Nokia Corp ADR

NYSE: NOK

$4.13

Closing Price on November 21, 2024

NOK Articles

Value investors frequently defend Nokia. They have had high hopes for 5G and have seen the company as a winner against Huawei. The problem is that Nokia has a very long history of disappointments.

Published:

Tuesday's top analyst upgrades and downgrades include Apple, Baidu, Boeing, Delta Air Lines, L3Harris Technologies, Moderna, Raytheon Technologies, Roku and Walt Disney.

Published:

Lower-priced stocks offer not only a way to make some good money but to get a higher share count. The five are likely to survive the current troubles and could very well offer patient investors some...

Published:

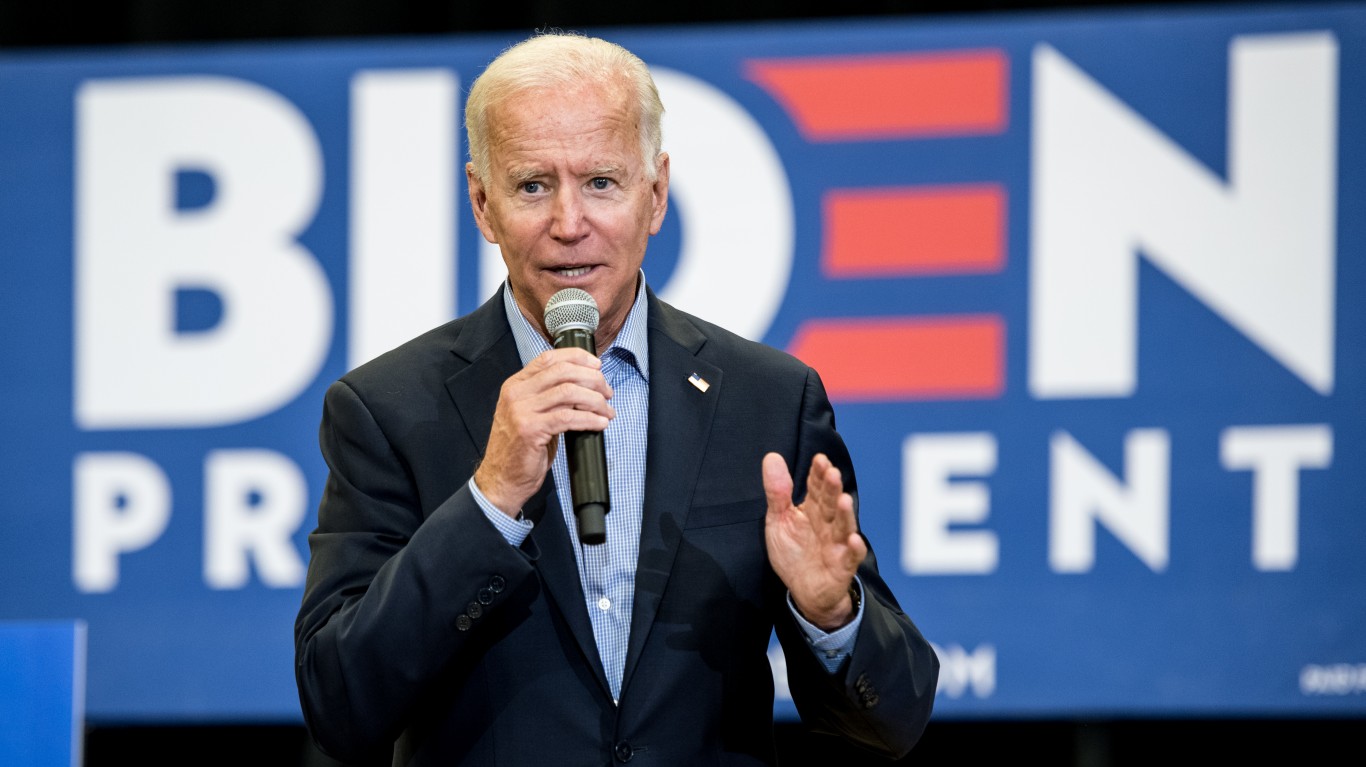

See why UBS feels these 10 stocks in a variety of sectors with solid upside potential could do very well with a Joe Biden victory in November.

Published:

Wednesday's top analyst upgrades and downgrades included Altria, Apple, Caterpillar, Citigroup, JPMorgan, Nikola, Nokia, Novavax, Transocean, Valero Energy, Walt Disney and Wells Fargo.

Published:

These five well-known blue-chip companies are likely to survive the current troubles and could very well offer patient investors some huge returns over the next year or so.

Published:

Some technology companies have performed well during the instant recession. Others have performed poorly. Nokia was not one of the winners. Not at all.

Published:

These five stocks are trading under $10 per share and could be massive bargains now and have big upside to the price targets. They are not penny stocks with absolutely no track record or liquidity,...

Published:

Jabil, one of the world's top outsourced manufacturing companies, has announced that the Covid-19 outbreak is having a negative impact on its second quarter of fiscal 2020.

Published:

It appears that the odds of Sprint becoming part of T-Mobile have improved, and it shows in shares of many rivals, partners and equipment suppliers.

Published:

Nokia has become a company that just cannot ever seem to get its act together for shareholders. It has continued to disappoint despite so many industry positives around the 5G buildout.

Published:

Last Updated:

Tuesday's top analyst upgrades, downgrades and initiations included Alphabet, American Express, Apple, AT&T, Boeing, JPMorgan, Nokia, Slack and Under Armour.

Published:

Last Updated:

These analyst favorites may appeal to aggressive accounts looking to get share count leverage on companies that have sizable upside potential.

Published:

Last Updated:

Ford, General Electric and these other well-known stocks could prove exciting additions to portfolios looking for solid alpha potential.

Published:

Last Updated:

Nokia and Ericsson shares have performed dismally during the major bull market. As investors have lost money in both over the past five and 10 years, it's time for these companies to shine in the...

Published:

Last Updated: