Riot Platforms Inc

NASDAQ: RIOT

$12.07

Real Time Data Delayed 15 Min.

RIOT Stock Chart and Intraday Price

RIOT Stock Data

| Asset Type | Stock |

| Exchange | NASDAQ |

| Currency | USD |

| Country | USA |

| Sector | LIFE SCIENCES |

| Industry | IN VITRO & IN VIVO DIAGNOSTIC SUBSTANCES |

| Address | 202 6TH STREET, SUITE 401, CASTLE ROCK, CO, US |

| Fiscal Year End | December |

| Latest Quarter | 12/31/2023 |

| Market Cap | 3,661.09M USD |

| Shares Outstanding | 253,538,000 |

RIOT Articles

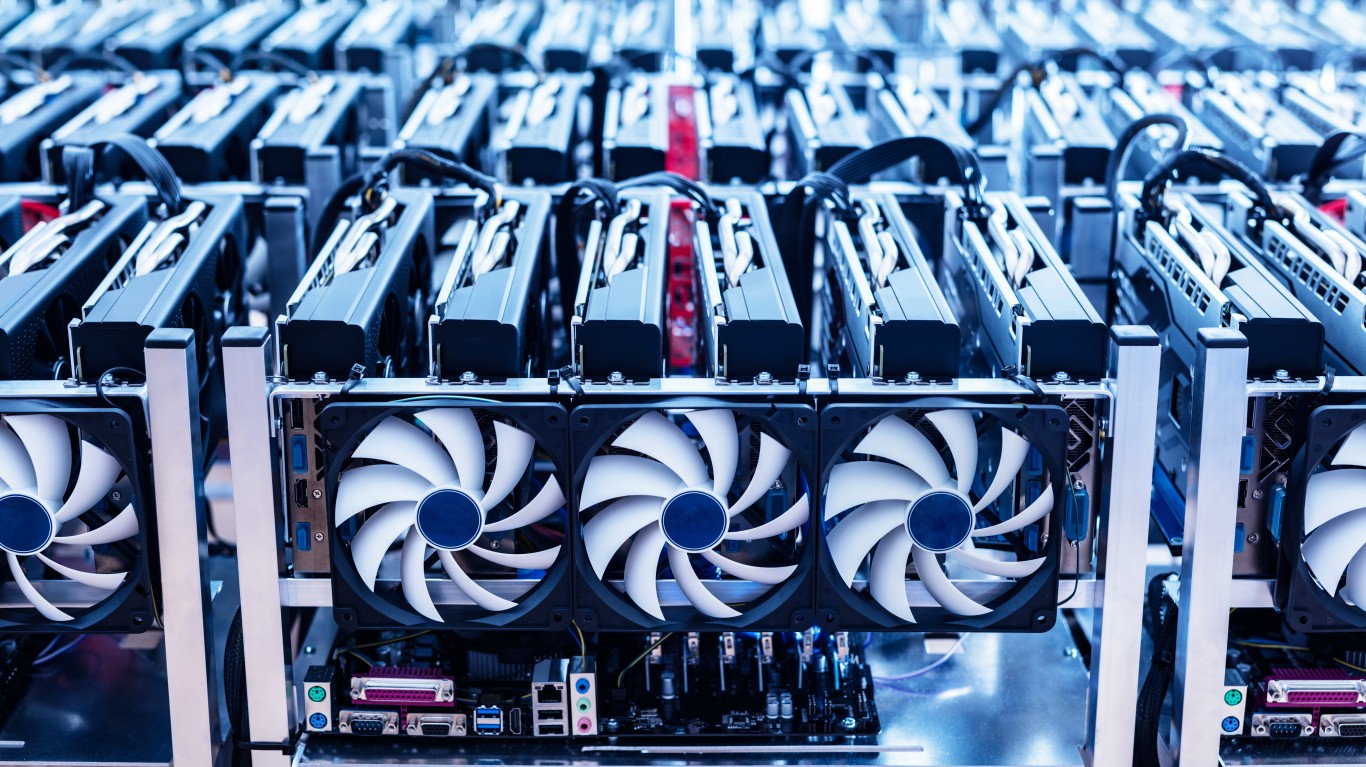

President Trump’s election victory is leading to a buying frenzy in the cryptocurrency markets. Bitcoin (CRYPTO:BTC) is soaring in value and hit its highest price ever of more than $75,000. That...

Published:

Bitcoin (CRYPTO:BTC) and other cryptocurrencies have been under a modest amount of pressure in recent months. Though the weakness may be an ominous sign to some, dip-buyers who are gearing for...

Published:

The digital currency landscape has captured the imagination of investors worldwide, sparking fervent discussions about the future of finance. In the wake of the 2008 financial meltdown, Bitcoin...

Published:

Three of China's top EV makers have released delivery data for September, and data from Tesla is due out soon. In the meantime, Bitcoin has jumped above $28,000 because its October.

Published:

U.S. markets closed mixed on Monday and were trading slightly in the green in Tuesday's premarket, no thanks to an announced acquisition in the cannabis industry.

Published:

Wednesday's top analyst upgrades and downgrades included BioMarin Pharmaceutical, BlackRock, CF Industries, Constellation Energy, DocuSign, DraftKings, Mosaic, Norfolk Southern, Nvidia, RingCentral,...

Published:

These are five stocks for aggressive investors looking to get share count leverage on companies that have sizable upside potential. While not suited for all investors, they are not penny stocks with...

Published:

These are five stocks for aggressive investors looking to get share count leverage on companies that have sizable upside potential. While not suited for all investors, they are not penny stocks with...

Published:

These are five stocks for aggressive investors looking to get share count leverage on companies that have sizable upside potential. While not suited for all investors, they are not penny stocks with...

Published:

Here are the top analysts calls for Friday, November 25.

Published:

Expect more volatility in the cryptocurrency market according to researchers at S3 Analytics.

Published:

Last Updated:

Thursday's top analyst upgrades and downgrades included Apple, CSX, Enovix, Healthpeak Properties, Lockheed Martin, Netflix, Philip Morris International, Regions Financial, Riot Blockchain, Rivian...

Published:

These are five stocks for aggressive investors looking to get share count leverage on companies that have sizable upside potential. While not suited for all investors, they are not penny stocks with...

Published:

Last Updated:

Tuesday's top analyst upgrades and downgrades included Atlassian, Autodesk, BioMarin Pharmaceutical, Darden Restaurants, DraftKings, eBay, Fortinet, LyondellBasell Industries, Riot Blockchain and WEC...

Published:

Many bitcoin mining companies have declared that they will not sell the bitcoin they mine. But the pressure is on now as easy money flows have stopped and mining profits have tanked.

Published: