Agnico Eagle Mines Ltd

NYSE: AEM

$81.72

Closing Price on November 25, 2024

AEM Articles

Both gold and silver experienced a classic pullback as interest rates drifted higher and some strength in the dollar was seen. These five stocks now make sense for investors looking to initiate or...

Published:

Analysts at Credit Suisse still see lots of upside in gold and the key gold-mining stocks. The firm even has referred to the recent sell-off as a "transient pullback."

Published:

Short interest in gold mining stocks and gold ETFs rose sharply in the two-week period ended July 31. The steep run-up in gold futures took a breather last week.

Published:

Given current trends, BofA Securities believes that gold soon could hit $3,000 an ounce, and these five stocks may have the biggest upside potential.

Published:

Short interest in gold-mining stocks and ETFs rose in the two-week reporting period ending July 15. But gold prices rose more sharply.

Published:

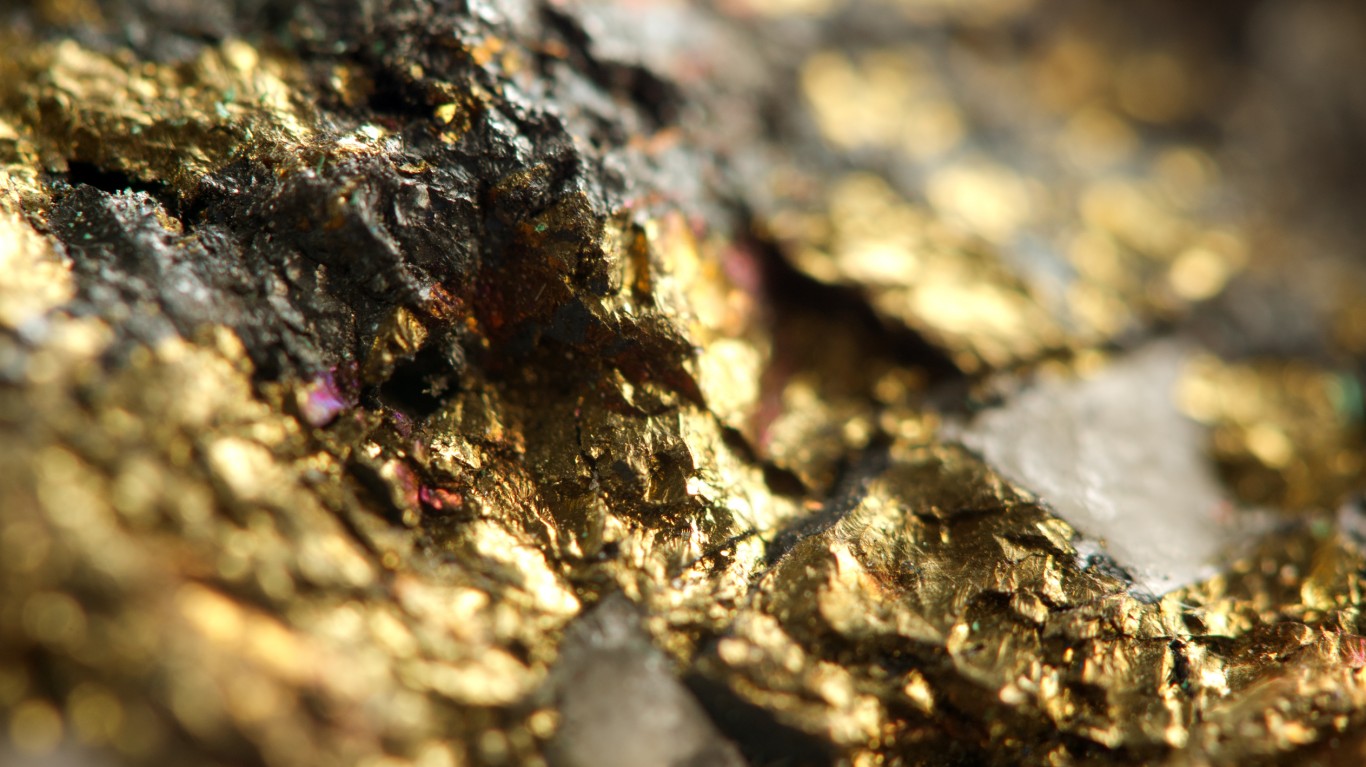

Gold prices have been on a tear that began more than a year ago. One segment likely to see increased profits are the gold miners. Here a several that deserve another look.

Published:

The gold bugs must be happy again. With gold trading just under $1,800 again, the gold bugs are going to be increasing their calls for gold to rise to $2,000. Some have even been publishing reports...

Published:

Proper asset allocation should always include a single-digit percentage holding of precious metals like gold and silver. These six stocks look like solid choices for investors.

Published:

Gold is making a great case for itself this year, and gold bugs have to be happy about that. The strategists at JPMorgan have a bullish view on gold.

Published:

24/7 Wall St. screened the BofA Securities precious metals research universe and found five gold stocks rated Buy that look like solid plays for investors starting to worry about renewed volatility.

Published:

Proper asset allocation should always include a holding of precious metals. Not only does it have the potential to hedge inflation over the long term, but such a position can really help if the...

Published:

The current coronavirus outbreak could be a pandemic. If so, one asset class could explode much higher. While gold traded to seven-year highs recently, the top could get blown off if things get...

Published:

These five companies pay dividends, have shares that are rated Buy, tend to do well when the federal funds rate is cut and make good sense for worried investors now.

Published:

With the markets facing a “witches' brew” of potential problems, one way to hedge a sell-off would be to buy gold. Here are five solid stock picks and an ETF for investors to consider.

Published:

While the stock market is poised for a bad end to the week, both gold and oil are skyrocketing higher on the global tension.

Published: