Cameco Corp

NYSE: CCJ

$60.93

Closing Price on November 21, 2024

CCJ Stock Chart and Intraday Price

CCJ Stock Data

| Asset Type | Common Stock |

| Exchange | NYSE |

| Currency | USD |

| Country | USA |

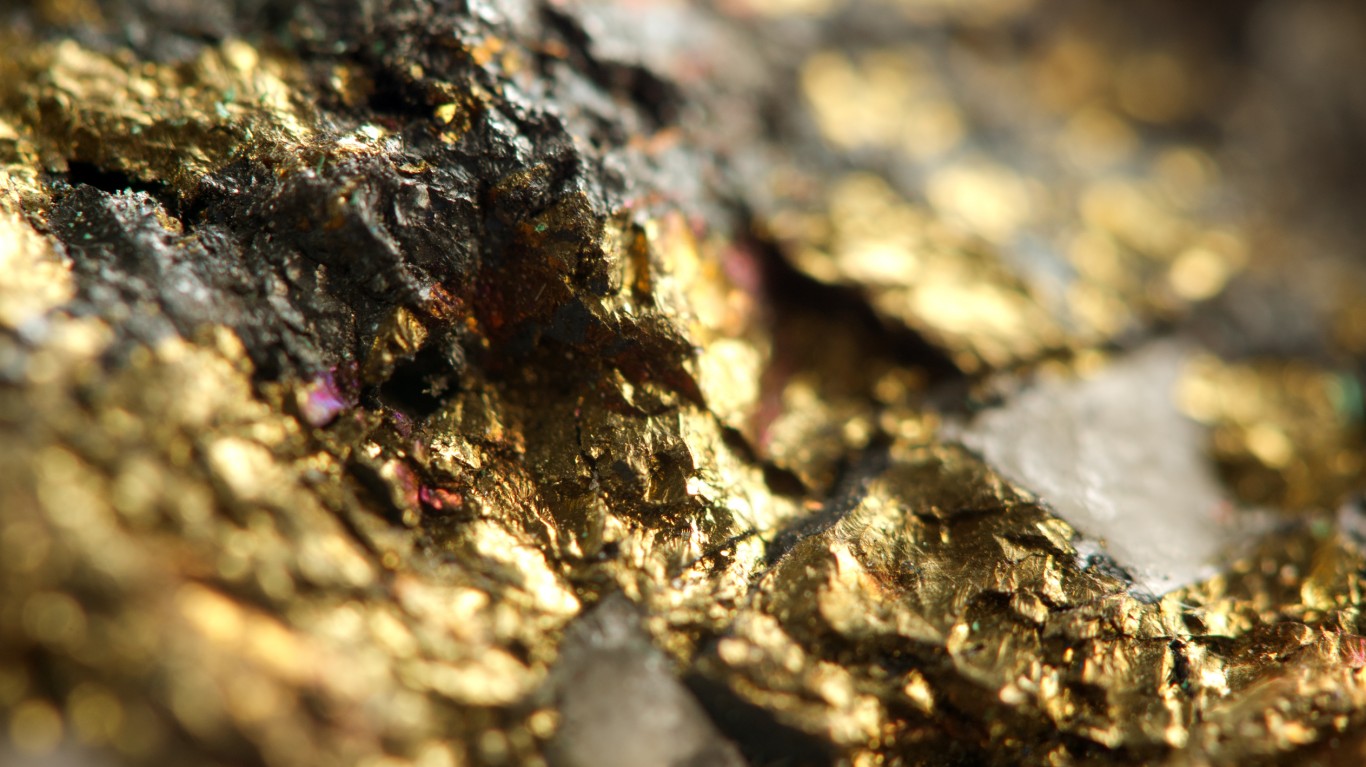

| Sector | ENERGY & TRANSPORTATION |

| Industry | MISCELLANEOUS METAL ORES |

| Address | 2121 11TH ST W, SASKATOON, SK, CA |

| Fiscal Year End | December |

| Latest Quarter | 2023-12-31 |

| Market Cap | 21,042.69M USD |

| Shares Outstanding | 434,176,000 |

CCJ Articles

Big tech’s impact on nuclear power stocks has been almost palpable. And while artificial intelligence (AI) data center demands could act as a boon for nuclear power producers and uranium miners for...

Published:

The nuclear power utilities have really heated up as some tech titans turned to small nuclear reactors to help fuel their AI data centers of the future. Indeed, Vistra (NYSE:VST) has enjoyed high...

Published:

Demand for uranium spiked in 2023, nearly doubling in price. The Federal Reserve said the global price of uranium jumped from $39 per pound at the end of 2022 to over $$70 per pound by last December....

Published:

Since Bridgewater Associates founding in 1975, Ray Dalio has grown the investment firm into the world’s largest hedge fund with over $124 billion in assets under management (AUM). With nearly 900...

Published:

The setup for the benchmark Oil indices of Brent Crude and West Texas Intermediate to soar over $100 was all in place. Massive Saudi and OPEC+ production cuts, U.S producers halting drilling in some...

Published:

One of the country's largest health care companies, North America's largest uranium producer and a Warren Buffett favorite are on deck to report quarterly earnings before U.S. markets open on...

Published:

Before U.S. markets open on Thursday, AbbVie, Cameco, Canopy Growth, PepsiCo and Under Armour will report quarterly earnings.

Published:

Before markets open on Thursday, these four companies will report quarterly results. Here is what analysts are expecting.

Published:

All three major U.S. equity indexes closed lower on Friday. The Dow Jones Industrial Average slipped 0.43%%, the S&P 500 was off 0.93%, and the Nasdaq Composite fell 1.87%. Eight of 11 sectors,...

Published:

Uranium prices are up about 80% over the past 12 months, and uranium mining companies were along for the ride for a long time. Is that still the case?

Published:

Here is a look at four commodities companies set to report quarterly results on Wednesday or Thursday.

Published:

Before markets open Wednesday we will hear earnings results from a key uranium miner, a struggling marijuana grower and a pharmacy/health care services giant.

Published:

Shares of uranium miners soared over the first 10 months of 2021. What happened?

Published:

Three oil industry giants and North America's leading uranium miner are reporting quarterly results before markets open on Friday.

Published:

The spot price of uranium has been rising again after a dip in late September. Rising along with it are the share prices of several uranium miners and one exchange-traded fund.

Published: