Marathon Digital Holdings Inc

NASDAQ: MARA

$24.18

Closing Price on November 21, 2024

MARA Stock Chart and Intraday Price

MARA Stock Data

| Asset Type | Stock |

| Exchange | NASDAQ |

| Currency | USD |

| Country | USA |

| Sector | REAL ESTATE & CONSTRUCTION |

| Industry | PATENT OWNERS & LESSORS |

| Address | 1180 N. TOWN CENTER DRIVE, SUITE 100, LAS VEGAS, NV, US |

| Fiscal Year End | December |

| Latest Quarter | 9/30/2023 |

| Market Cap | 6,010.88M USD |

| Shares Outstanding | 222,625,000 |

MARA Articles

This post may contain links from our sponsors and affiliates, and Flywheel Publishing may receive compensation for actions taken through them. I typically only invest my money in index funds but I am...

Published:

Bitcoin (CRYPTO:BTC) and other cryptocurrencies have been under a modest amount of pressure in recent months. Though the weakness may be an ominous sign to some, dip-buyers who are gearing for...

Published:

Former President Donald Trump has shifted from his previous criticism to a more favorable view of cryptocurrencies, recognizing their potential benefits. This change was evident in recent speeches,...

Published:

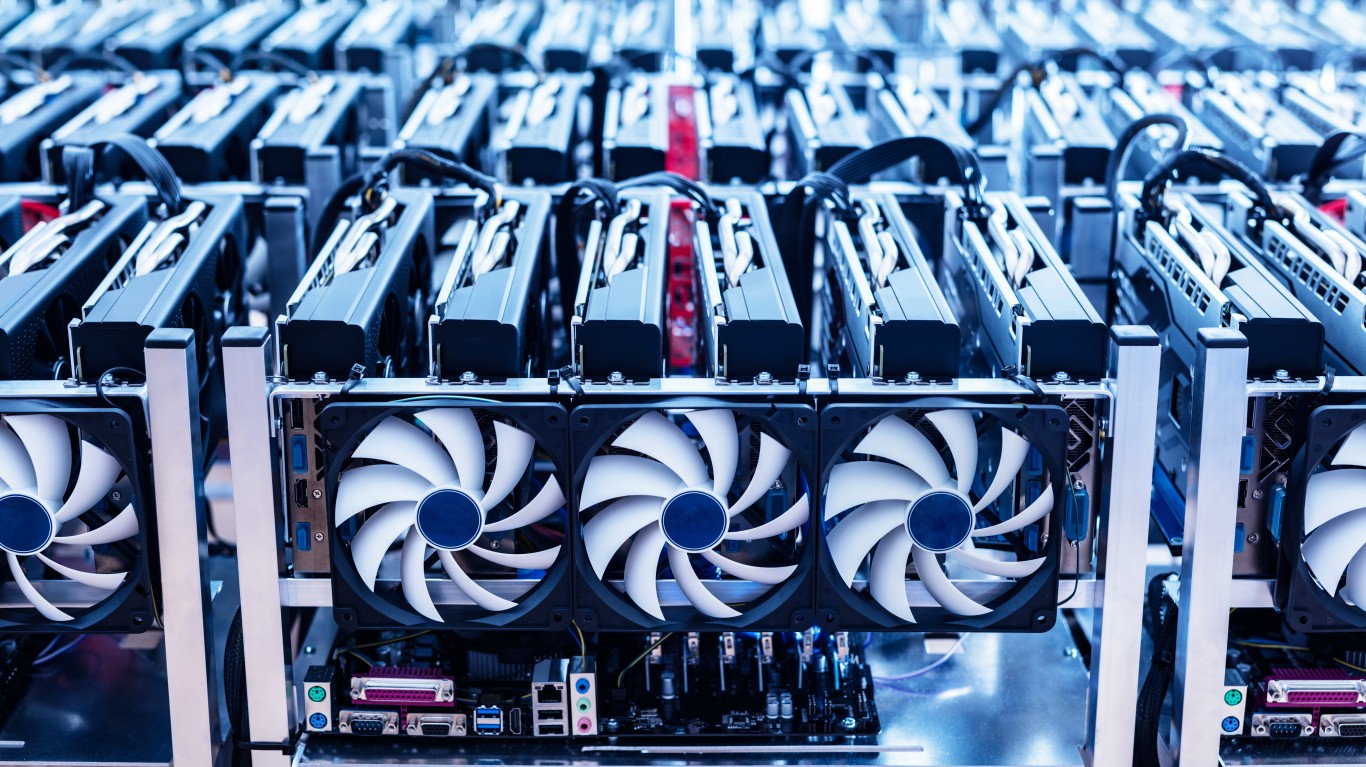

Crypto mining remains a lucrative albeit energy-intensive business. Marathon Digital Holdings is up 29% over the past month. Short sellers have increased their positions targeting the blockchain...

Published:

In 2024, the fastest-growing stocks have been in the momentum category, led by NVIDIA (NASDAQ: NVDA). We reviewed the sales growth rates of some of the other fastest-growing companies in the market...

Published:

Regardless of your opinion about bitcoin (CRYPTO:BTC), or cryptocurrencies in general, they are here and many people are making a lot of money with them. As with any new technological advancement,...

Published:

As earnings season takes off, analyst rating changes have picked up and Wednesday saw a downgrade to two automakers.

Published:

The U.S. SEC grudgingly approved applications from 11 investment firms seeking to offer spot Bitcoin ETFs. Let the good times roll.

Published:

Three of China's top EV makers have released delivery data for September, and data from Tesla is due out soon. In the meantime, Bitcoin has jumped above $28,000 because its October.

Published:

Here is a look at what analysts expect to hear from these five companies due to report quarterly earnings after Tuesday's closing bell.

Published:

U.S. markets closed mixed on Monday and were trading slightly in the green in Tuesday's premarket, no thanks to an announced acquisition in the cannabis industry.

Published:

Amazon announced an increase to 18,000 staff firings and AMD launched new chips at the CES show in Las Vegas.

Published:

Expect more volatility in the cryptocurrency market according to researchers at S3 Analytics.

Published:

Last Updated:

Friday's top analyst upgrades and downgrades included Amgen, CarMax, D.R. Horton, Frontier, General Electric, Home Depot, Ingersoll Rand, Marathon Digital, MetLife, Palantir Technologies, Realty...

Published:

Many bitcoin mining companies have declared that they will not sell the bitcoin they mine. But the pressure is on now as easy money flows have stopped and mining profits have tanked.

Published: