Becton Dickinson & Company

NYSE: BDX

$225.45

Closing Price on November 21, 2024

BDX Articles

Friday's top analyst upgrades and downgrades included Alteryx, Booking, CarGurus, Datadog, FedEx, First Solar, Uber Technologies, Vonage, Yeti and Zillow.

Published:

Investors look at Aytu BioScience as it looks at expanding in the COVID testing field.

Published:

With the focus on health care expected to remain center stage for 2020, these Raymond James top health care stock picks all make sense now.

Published:

Monday's top analyst upgrades and downgrades included Amazon.com, Canopy Growth, CarMax, Chipotle Mexican Grill, Geron, Hess, Inogen, Occidental Petroleum, Snap, Teva Pharmaceutical, Vail Resorts and...

Published:

Aytu BioScience has a distribution agreement for a COVID-19 rapid test and is developing a potential UV light-based treatment.

Published:

This specialty pharmaceutical company is making good progress on multiple fronts, including changes to its board of directors and with its test for and treatment of COVID-19.

Published:

Aytu BioScience has been one of the biggest winners in the fight against the novel coronavirus. The company is sending 2,700 COVID-19 rapid tests to Denver for use with first responders.

Published:

Co-Diagnostics has been the toast of Wall Street after it went from penny stock status to a revered coronavirus testing stock.

Published:

GenMark Diagnostics shares shot up early on Wednesday after the company provided an update on its quarterly numbers and where it stands with its coronavirus test.

Published:

Co-Diagnostics shares popped on Monday after the company announced a key update from the FDA on its COVID-19 test kit.

Published:

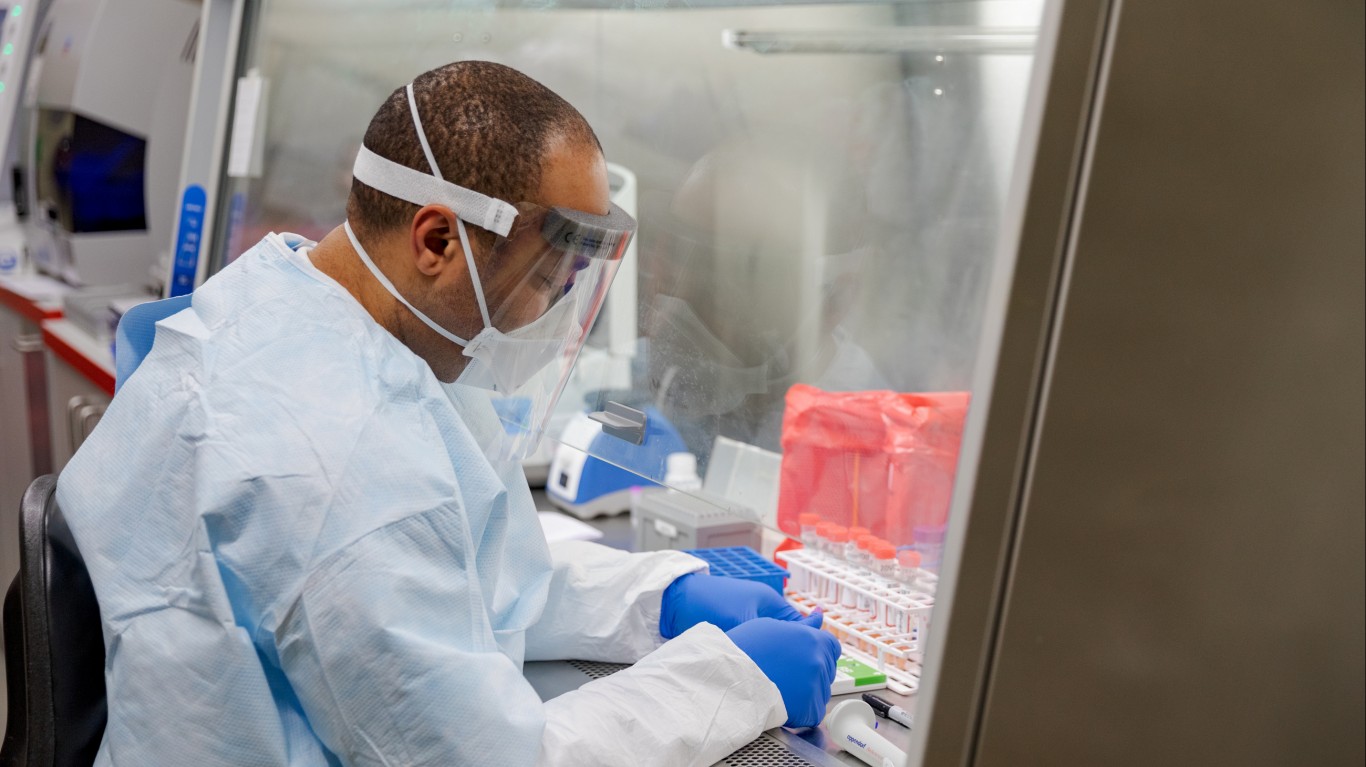

Becton, Dickinson is officially throwing its hat in the ring to fight COVID-19. Specifically, this firm is working on the front end by testing for the disease and antibodies that have been built up...

Published:

Thursday's top analyst upgrades, downgrades and initiations included Abbott Laboratories, Alexion Pharmaceuticals, Avis Budget, DexCom, Johnson & Johnson, Marvell Technology, Moderna, Snap, Splunk...

Published:

Friday's top analyst upgrades, downgrades and initiations included Cardinal Health, Domino's, FedEx, Ford, General Electric, Grubhub, HSBC, Marvell Technology, Twitter and Uber.

Published:

These four health care stocks look like solid picks for the fourth quarter and into 2020. They are also favorite picks from Raymond James analysts.

Published:

Last Updated:

These five Raymond James analyst favorite stock picks have substantial upside potential to the price targets and would make solid portfolio additions at current price levels.

Published:

Last Updated: