Coterra Energy Inc

NYSE: CTRA

$27.63

Closing Price on November 22, 2024

CTRA Stock Chart and Intraday Price

CTRA Stock Data

| Asset Type | Stock |

| Exchange | NYSE |

| Currency | USD |

| Country | USA |

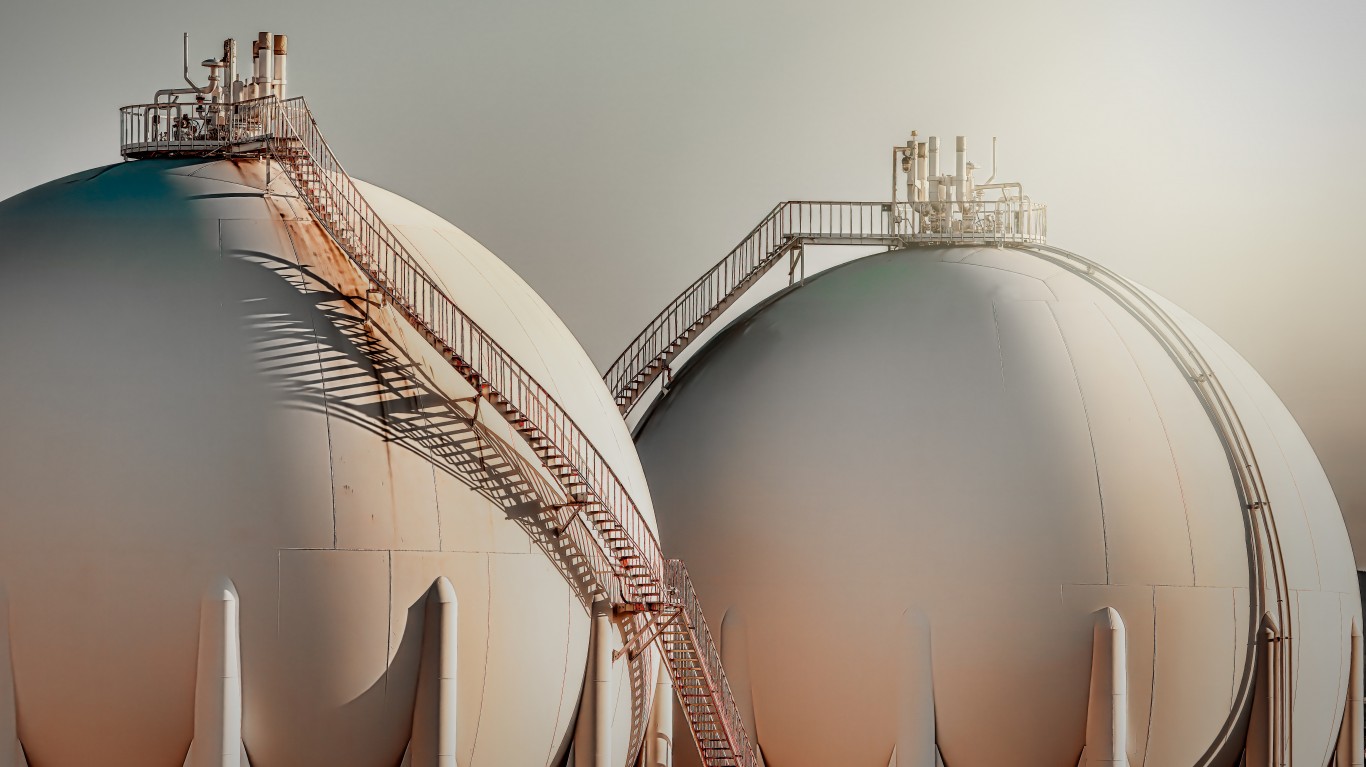

| Sector | ENERGY & TRANSPORTATION |

| Industry | CRUDE PETROLEUM & NATURAL GAS |

| Address | 840 GESSNER ROAD, SUITE 1400, HOUSTON, TX, US |

| Fiscal Year End | December |

| Latest Quarter | 12/31/2023 |

| Market Cap | 19,517.95M USD |

| Shares Outstanding | 751,847,000 |

CTRA Articles

24/7 Insights Dividend stocks offer investors the opportunity to increase investment total return. Dividend stocks offer passive income streams. Check out this free report: Access 2 legendary,...

Published:

24/7 Wall St. Insights In April, we wrote that Marathon Oil could be acquired. ConocoPhillips is a surprise buyer in the large-cap energy sweepstakes. Access 2 legendary, high-yield dividend stocks...

Published:

With corporate profits reaching record highs, some companies have been blamed for jacking up prices under the cover of inflation in what’s been termed “greedflation.” Though PepsiCo is...

Published:

Last fall, Exxon Mobil Corporation (NYSE: XOM) made a monumental move, announcing its acquisition of oil shale titan Pioneer Natural Resources (NYSE: PXD) for a staggering $59.5 billion in an...

Published:

Last Updated:

With oil prices rising and demand expected to grow over the coming years, these five top exploration and production companies could be the next takeover targets.

Published:

Tuesday's top analyst upgrades and downgrades included Amgen, CF Industries, Coterra Energy, CymaBay Therapeutics, Eaton, Marriott, Monster Beverage, Mosaic, Nutrien, Public Service Enterprise, Urban...

Published:

These seven outstanding stocks make sense for growth and income investors looking to add energy as they are rated Buy, come with large and dependable dividends and have solid upside to the posted...

Published:

These top U.S. oil exploration and production stocks and a master limited partnership pay among the biggest dividends in the sector and are offering outstanding entry points, so they make sense for...

Published:

Wednesday's top analyst upgrades and downgrades included Alibaba, Alphabet, Antero Resources, Ballard Power Systems, Coterra Energy, Frontier Communications Parent, GE HealthCare Technologies, Host...

Published:

Recent policy changes in China could boost oil prices in a big way as summer rolls on. These five outstanding stocks with healthy dividends make sense now for growth and income investors looking to...

Published:

Thursday's top analyst upgrades and downgrades included Antero Resources, AutoZone, Coterra Energy, Dollar General, Eli Lilly, First Horizon, Infosys, Owens Corning, Palo Alto Networks, Range...

Published:

Wednesday's top analyst upgrades and downgrades included Aflac, Capri, Coterra Energy, First Republic Bank, PDD, Range Resources, Stanley Black & Decker, Starwood Property Trust, VFC, Viking...

Published:

Friday's top analyst upgrades and downgrades included Alphabet, Chegg, Citizens Financial, Comstock Resources, Coterra Energy, CubeSmart, Emerson Electric, Fastly, General Electric, Las Vega Sands,...

Published:

A wave of mergers and acquisitions in the energy space may be on tap, and these five top exploration and production companies could be swallowed up next. Plus, they all pay solid dividends while...

Published: