ASE Technology Holding Co.Ltd

NYSE: ASX

$9.81

Closing Price on November 21, 2024

ASX Stock Chart and Intraday Price

ASX Stock Data

| Asset Type | Stock |

| Exchange | NYSE |

| Currency | USD |

| Country | USA |

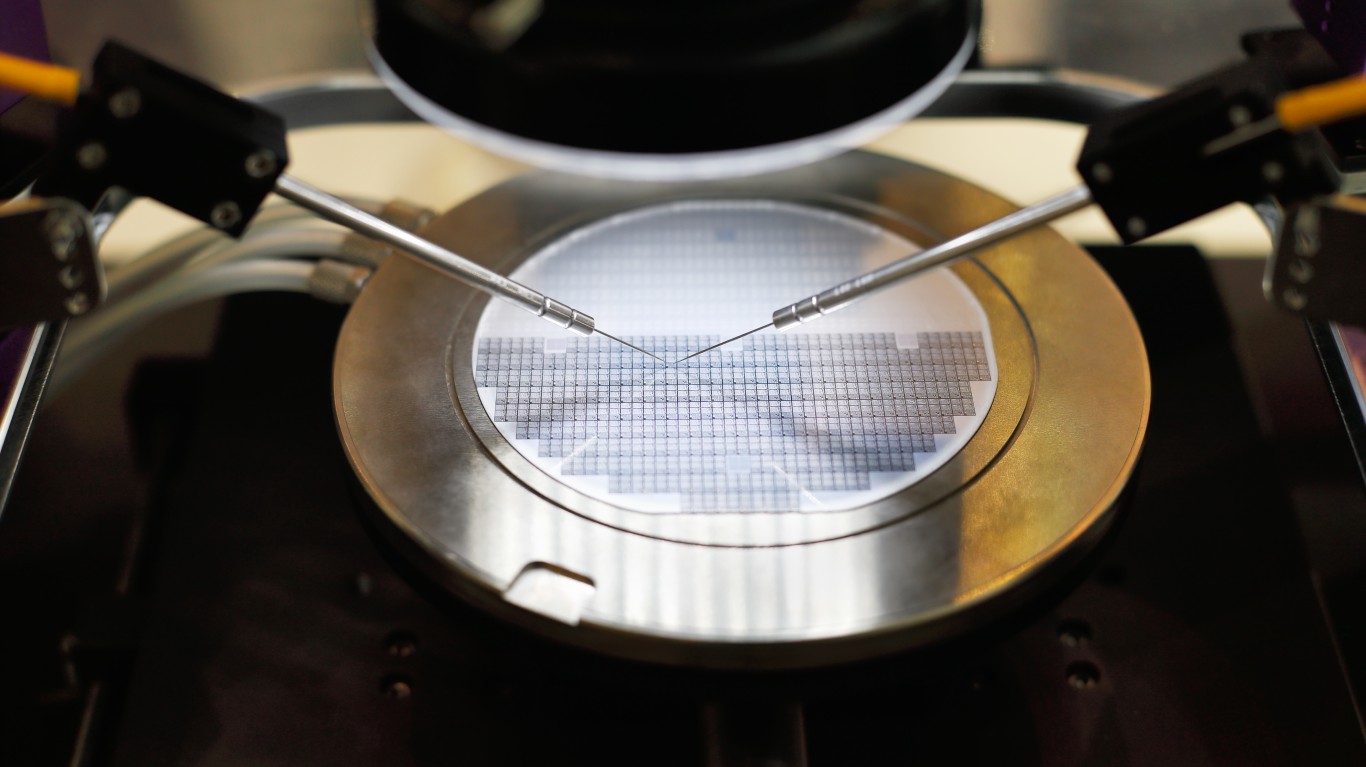

| Sector | MANUFACTURING |

| Industry | SEMICONDUCTORS & RELATED DEVICES |

| Address | 26 CHIN THIRD ROAD, NANTZE EXPORT PROCESSING ZONE, KAOHSIUNG TAIWAN, TW |

| Fiscal Year End | December |

| Latest Quarter | 12/31/2023 |

| Market Cap | 21,363.38M USD |

| Shares Outstanding | 2,155,740,000 |

ASX Articles

These five solid, lower-priced technology stocks pay dependable dividends. Investors can purchase them and start to generate positive total returns right away.

Published:

24/7 Insights Dividend stock increases the total return potential for investors Since 1926, dividends have contributed approximately 32% of the total return for the S&P 500, while capital...

Published:

Monday's top analyst upgrades and downgrades included ASE Technology, Block, Comcast, Copart, Digital Realty Trust, Enphase Energy, First Solar, Intel, Meta Platforms, Roku, Southwest Airlines, Snap...

Published:

These are five stocks for aggressive investors looking to get share count leverage on companies that have sizable upside potential. While not suited for all investors, they are not penny stocks with...

Published:

The bear market may still have a way to go, but now is the time for savvy investors to start looking at the stocks they would like to add at a substantial discount. These five top technology ideas...

Published:

Want to own tech stocks but also need income? These five well-known technology companies pay big dividends, have solid growth prospects for the rest of 2022 and beyond, and look like outstanding...

Published:

These are five stocks for aggressive investors looking to get share count leverage on companies that have sizable upside potential. While not suited for all investors, they are not penny stocks with...

Published:

These five top technology companies pay solid and dependable dividends and have solid growth prospects for the rest of the fourth quarter and beyond. They look like outstanding ideas now for...

Published:

Thursday's top analyst upgrades and downgrades included AT&T, Alibaba, Ally Financial, BioMarin Pharmaceutical, Box, Citrix Systems, Nio, Schlumberger and TJX Companies.

Published:

Semiconductor manufacturing giant TSMC reported better-than-expected quarterly and annual results Thursday morning. But the real winners could be the companies that provide services to TSMC.

Published:

Semiconductor equipment company stocks have had a strong 12-month run, and Needham has selected Applied Materials as its top pick going forward.

Published:

While chipmaking giant Intel may be having manufacturing difficulties with its latest chip designs, the makers of semiconductor manufacturing equipment are flourishing.

Published: