Applied Materials Inc

NASDAQ: AMAT

$168.37

Closing Price on December 24, 2024

AMAT Articles

These are the eight top thematic breakout picks from Merrill Lynch for the third quarter of 2017. While some of the stock chart patterns call for near-term upside, others call for much higher prices...

Published:

Last Updated:

The June 15 short interest data have been compared with the previous report. Short interest decreased in most of these selected semiconductor stocks.

Published:

Last Updated:

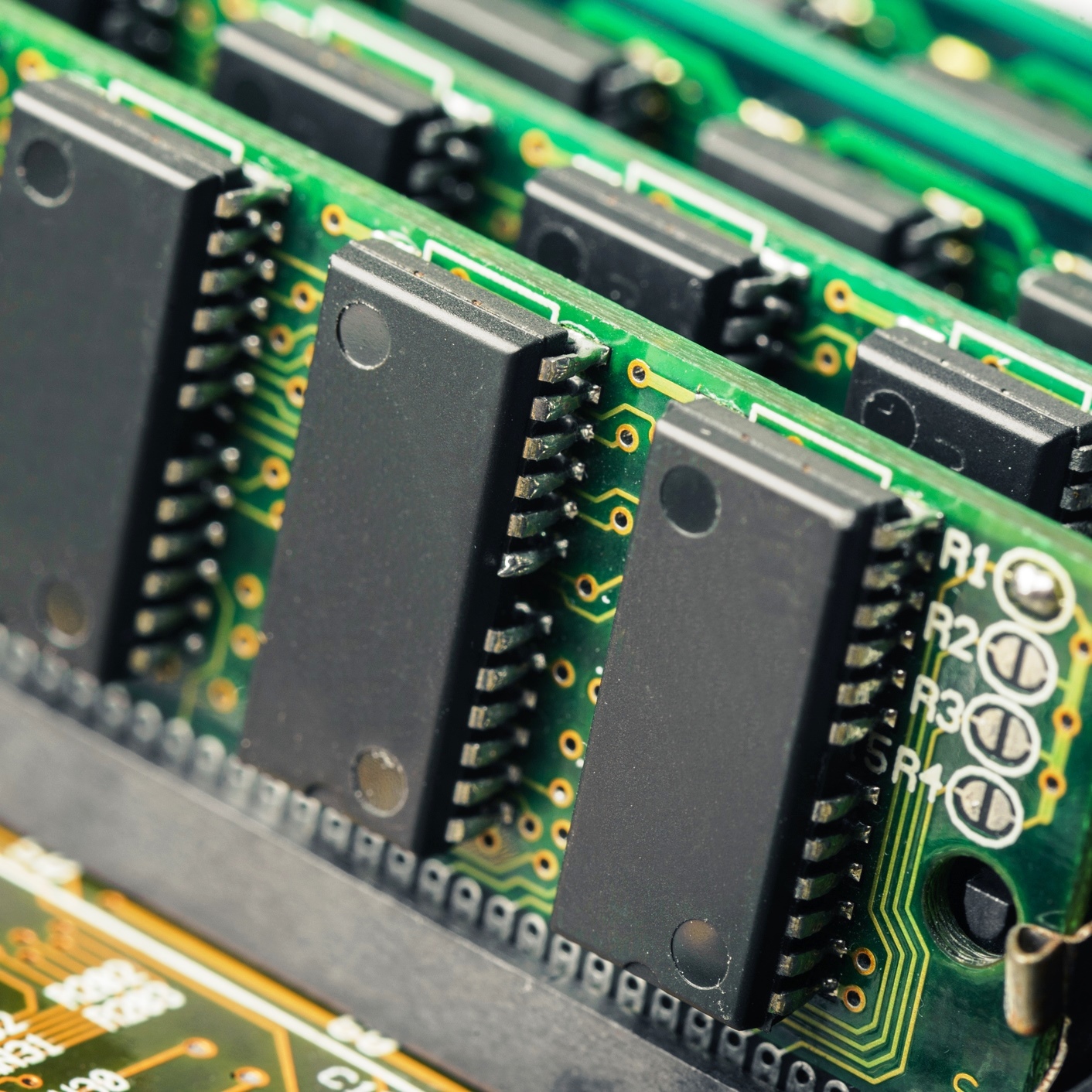

These four top picks from JPMorgan give aggressive accounts the ability to participate in the growing memory market and demand.

Published:

Last Updated:

The May 31 short interest data have been compared with the previous report. Short interest increased in most of these selected semiconductor stocks.

Published:

Last Updated:

With summertime setting in, should investors look for even more gains in these three stock? Or should they consider taking some money off the table after such major gains?

Published:

Last Updated:

Now that summer is kicking off, 24/7 Wall St. wanted to review some of these top S&P tech sector stocks so far in 2017. These had the most impressive gains as of the end of May.

Published:

Last Updated:

he May 15 short interest data have been compared with the previous report. Short interest increased in most of these selected semiconductor stocks.

Published:

Last Updated:

Merrill Lynch has raised its price targets on five quality, large-cap growth stocks that make good sense for growth investors looking to reposition their portfolios to account for perhaps more...

Published:

Last Updated:

The top analyst upgrades, downgrades and other research calls from Friday include Autodesk, IBM, Lumber Liquidators, NVIDIA, Salesforce.com, Symantec, T-Mobile and Wal-Mart.

Published:

Last Updated:

The top analyst upgrades, downgrades and other research calls from Monday include Applied Materials, Cerner, Cisco Systems, Johnson & Johnson, Level 3 Communications and Salesforce.com.

Published:

Last Updated:

JPMorgan remains Overweight the semiconductor equipment group and is reasonably bullish on the landscape for the top companies going forward.

Published:

Last Updated:

The April 28 short interest data have been compared with the previous report. Short interest moves were mixed in these selected semiconductor stocks.

Published:

Last Updated:

The April 13 short interest data have been compared with the previous report. Short interest moves were mixed in these selected semiconductor stocks.

Published:

Last Updated:

Stifel belives the demand and strong pricing for 3D NAND and DRAM bodes well for the top semiconductor capital equipment companies.

Published:

Last Updated:

The March 31 short interest data have been compared with the previous report. Short interest decreased in most of these selected semiconductor stocks.

Published:

Last Updated: