Kinross Gold Corporation

NYSE: KGC

$10.22

Closing Price on November 22, 2024

KGC Articles

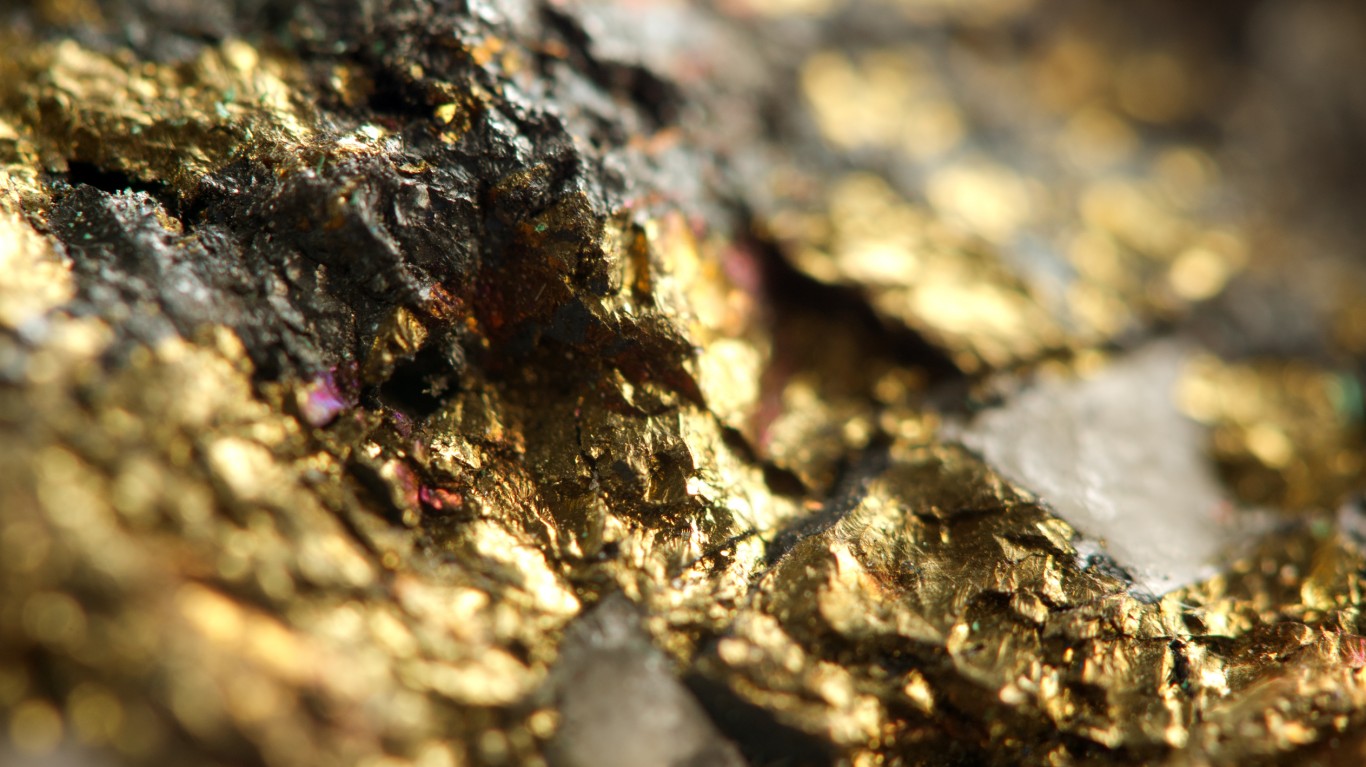

Gold prices have been on a tear that began more than a year ago. One segment likely to see increased profits are the gold miners. Here a several that deserve another look.

Published:

The gold bugs must be happy again. With gold trading just under $1,800 again, the gold bugs are going to be increasing their calls for gold to rise to $2,000. Some have even been publishing reports...

Published:

Tuesday's top analyst upgrades and downgrades included Advanced Micro Devices, Alcoa, Apple, Broadwind, Cogent Communications, Intel, Micron Technology, Netflix, Nvidia, Qualcomm, Square and Zscaler.

Published:

Thursday's top analyst upgrades, downgrades and initiations included Abbott Laboratories, Chevron, Cimarex, DocuSign, General Electric, IBM, Micron Technology, Microsoft, Nvidia, Tesla and Western...

Published:

Here are five of the top gold-mining and gold-producing stocks that appear undervalued despite gold's performance in 2019.

Published:

With China devaluing the yuan and halting purchases of U.S. agricultural products in response to President Trump's additional tariffs last week, gold and gold miners are having their day.

Published:

Last Updated:

The top analyst upgrades, downgrades and initiations seen on Thursday included Apple, Citigroup, Comcast, Cypress Semiconductor, Huya, Six Flags, Tesla, Teva Pharmaceutical, U.S. Steel, Verizon...

Published:

Last Updated:

Monday's announcement of the $10 billion merger between gold mining giants Newmont and Goldcorp naturally leads to the question about what other firms may be on the block.

Published:

Last Updated:

Encana, Weatherford International, EQT Corp. and Kinross Gold all posted new 52-week lows Tuesday.

Published:

Last Updated:

CommScope, Ctrip.com, Kinross Gold, and Zayo all posted new 52-week lows Thursday.

Published:

Last Updated:

One way to always have a degree of protection is to own gold-mining stocks. And now could be an excellent time to buy some protection and add some gold into long-term growth portfolios.

Published:

Last Updated:

Does Monday's announced merger between gold miners Barrick and Randgold presage a rush of consolidation and merger in an industry that has been reeling for a couple of years now?

Published:

Last Updated:

Here are five stocks for aggressive accounts that look to get share count leverage on companies that have sizable upside potential.

Published:

Last Updated:

The top analyst upgrades, downgrades and initiations seen on Wednesday include AMD, Alphabet, Amazon.com, Best Buy, Dollar General, Ferrari, Goldcorp, Hewlett Packard Enterprise, Square and Tilray.

Published:

Last Updated:

The top analyst upgrades, downgrades and initiations seen on Monday include Applied Materials, Baker Hughes, Bloom Energy, Constellation Brands, Deere, JC Penney, Kroger, Nike and Tesla.

Published:

Last Updated: