Apple Inc

NASDAQ: AAPL

$242.65

Closing Price on December 3, 2024

AAPL Articles

Companies have several ways they can share their success with their investors: They can pay dividends or they can buy back stock. Both are popular with investors and are generally considered a...

Published:

Warren Buffett is famous for being a value investor while Peter Lynch tended to be growth-oriented. Some investors are neither, or rather they are a mix of the two as everyone wants to buy a stock at...

Published:

: iPhone XVI Sales: Delayed software and minimal changes may lead to weak sales. Chinese Competition: Foldable phones from Chinese brands are challenging Apple’s dominance. Increased Advertising:...

Published:

Last Updated:

Diversification is key in today’s investing world. Exchange-traded funds, or ETFs, offer a convenient and affordable way to achieve this. Think of them as baskets filled with a variety of stocks....

Published:

David Elliot Shaw was known for his elusive investment strategies, rooted in his computer science background. His time as a Columbia University professor likely shaped his quantitative trading...

Published:

: John Ive, former Apple design head, is partnering with OpenAI to develop an AI-based hardware product. The collaboration could disrupt consumer electronics, drawing parallels to how Microsoft and...

Published:

Last Updated:

Politicians are more known for their trading than running hedge funds. They seem to have an uncanny knack for making stock trades that perform remarkably well, well above what the averages suggest...

Published:

Warren Buffett’s Berkshire Hathaway (NYSE:BRK-B) may have offloaded a massive chunk of Apple (NASDAQ:AAPL) stock this year. Still, there are plenty of reasons to hang on as the Oracle of Omaha...

Published:

24/7 Wall St. Insights With interest rates headed lower, dividend stocks will be in favor. Berkshire Hathaway is up over 20% in 2024. Sit back and let dividends do the heavy lifting for a simple,...

Published:

Apple was the first U.S. company valued at $1 trillion, then $3 trillion, but will it be first to have a $5 trillion market cap?

Published:

247 Wall St. Key Insights QQQ offers higher growth potential but comes with greater risk due to its reliance on tech stocks. VOO provides broad market exposure with lower risk and steady growth. ...

Published:

While many investors might not know who Israel Englander is, they have likely heard of his Millennium Management hedge fund. It is one of the world’s largest hedge funds with almost $68 billion in...

Published:

: iPhone XVI launch underwhelms due to similarity with previous models and delayed iOS 18 release. Apple’s competitive edge in China is at risk against innovative local smartphones. Concerns arise...

Published:

If you’re over 50 and are starting to think about setting up a roadmap to retirement, or if you’re looking to wind down gradually by easing into some sort of semi-retirement, it’s a wise idea...

Published:

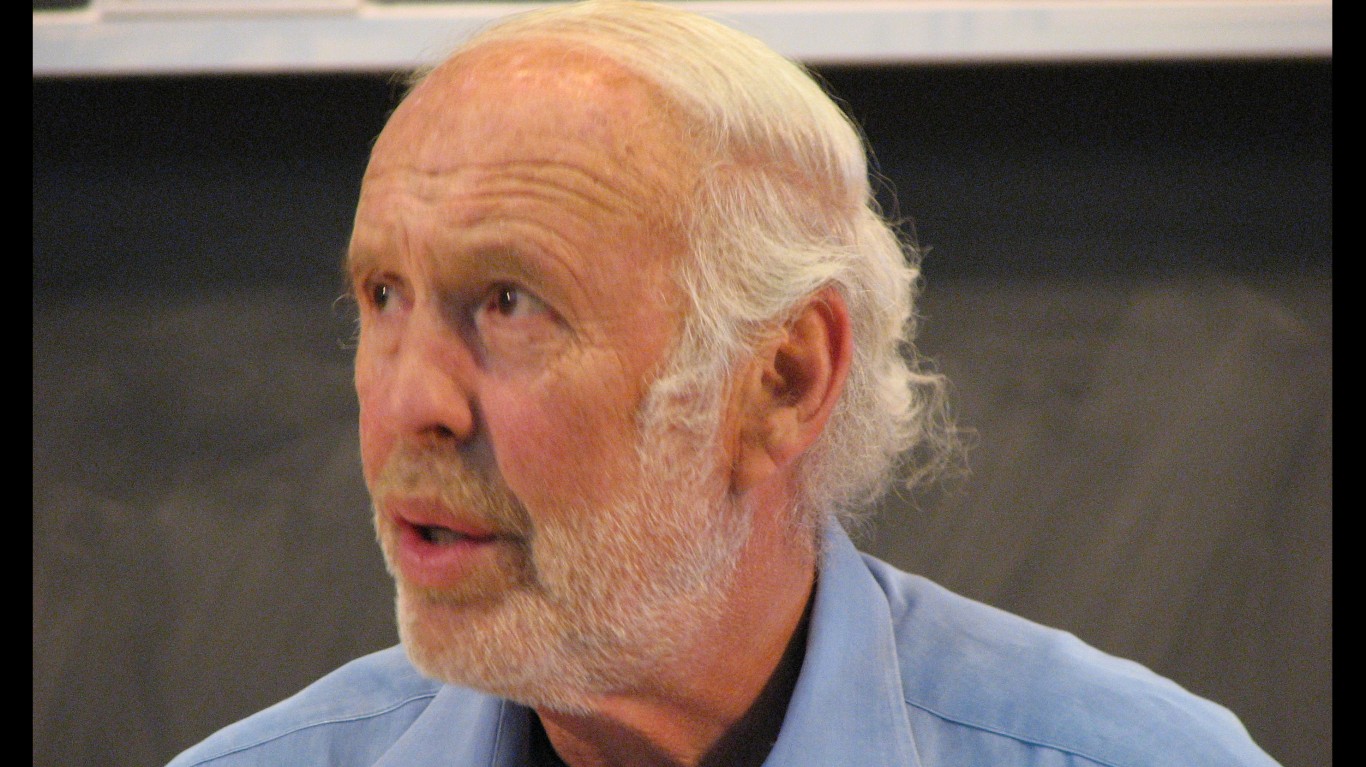

Jim Simons was a mathematician-turned-investor who built Renaissance Technologies into the world’s second-largest hedge fund. Although Simons died earlier this year at age 86, it is still possible...

Published: