Matador Resources Company

NYSE: MTDR

$60.16

Closing Price on November 21, 2024

MTDR Stock Chart and Intraday Price

MTDR Stock Data

| Asset Type | Stock |

| Exchange | NYSE |

| Currency | USD |

| Country | USA |

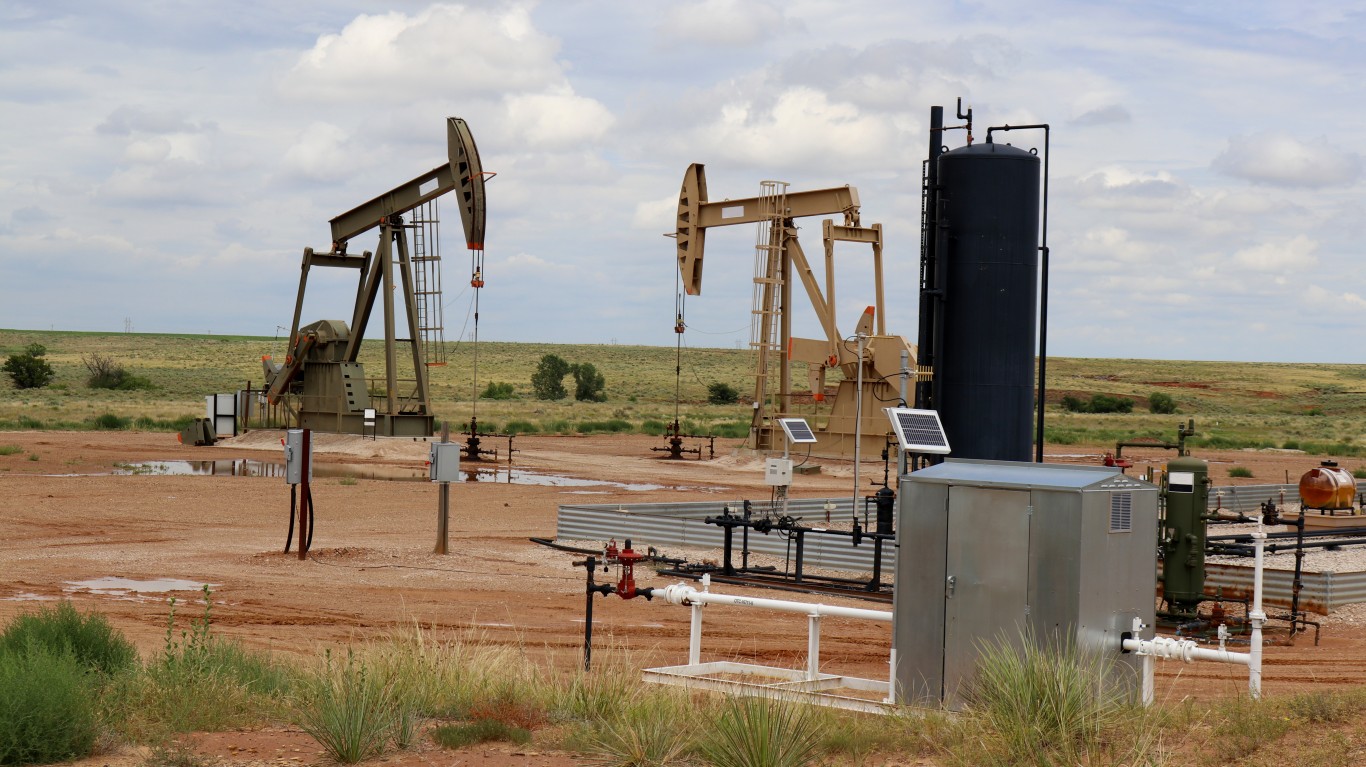

| Sector | ENERGY & TRANSPORTATION |

| Industry | CRUDE PETROLEUM & NATURAL GAS |

| Address | 5400 LBJ FREEWAY, SUITE 1500, DALLAS, TX, US |

| Fiscal Year End | December |

| Latest Quarter | 12/31/2023 |

| Market Cap | 7,701.87M USD |

| Shares Outstanding | 119,520,000 |

MTDR Articles

Thursday's top analyst upgrades and downgrades included Brixmor Property, CAVA, Chevron, GE Healthcare Technologies, Keurig Dr Pepper, News Corp, PACCAR, Permian Resources, Pioneer Natural Resources,...

Published:

Thursday’s top analyst upgrades and downgrades included AutoZone, CrowdStrike, Estee Lauder, Morgan Stanley, Nvidia and Western Digital.

Published:

Monday's top analyst upgrades and downgrades included Applied Materials, Autodesk, Bath & Body Works, BJ’s Wholesale Club, Cenovus Energy, Corning, Doximity, HP, Intercontinental Exchange,...

Published:

Thursday's top analyst upgrades and downgrades included Bed Bath & Beyond, Block, Citizens Financial, DoorDash, Exelon, Exxon Mobil, Halliburton, Kinross Gold, Lockheed Martin, Matador Resources,...

Published:

Monday's top analyst upgrades and downgrades included Adobe, Anheuser-Busch, Baker Hughes, Chevron, Eli Lilly, Halliburton, Home Depot, Intuit, Microsoft, Robinhood Markets, Shopify, Sirius XM,...

Published:

Analysts at JPMorgan shuffled the deck on oil and gas producers Wednesday morning, including a big downgrade for Chevron.

Published:

Thursday's top analyst upgrades and downgrades included Alaska Airlines, Clover Health Investment, CME, Dillard's, Discovery, Fastly, Marathon Oil, ServiceNow and UPS.

Published:

Wednesday's top analyst upgrades and downgrades included Alcoa, Apple, Cloudflare, Continental Resources, Freeport-McMoRan, GameStop, Infosys and Zscaler.

Published:

Tuesday's top analyst upgrades and downgrades included Bilibili, Constellation Brands, FedEx, Harley-Davidson, Matador Resources, Twilio and Yandex.

Published:

Wednesday's top analyst upgrades and downgrades included Applied Materials, Caterpillar, Costco Wholesale, JPMorgan, Spotify, Vertex Pharmaceutical, Vornado Realty Trust and Whiting Petroleum.

Published:

Tuesday’s top analyst upgrades and downgrades included Alibaba, Amazon.com, Apple, Carvana, Illumina, NextEra Energy, Nikola, Shake Shack, Teladoc Health and WPX Energy.

Published:

24/7 Wall St. wanted to look for independent oil and gas players that are hedged on their oil production at much higher prices for 2020 and some even out to 2021.

Published:

One good sector to peruse now is energy, with summer right around the corner, and with energy production actually being reduced by the U.S. Energy Information Administration for the first time in six...

Published:

Last Updated:

These four top companies could be potential takeover targets. Regardless, the stocks are all very cheap and trading at valuations that make them great additions to aggressive portfolios for investors...

Published:

Last Updated:

These are five outstanding ideas from RBC. Given their strong and consistent dividends, they all offer investors excellent total return potential and a safer way to play energy in 2019.

Published:

Last Updated: