Goldman Sachs Group Inc

NYSE: GS

$604.21

Real Time Data Delayed 15 Min.

GS Articles

The top analyst upgrades, downgrades and other research calls from Wednesday include Avon, Broadcom, CDW, CSX, Goldman Sachs, Starbucks, Twitter, Under Armour and Windstream.

Published:

Last Updated:

Goldman Sachs Group released better-than-expected quarterly results before the markets opened on Tuesday.

Published:

Last Updated:

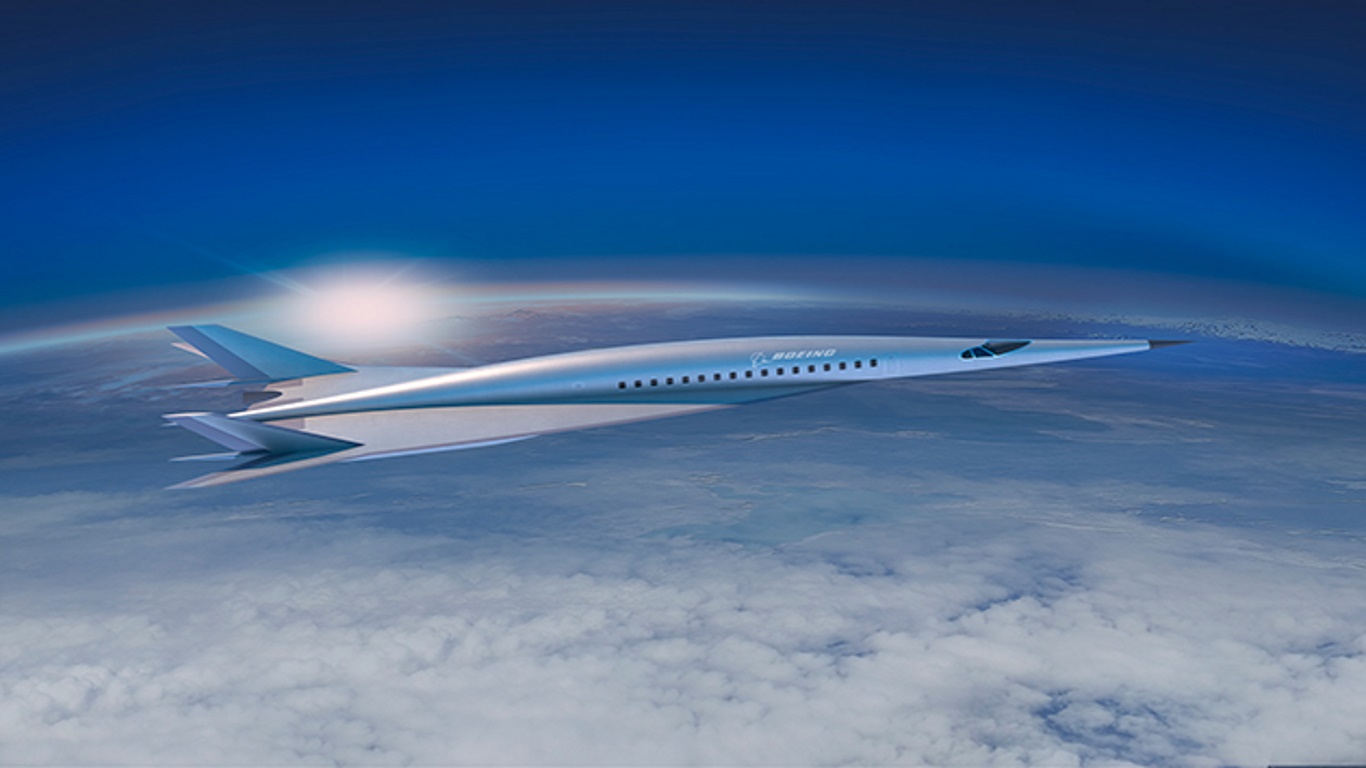

JPMorgan, Goldman Sachs, Cisco Systems, and Boeing were the leading Dow gainers Monday.

Published:

Last Updated:

The Goldman Sachs Group, Inc. (NYSE: GS) is scheduled to release its second quarter earnings report before the markets open on Tuesday. Thomson Reuters has consensus estimates calling for $4.66 in...

Published:

Last Updated:

Boeing sees a large number of new sales, China's GDP growth slows, Goldman Sachs to get a new CEO, and other important business headlines.

Published:

Last Updated:

What to expect from upcoming earnings reports from American Express, Johnson & Johnson, Microsoft and other Dow components.

Published:

Last Updated:

3M Company has maintained its position for a second week as the Dow's worst-performing stock for the year to date. Shares added nearly 2% last week, but that was not good enough.

Published:

Last Updated:

The June 29 short interest data have been compared with the previous figures, and short interest in these selected big bank stocks was lower.

Published:

Last Updated:

Caterpillar, JPMorgan, Boeing, and Goldman Sachs led the Dow higher Monday.

Published:

Last Updated:

These top financial stocks are trading well below their 52-week highs, and all boast extremely reasonable valuations.

Published:

Last Updated:

Some investors track what some might call the "pigs of the Dow" as the top laggards of the index. After all, great companies that get beaten down do not always stay down forever. Some come back with...

Published:

Last Updated:

In addition to taking GE's place on the Dow Jones Industrials index, Walgreens also took over its rank as the worst-performing Dow stock of the year to date.

Published:

Last Updated:

Goldman Sachs Group Inc. (NYSE: GS) and Morgan Stanley (NYSE: MS) did poorly in government stress tests. According to The Wall Street Journal: Regulators cleared most of the largest U.S. banks to...

Published:

Last Updated:

The June 15 short interest data have been compared with the previous figures, and short interest in these selected big bank stocks was lower.

Published:

Last Updated:

With interest rates trading higher, which should benefit big money center banks, and trading revenues looking better due to massive share buybacks, large financials look like a solid bet.

Published:

Last Updated: