Gulfport Energy Corp (New)

NYSE: GPOR

$176.77

Closing Price on November 22, 2024

GPOR Stock Chart and Intraday Price

GPOR Stock Data

| Asset Type | Stock |

| Exchange | NYSE |

| Currency | USD |

| Country | USA |

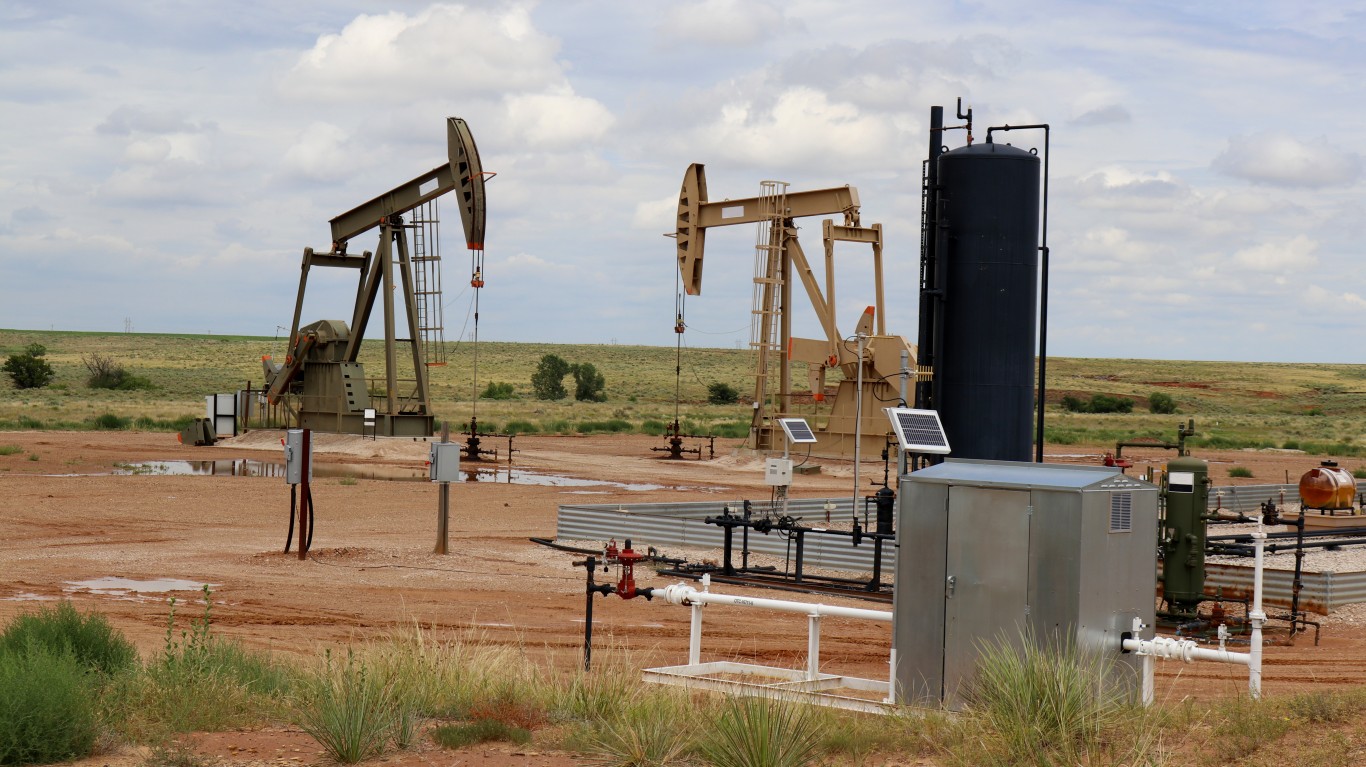

| Sector | ENERGY & TRANSPORTATION |

| Industry | CRUDE PETROLEUM & NATURAL GAS |

| Address | 14313 NORTH MAY AVENUE, SUITE 100, OKLAHOMA CITY, OK, US |

| Fiscal Year End | December |

| Latest Quarter | 12/31/2023 |

| Market Cap | 2,598.60M USD |

| Shares Outstanding | 18,300,000 |

GPOR Articles

Thursday's top analyst upgrades and downgrades included Best Buy, Carnival, Caterpillar, Centene, ChargePoint, Foot Locker, Hewlett Packard Enterprise, Palo Alto Networks, PDD, Peloton Interactive,...

Published:

Wednesday's top analyst upgrades and downgrades included Alibaba, Alphabet, Amazon.com, AppLovin, Cognizant Technology Solutions, Emerson Electric, Meta Platforms, Pinterest, Sea, Shopify, Target and...

Published:

Thursday's top analyst upgrades and downgrades included Brixmor Property, CAVA, Chevron, GE Healthcare Technologies, Keurig Dr Pepper, News Corp, PACCAR, Permian Resources, Pioneer Natural Resources,...

Published:

Friday's top analyst upgrades and downgrades included AppLovin, Crown Castle, GoodRx, Global Payments, Monster Beverage, Penn Entertainment, Plug Power, Roblox, Southern Company and Wynn Resorts.

Published:

Monday's top analyst upgrades and downgrades included Amphenol, Apollo Global Management, Applied Materials, Bloom Energy, Dell Technologies, EOG Resources, Gap, Invesco, PBF Energy, Range Resources,...

Published:

Mizuho analyst Nitin Kumar has made a number of changes to energy sector price targets, along with one rating change.

Published:

Analysts at JPMorgan shuffled the deck on oil and gas producers Wednesday morning, including a big downgrade for Chevron.

Published:

Tuesday's top analyst upgrades and downgrades included Apache, Broadcom, Caterpillar, Dollar General, Microsoft, NXP Semiconductors, Salesforce.com, Sirius XM, Slack and Yelp.

Published:

Tuesday's top analyst upgrades, downgrades and initiations included Barclays, CrowdStrike, Edgewell Personal Care, Facebook, Funko, RingCentral, Rio Tinto, Royal Bank of Scotland, Salesforce.com and...

Published:

These are five energy stocks for aggressive accounts that look to get share count leverage on companies that have sizable upside potential and to add energy exposure.

Published:

Last Updated:

Antero Resources, Northern Oil and Gas and these other energy stocks could prove exciting additions to portfolios looking for solid alpha potential.

Published:

Last Updated:

24/7 Wall St. We screened Stifel’s energy research universe and found five stocks trading under the $10 level that could provide investors with some solid upside potential.

Published:

Last Updated:

The top analyst upgrades, downgrades and initiations seen on Friday included Bed Bath & Beyond, Celgene, Dow, Fannie Mae, Intel, Lennar, Snap, UGI, Viacom and WEX.

Published:

Last Updated:

These are five energy stocks for aggressive accounts that look to get share count leverage on companies with sizable and reasonable upside potential.

Published:

Last Updated:

The top analyst upgrades, downgrades and initiations seen on Friday included Apple, Broadcom, Chesapeake Energy, Devon Energy, Lululemon Athletica, SecureWorks, Tesla and Zendesk.

Published:

Last Updated: