Applied Materials Inc

NASDAQ: AMAT

$185.75

Real Time Data Delayed 15 Min.

AMAT Articles

The April 13 short interest data have been compared with the previous report. Short interest moves were mixed in these selected semiconductor stocks.

Published:

Last Updated:

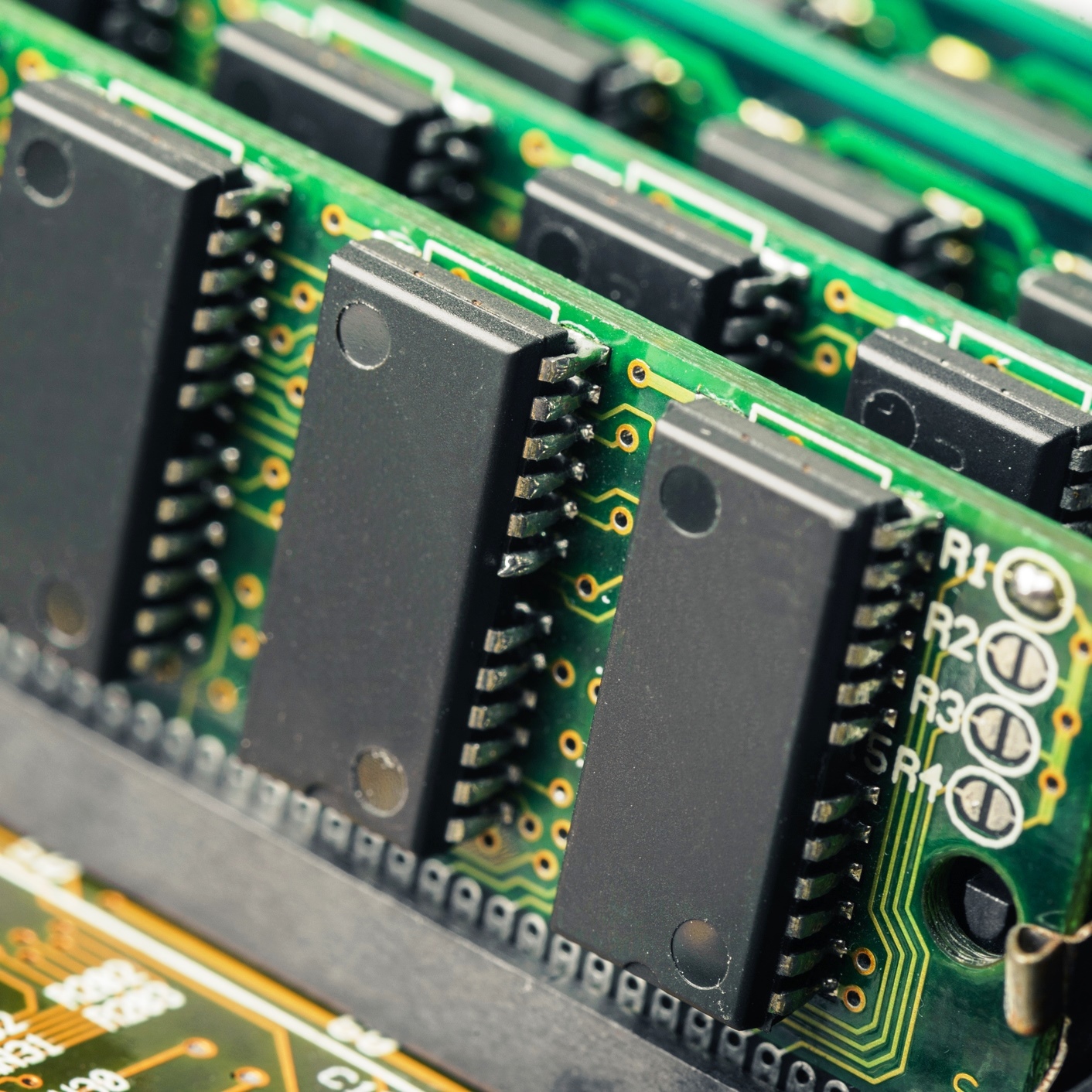

Stifel belives the demand and strong pricing for 3D NAND and DRAM bodes well for the top semiconductor capital equipment companies.

Published:

Last Updated:

The March 31 short interest data have been compared with the previous report. Short interest decreased in most of these selected semiconductor stocks.

Published:

Last Updated:

The March 15 short interest data have been compared with the previous report. Short interest increased in most of these selected semiconductor stocks.

Published:

Last Updated:

The February 28 short interest data have been compared with the previous report. Short interest moves were mixed in these selected semiconductor stocks.

Published:

Last Updated:

Semiconductor trends are considered to be leading indicators of technology and broader electronics demand. In a broader sense, semiconductor and tech stocks are considered to be leading indicators...

Published:

Last Updated:

Although Applied Materials reported record fiscal first-quarter financial results last week, it was not enough to move the stock significantly. However, practically all analysts covering Applied...

Published:

Last Updated:

In the late innings of a tired bull market, it just makes sense to stick with winners. When the inevitable sell-off comes, you can be sure that the weaker hands at the table will get sold the hardest.

Published:

Last Updated:

The January 31 short interest data have been compared with the previous report. Short interest moves were mixed in these selected semiconductor stocks.

Published:

Last Updated:

The January 13 short interest data have been compared with the previous report. Short interest moves were mixed in these selected semiconductor stocks.

Published:

Last Updated:

Deutsche Bank is in the camp that believes that 2017 could be solid for semiconductor capital equipment stocks, and it raised price target on four such stocks.

Published:

Last Updated:

The December 30 short interest data have been compared with the previous report. Short interest moves were down in most of these selected semiconductor stocks.

Published:

Last Updated:

We saw a ton of insider selling last week, as insiders, hedge funds and other institutional accounts appear to have waited until 2017 to sell shares, with the notion that nominal tax rates soon may...

Published:

Last Updated:

The December 15 short interest data have been compared with the previous report. Short interest moves were mixed in these selected semiconductor stocks.

Published:

Last Updated:

The November 30 short interest data have been compared with the previous report. Short interest moves were mixed in these selected semiconductor stocks.

Published:

Last Updated:

Discover Our Top AI Stocks

Our expert who first called NVIDIA in 2009 is predicting 2025 will see a historic AI breakthrough.

You can follow him investing $500,000 of his own money on our top AI stocks for free.