by $1.4 billion. The company was ruined and forced to rebrand before going public again.

Martin Shrekli will be forever remembered for upping the price of one of Turing Pharmaceuticals’ drugs by 5,000 percent to boost the company’s bottom line. The resulting scandal forced the company to rebrand, and Shrekli was put in prison.

In 2002, WorldCom was a telecom giant, only to be rocked by a $11 billion scandal involving inflated company assets. The resulting scandal led to WorldCom filing for bankruptcy and multiple executives pleading guilty to fraud.

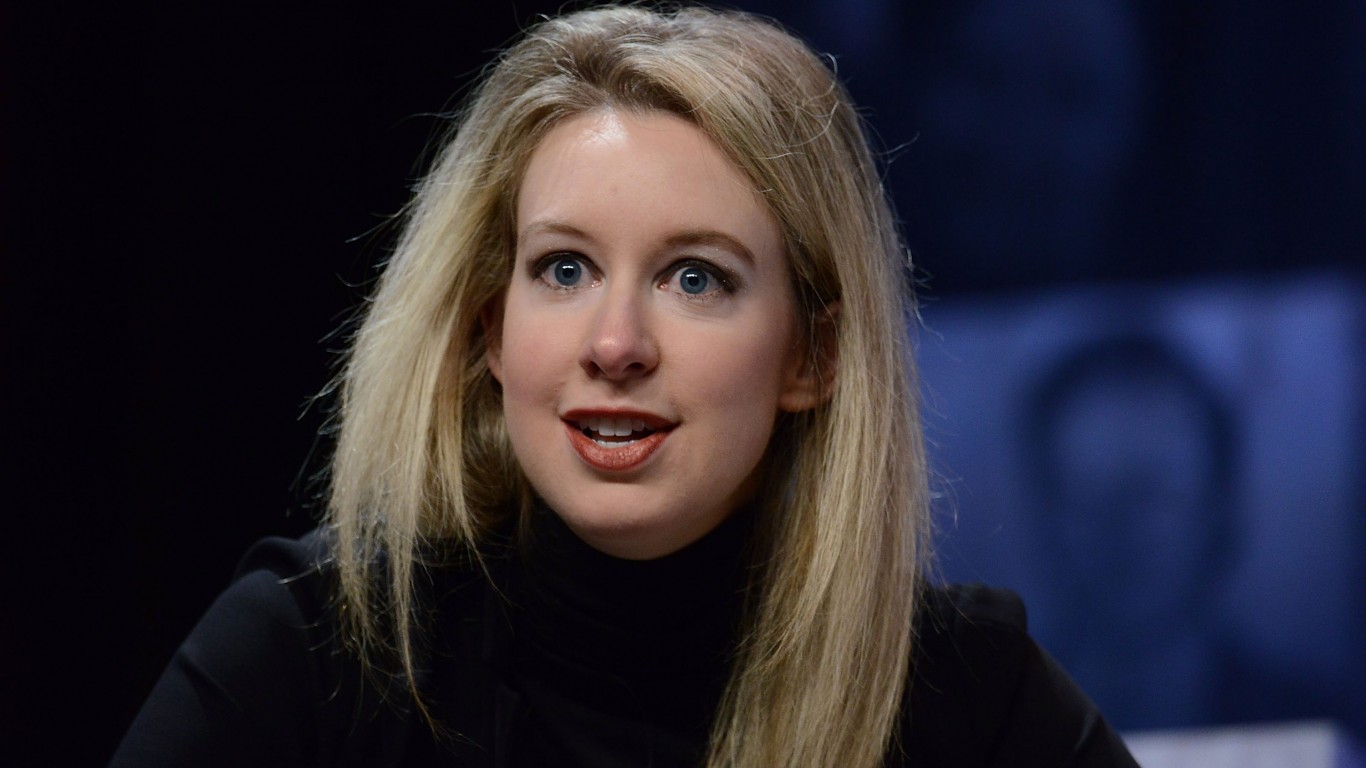

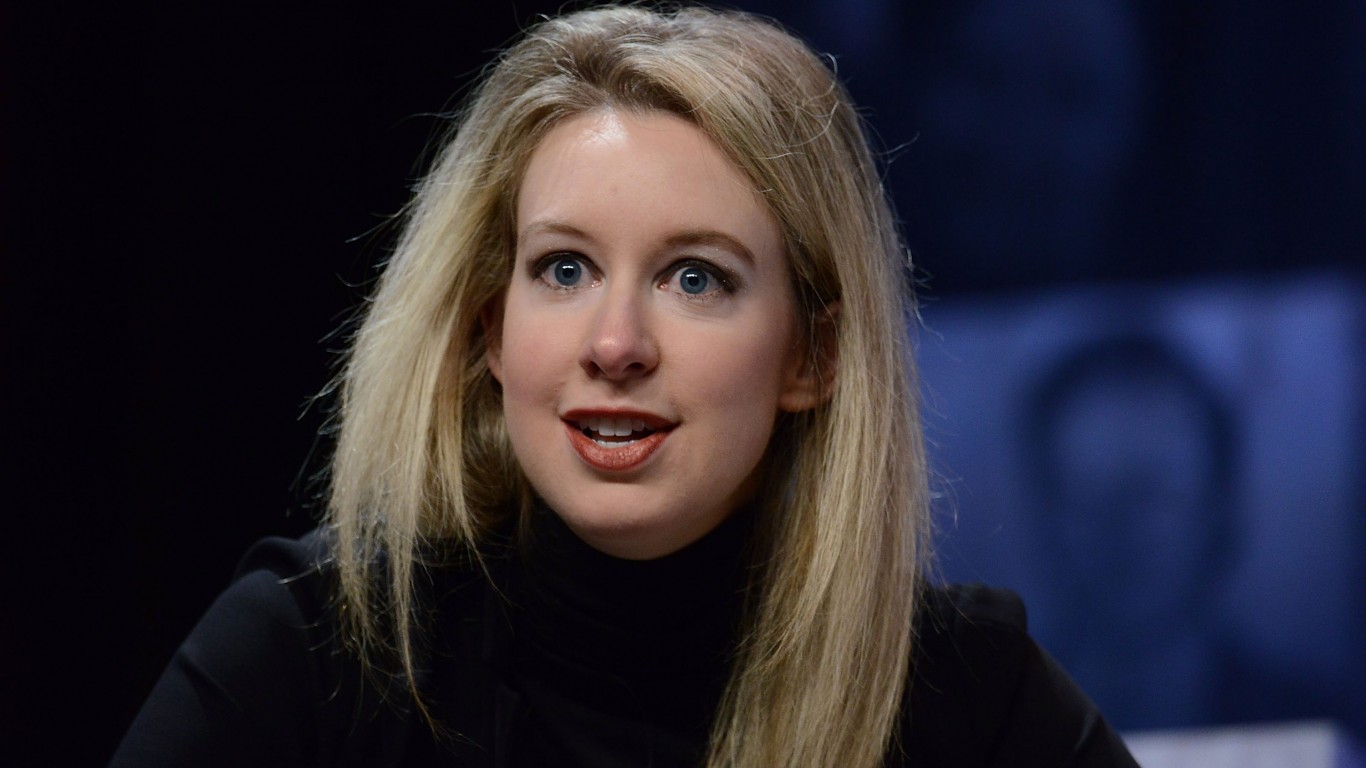

Theranos is a textbook example of a company ruined by a massive scandal. Promising a revolutionary way to test blood, Theranos couldn’t do anything it promised, and its $9 billion valuation went up in smoke.

Enron was the largest bankruptcy in US history at the time after losing $74 billion, and it is undoubtedly the biggest company completely ruined by scandal. Along with Enron, its accounting firm, Arthur Anderson, was also destroyed by the Enron scandal.

The average American spends $17,274 on debit cards a year, and it’s a HUGE mistake. First, debit cards don’t have the same fraud protections as credit cards. Once your money is gone, it’s gone. But more importantly you can actually get something back from this spending every time you swipe.

Issuers are handing out wild bonuses right now. With some you can earn up to 5% back on every purchase. That’s like getting a 5% discount on everything you buy!

Our top pick is kind of hard to imagine. Not only does it pay up to 5% back, it also includes a $200 cash back reward in the first six months, a 0% intro APR, and…. $0 annual fee. It’s quite literally free money for any one that uses a card regularly. Click here to learn more!

Flywheel Publishing has partnered with CardRatings to provide coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.