Companies and Brands

These Families Built the America We Know Today, Where Are They Now?

Published:

Last Updated:

When it comes to the families that helped build America, there is plenty of lore and mystery around their names. Vanderbilt, Kennedy, Rockefeller, Morgan, Walton, Johnson, and others made billions through real estate, construction, oil, pharmaceuticals, and other industries. While the accomplishments of these families historically may be great, it begs the question of where they are today and if the wealth has grown or disappeared forever.

If it wasn’t for the Rockefellers or the Vanderbilts, we might not know the world of railroads and oil as we do today. The companies these families started began shaping the country in the 19th century, and their legacy lives on today. There is little question that these families are at least partially responsible for the economic might that helped turn America into a financial superpower.

Cornelius Vanderbilt, the scion of the Vanderbilt family, is widely considered one of the greatest American industrialists. A shipping and railroad tycoon, Vanderbilt was one of the wealthiest Americans in history, with a net worth of $100 million when he died. Unfortunately, most of the family money was gone within 50 years of Cornelius’ death.

John Davidson Rockefeller Sr., or JD Rockefeller, was among the richest people in modern history. When he died, the founder of Standard Oil Company (now ExxonMobil) had a net worth of nearly $900 million. Today, descendants of JD have significant wealth controlled by a family trust, which has used the money for real estate ventures like building the Rockefeller Center and the Museum of Modern Art.

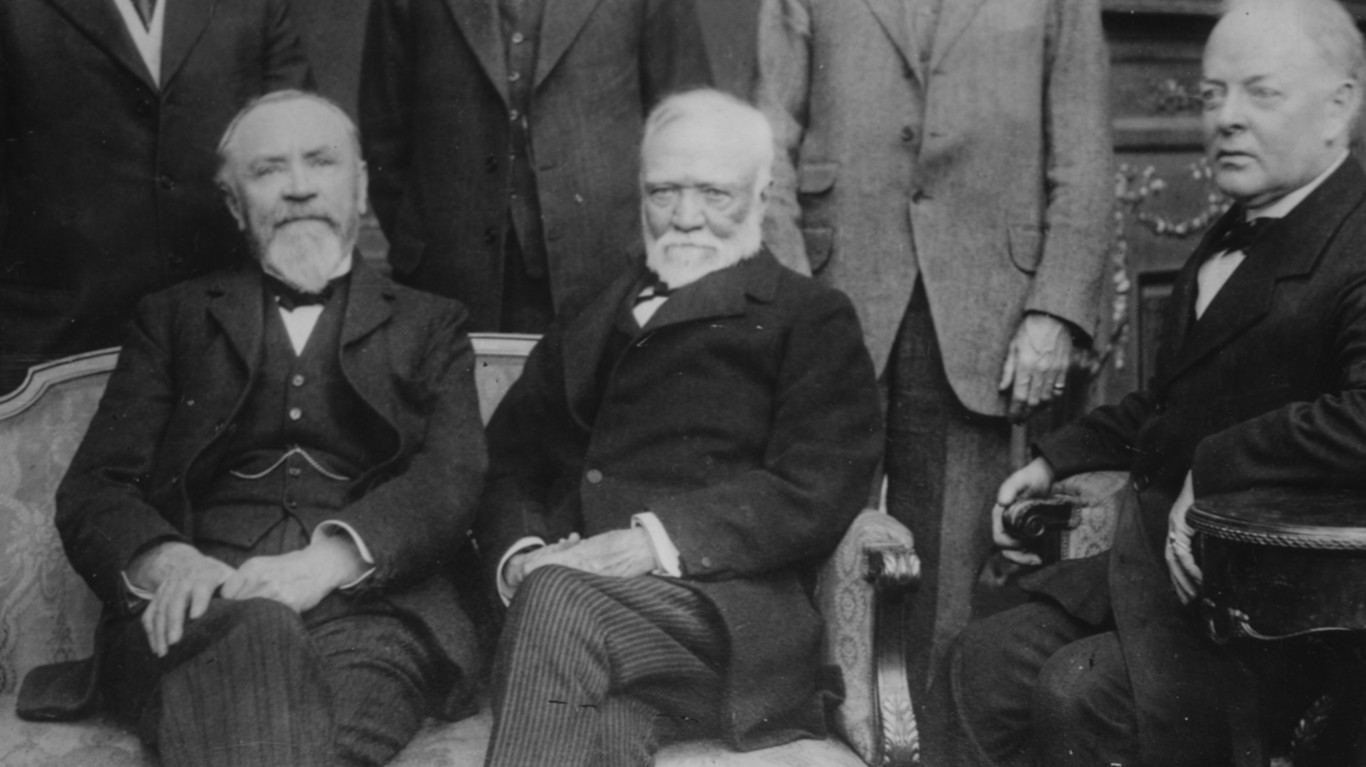

When Andrew Carnegie, the founder of Carnegie Steel Company, died in 1919, he was among the richest Americans in history. During the later years of his life, he gave away almost 90% of his fortune. Carnegie believed in using his money to improve society, including building 3,000 public libraries. His last $30 million was given to various foundations upon his death, leaving his descendants with nothing.

Joseph P. Kennedy Sr. was an American businessman who made his fortune in real estate and the stock market. The father of President John F. Kennedy, Senator Ted Kennedy, and US Attorney General Robert F. Kennedy, the Kennedy name still lives on. The family is believed to have around $1.2 billion in total net worth, with Caroline Kennedy, the daughter of JFK, worth an estimated $250 million.

Known as the first multi-millionaire in the United States, John Jacob Astor was a German-born American businessman who immigrated to the US in 1783 and made a fortune in the fur trade. By 1800, Astor had a net worth equal to $229 million in 2024 money and was a significant figure in New York City real estate. Family heir John Jacob Astor IV sadly died as the Titanic’s wealthiest passenger, which started the family’s decline, though it still has significant resources.

When Samuel Curtis Johnson opened his business as S.C. Johnson, little did he know that his household cleaning product company would become one of history’s most crucial consumer brands. A family member has run the company since its founding. Today, the company is run by fifth-generation Fisk Johnson, who has a net worth of $3.2 billion and is well known for his work of giving back to the community.

With a family net worth of $14.3 billion spread across close to 3,500 living descendants of Pierre Samuel du Pot de Nemours, the Du Pont family helped build America. The family owns DuPont company, which laid the groundwork for many accomplishments in building a young nation, including early involvement with the Philadelphia Phillies, Indian Motorcycle Company, US Airways, and dozens of other nonprofit organizations.

Led by family scion Archibald Mellon, the Mellon family has significantly influenced America. Its interests include banking with Mellon National Bank and Gulf Oil (now Chevron) and Andrew Mellon, former US Treasury Secretary. Timothy Mellon, Andrew’s grandson, controls the family’s banking fortune today, with an estimated net worth of $14.1 billion.

The largest privately held company in the US, Cargill-MacMillan, was founded in 1865 by William Wallace Cargill. With its hands in a dozen businesses, the food and agriculture company has over 160,000 employees and $165 billion in revenue. The family controls 90% of the business and is among the most philanthropic families in America, giving away $6 billion in the last 20 years against the family’s $38 billion fortune.

Founded in Dayton, Ohio, in 1898, James M. Cox purchased the Dayton Daily News. Since then, the family has become one of the largest media names in America. The company’s biggest holding, Cox Communications, is America’s third-largest cable brand, giving the family a net worth of around $26 billion. The family also has considerable holdings with Axios.com, Kelley Blue Book, and various TV stations.

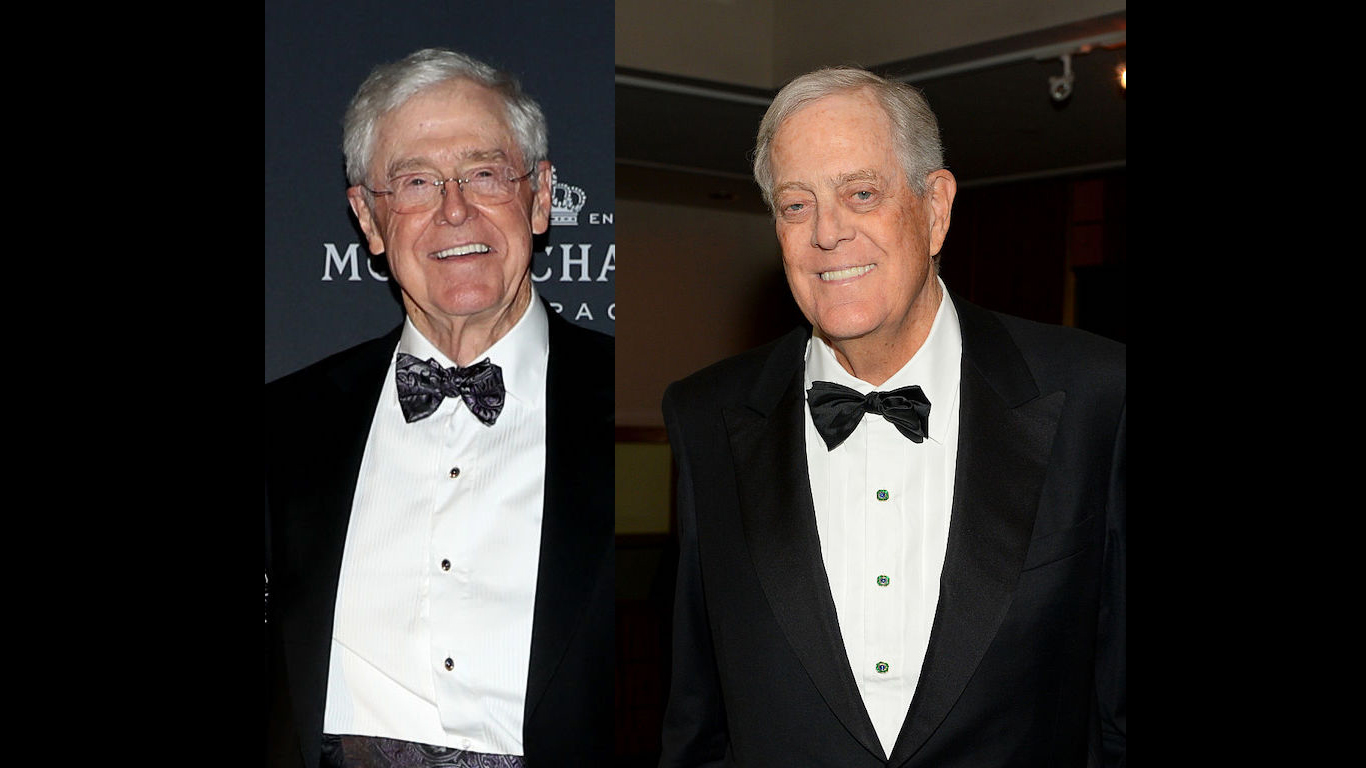

Fred C. Koch founded what would become Koch Industries, today’s second-largest privately held company in America. Making his fortune in the 1920s and 1930s, the family was now famously run by Charles and David Koch, among the biggest libertarian and conservative party donors. At the time of David’s death in 2019, the family fortune was estimated to be well beyond $100 billion.

Founded by Franklin Clarence Mars in 1911, the company manufactures Milky Way, M&Ms, and Snickers, among other popular items, alongside pet food brands like Pedigree, Nutro, and Whiskas. The company is continuously ranked among the largest privately owned companies. As a result, the family has a net worth of $126 billion, and they are very charitable through the Mars Family Foundation.

Credit card companies are pulling out all the stops, with the issuers are offering insane travel rewards and perks.

We’re talking huge sign-up bonuses, points on every purchase, and benefits like lounge access, travel credits, and free hotel nights. For travelers, these rewards can add up to thousands of dollars in flights, upgrades, and luxury experiences every year.

It’s like getting paid to travel — and it’s available to qualified borrowers who know where to look.

We’ve rounded up some of the best travel credit cards on the market. Click here to see the list. Don’t miss these offers — they won’t be this good forever.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.