Microsoft Corporation

NASDAQ: MSFT

$427.99

Closing Price on November 26, 2024

MSFT Articles

In the ever-changing world of investing, ETFs have become the go-to choice for many novice and seasoned investors. ETFs are “baskets” of stocks. When you buy an ETF, you’re investing in all the...

Published:

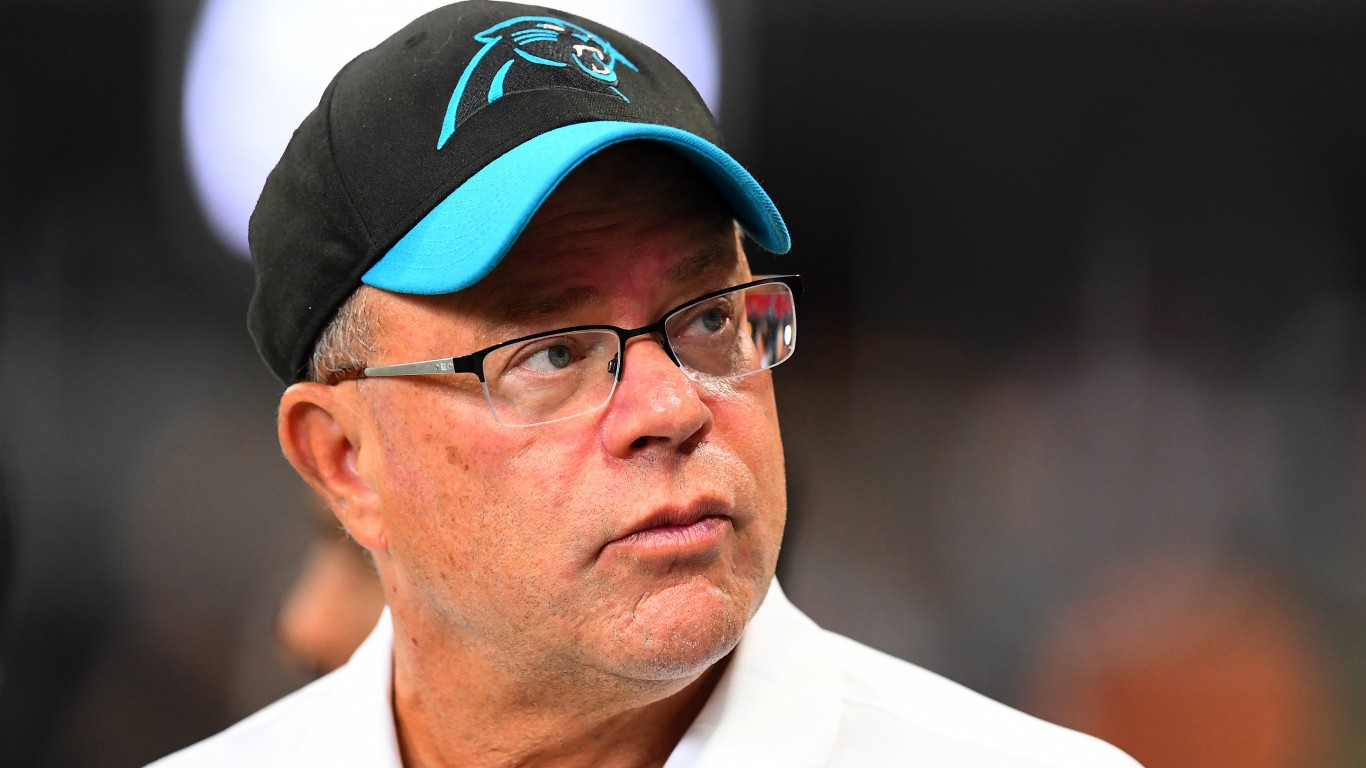

David Tepper is a notable figure in finance, most notably the billionaire founder of global hedge fund Appaloosa management based in Florida. However, the institutional investor is also notably the...

Published:

For the soon-to-be-retired, there’s one last stretch to sprint before you break the finish line. Undoubtedly, the last part of a race can be the toughest, with the end in sight and you’re running...

Published:

Last Updated:

Companies have several ways they can share their success with their investors: They can pay dividends or they can buy back stock. Both are popular with investors and are generally considered a...

Published:

Billionaire Larry Ellison has significant holdings in Tesla and real estate, but his massive net worth is almost entirely in his Oracle holdings.

Published:

Diversification is key in today’s investing world. Exchange-traded funds, or ETFs, offer a convenient and affordable way to achieve this. Think of them as baskets filled with a variety of stocks....

Published:

David Elliot Shaw was known for his elusive investment strategies, rooted in his computer science background. His time as a Columbia University professor likely shaped his quantitative trading...

Published:

: John Ive, former Apple design head, is partnering with OpenAI to develop an AI-based hardware product. The collaboration could disrupt consumer electronics, drawing parallels to how Microsoft and...

Published:

Last Updated:

Politicians are more known for their trading than running hedge funds. They seem to have an uncanny knack for making stock trades that perform remarkably well, well above what the averages suggest...

Published:

The publication in 2005 of Joel Greenblatt’s book “The Little Book That Beat the Market” caused a sensation as it opened up a unique opportunity for investors. The investing strategies used by...

Published:

Apple was the first U.S. company valued at $1 trillion, then $3 trillion, but will it be first to have a $5 trillion market cap?

Published:

247 Wall St. Key Insights QQQ offers higher growth potential but comes with greater risk due to its reliance on tech stocks. VOO provides broad market exposure with lower risk and steady growth. ...

Published:

Along with the rise of artificial intelligence has been the growth in data centers. The former has been directly responsible for the latter’s meteoric rise. According to the National...

Published:

It’s hard to argue against the investing decisions of billionaire Bill Gates. At just 68, he’s now worth $138.6 billion thanks in large part to the success of Microsoft. Nowadays, after stepping...

Published:

You can say hedge fund operator Ken Griffin likes diversification. His Citadel Advisors has almost 7,000 positions in its portfolio. With more than $102 billion in assets under management, the hedge...

Published: