American Axle & Manufacturing Holdings Inc

NYSE: AXL

$6.52

Closing Price on November 22, 2024

AXL Stock Chart and Intraday Price

AXL Stock Data

| Asset Type | Stock |

| Exchange | NYSE |

| Currency | USD |

| Country | USA |

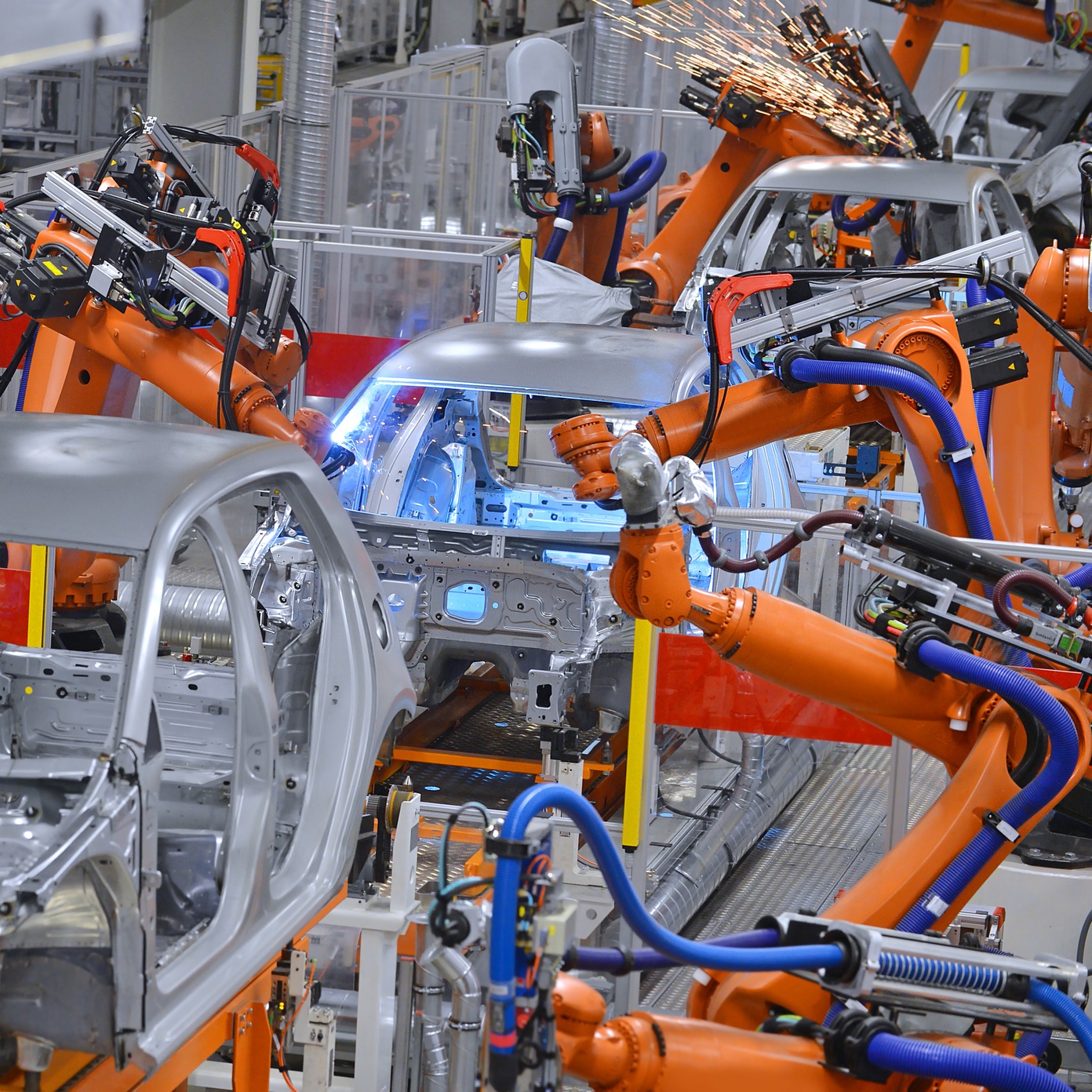

| Sector | MANUFACTURING |

| Industry | MOTOR VEHICLE PARTS & ACCESSORIES |

| Address | ONE DAUCH DRIVE, DETROIT, MI, US |

| Fiscal Year End | December |

| Latest Quarter | 12/31/2023 |

| Market Cap | 804.27M USD |

| Shares Outstanding | 117,070,000 |

AXL Articles

Monday's top analyst upgrades and downgrades included Adobe, Carvana, Goldman Sachs, Hudson Pacific Properties, Moderna, Take-Two Interactive Software and T-Mobile.

Published:

Tuesday's top analyst upgrades and downgrades included Arista Networks, Block, Cheniere Energy, Datadog, Foot Locker, Intuit, Kroger, TechnipFMC and Workday.

Published:

Thursday’s top analyst upgrades and downgrades included AutoNation, Enbridge, Gap, JinkoSolar, Micron Technology, Nvidia, Tractor Supply, Twilio and Vertex Pharmaceuticals.

Published:

New trends may be helping to change the automotive industry landscape. There may even be some upside for the sector coming out of the pandemic.

Published:

The top analyst upgrades, downgrades and initiations seen on Wednesday included CenturyLink, Deere, Ecolab, E*Trade, Merck, Southwest Airlines, S&P, Transocean and Walmart.

Published:

Last Updated:

Welbilt, Clearside Medical, American Axle and Hi-Crush all posted new 52-week lows Monday.

Published:

Last Updated:

The top analyst upgrades, downgrades and initiations seen on Monday included Adamas Pharmaceuticals, Alibaba, Bluebird Bio, Chevron, Encana, Parsley Energy, Starbucks, Teva Pharmaceutical and Under...

Published:

Last Updated:

While there is absolutely no guarantee that these industrial companies are acquired, they all are outstanding stocks to own in aggressive growth portfolios on their own.

Published:

Last Updated:

The top analyst upgrades, downgrades and other research calls from Tuesday include Albermarle, BB&T, Cheniere Energy Partners, Chesapeake Energy, Kinder Morgan, Red Hat and Roku.

Published:

Last Updated:

The top analyst upgrades, downgrades and other research calls from Thursday include Booking Holdings, Borg Warner, Delphi, Pandora, Ralph Lauren and Southwest Airlines.

Published:

Last Updated:

The top analyst upgrades, downgrades and initiations seen on Tuesday include Intuitive Surgical, Restaurant Brands, Scorpio Tankers, Teva Pharmaceutical, Under Armour and Zillow.

Published:

Last Updated:

The top analyst upgrades, downgrades and initiations seen on Monday morning include Citrix Systems, Enbridge Energy, Facebook, Hewlett Packard Enterprise, ArcelorMittal and Generac.

Published:

Last Updated:

Tuesday’s bounce was on the heels of two large sell-offs in post-Brexit trading, and shares were up again on Wednesday morning. It is important to remember that investors have found a myriad of...

Published:

Last Updated:

While there is no guarantee that any of these industrial companies get purchased, they all stand out on their own very strong metrics and make good sense as takeover candidates or standalone entities.

Published:

Last Updated:

24/7 Wall St. screened the updated Merrill Lynch Endeavor list for the higher profile companies to buy and found some outstanding stocks.

Published:

Last Updated: