Coca-Cola Company

NYSE: KO

$63.65

Real Time Data Delayed 15 Min.

KO Stock Chart and Intraday Price

KO Stock Data

| Asset Type | Stock |

| Exchange | NYSE |

| Currency | USD |

| Country | USA |

| Sector | MANUFACTURING |

| Industry | BEVERAGES |

| Address | ONE COCA COLA PLAZA, ATLANTA, GA, US |

| Fiscal Year End | December |

| Latest Quarter | 12/31/2023 |

| Market Cap | 256,720.73M USD |

| Shares Outstanding | 4,312,460,000 |

KO Articles

The S&P 500 dividend yield of 1.18% is the lowest since February 2001, according to a Nov. 12 article in Barron’s. Technology and financial stocks now account for 46% of the index. Many of...

Published:

Last year, the S&P 500 reached new highs despite geopolitical tensions and market pressures. Defensive stocks in sectors like technology, health, and food and beverage provided stable dividends...

Published:

According to World Population Review, Coca-Cola is the world’s most popular branded drink. WPR cites: “It is not only the most popular soft drink in the United States, but also the most popular...

Published:

Retired investors still have numerous options to add to their passive income streak, while rates and yields are still on the high end of the recent historical range. Undoubtedly, we’re coming off...

Published:

With approximately over 10,000 individuals retiring daily, baby boomers are increasingly reviewing their retirement planning goals. For each individual or couple entering or nearing retirement, the...

Published:

Coca-Cola Consolidated just rewarded its shareholders with a 400% dividend hike. The beverage bottler also announced a $1 billion share buyback program.

Published:

Given the huge market rise over the past year, these five high-yield dividend stocks from the Buffett portfolio look like great ideas in October.

Published:

24/7 Wall St. Key Takeaways: SCHD is best suited for long-term investors seeking both income and growth potential, while SCHR appeals to conservative investors focused on safety and capital...

Published:

24/7 Wall Street Insights Dividend Kings are companies with an unbroken track record of dividend increases spanning a minimum of 50 consecutive years. Some of these companies have been in business...

Published:

At 9:45 a.m. ET markets are down across the board today. The Nasdaq Composite is down .53% while the S&P 500 is performing slightly better. Let’s look at the performance of each major index:...

Published:

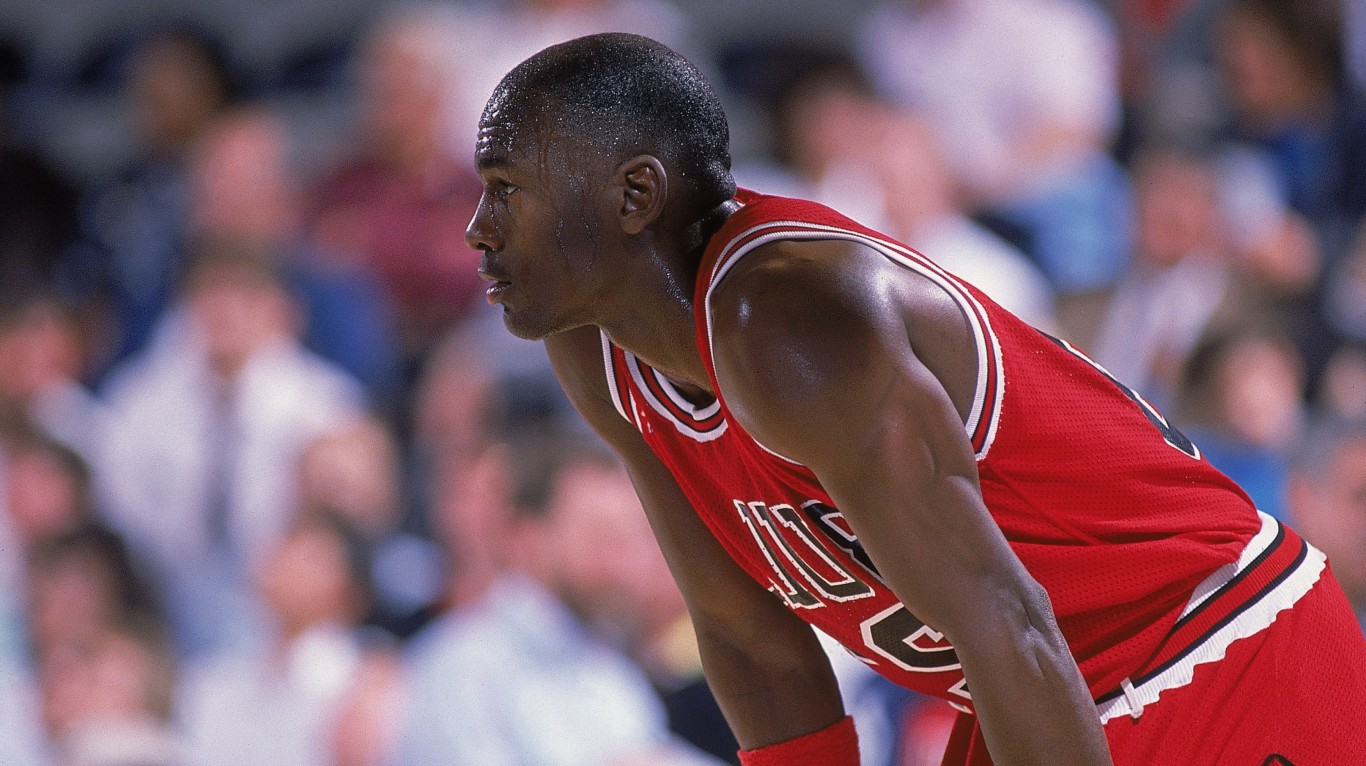

Michael Jordan is widely regarded as one of the greatest basketball players of all time. His professional career began in 1984 when he was drafted by the Chicago Bulls as the third overall pick. Over...

Published:

Warren Buffett could be the greatest investor of all time. Indeed, a number of surveys has pegged the Berkshire Hathaway (NYSE:BRK-B) CEO atop a long list of investing talent of our generation. I...

Published:

This post may contain links from our sponsors and affiliates, and Flywheel Publishing may receive compensation for actions taken through them. Your Individual Retirement Account (IRA) can help propel...

Published:

The Dividend Aristocrats should be treated as royalty after having raised their dividends consistently for at least two and a half decades. Indeed, over a quarter of a century timespan, some market...

Published:

Insider buying slowed ahead of the third-quarter earnings reporting season, but an IPO tempted one insider, and a repeat buyer returned to boost a stake.

Published: