Ford Motor Company

NYSE: F

$9.85

Real Time Data Delayed 15 Min.

F Articles

24/7 Wall St. looks at large public companies to find those that did particularly poorly in the past year due more to strategic decisions than the pandemic.

Published:

Chinese electric car maker Xpeng has announced an underwritten secondary offering of 40 million shares.

Published:

Short interest in electric carmakers mostly increased in the two-week reporting period ended November 13. Soaring share prices brought out the short sellers.

Published:

Wednesday's top analyst upgrades and downgrades included Analog Devices, Apple, Best Buy, Dell Technologies, Dollar Tree, Ford, General Electric, General Motors, HP, Medtronic and Zscaler.

Published:

New car sales in November are expected to come in more than 10% lower than sales in November 2019. But holiday car shoppers will find some Black Friday specials and somewhat better inventory of new...

Published:

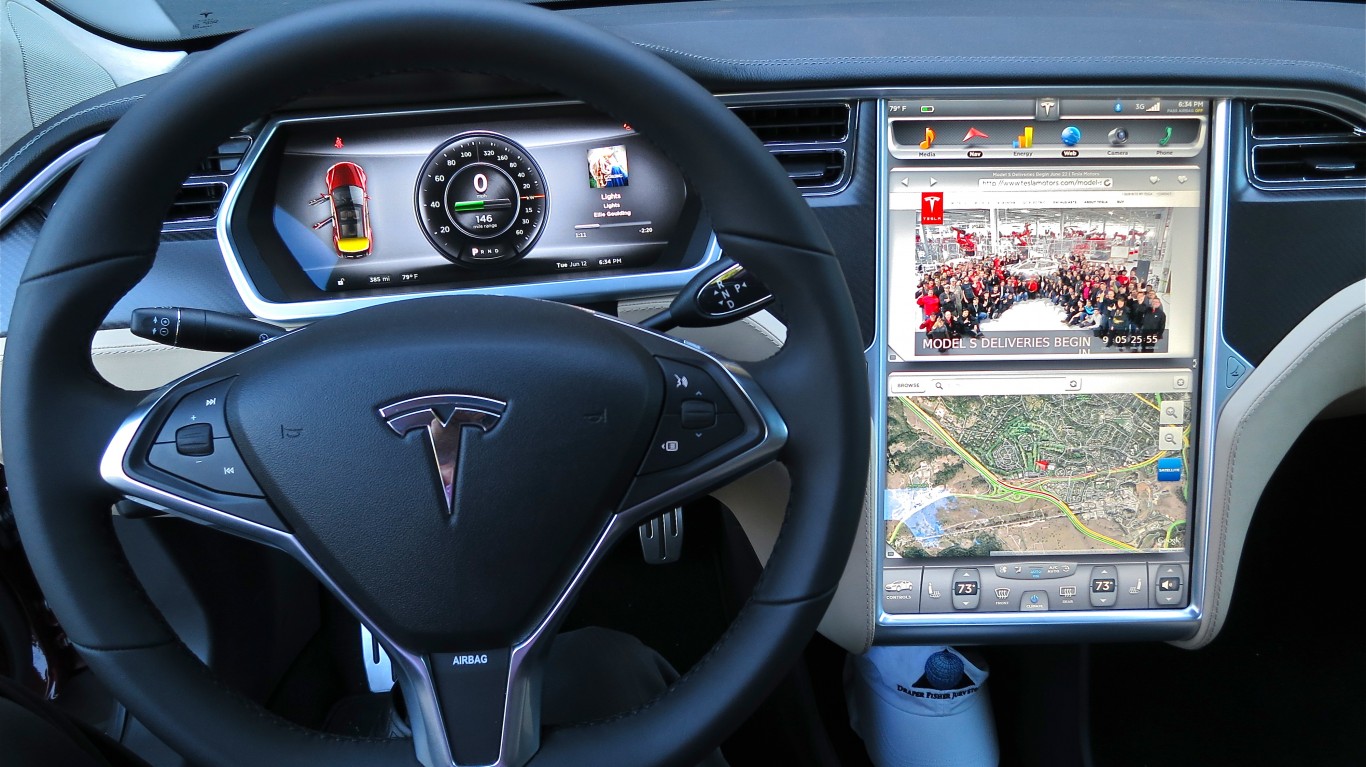

Consumer Reports magazine is out with its latest automobile reliability rankings and Tesla just managed to stay out of last place.

Published:

The Lincoln luxury brand was by far the biggest loser in the latest Consumer Reports rankings of the most reliable cars in America.

Published:

New Ford CEO Jim Farley has struggled with a problem that has vexed most of the company's six prior chief executives.

Published:

Short interest was mixed on electric vehicle makers in the two-week reporting period ended October 30. Short sellers also decreased their positions in two traditional carmakers.

Published:

Thursday's top analyst upgrades and downgrades included Amgen, Boeing, eBay, Etsy, Fastly, Fiverr, Ford, General Electric, Gilead Sciences, Pinterest and Six Flags.

Published:

Ford Motor Co. released its third quarter earnings report after the closing bell on Wednesday, and investors cheered these results.

Published:

Short interest in electric vehicle makers was evenly mixed in the two-week reporting period that ended October 15. But a couple of truck makers got some bad news Monday.

Published:

This week will be perhaps the biggest week of earnings season, with many major names reporting, including Amazon, Facebook, Ford and Starbucks.

Published:

These four beaten-down stocks are rated Buy BofA Securities and could very well offer patient investors some huge returns over the next year or so. They may not return to all their past glory, but...

Published:

New trends may be helping to change the automotive industry landscape. There may even be some upside for the sector coming out of the pandemic.

Published: