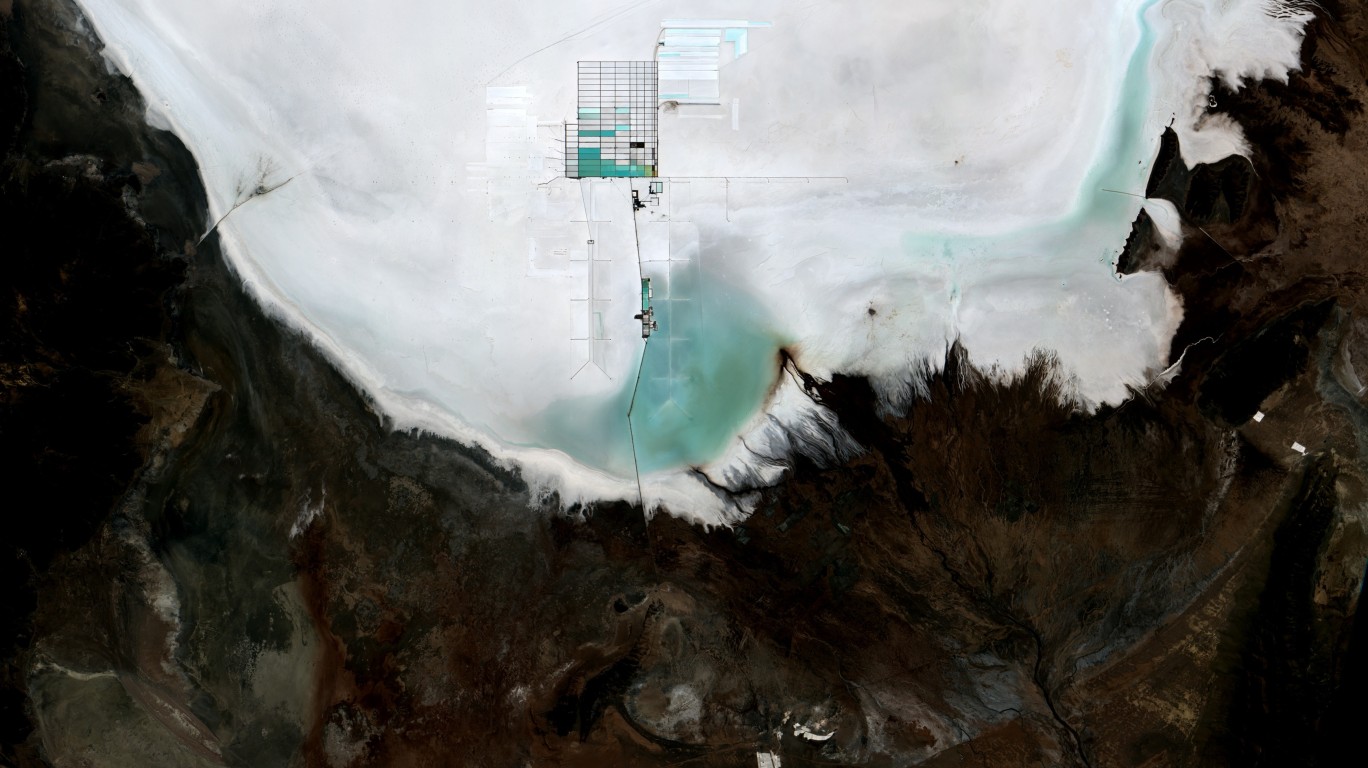

Sociedad Quimica Y Minera de Chile S.A.

NYSE: SQM

$39.18

Real Time Data Delayed 15 Min.

SQM Stock Chart and Intraday Price

SQM Stock Data

| Asset Type | Stock |

| Exchange | NYSE |

| Currency | USD |

| Country | USA |

| Sector | ENERGY & TRANSPORTATION |

| Industry | MINING & QUARRYING OF NONMETALLIC MINERALS (NO FUELS) |

| Address | EL TROVADOR 4285, 6TH FLOOR, SANTIAGO, CL |

| Fiscal Year End | December |

| Latest Quarter | 9/30/2023 |

| Market Cap | 14,690.36M USD |

| Shares Outstanding | 285,638,000 |

SQM Articles

The New York Times has filed suit claiming that Microsoft and OpenAI have infringed on copyrighted material. In Chile, a big deal in lithium.

Published:

After U.S. markets close on Wednesday, these three companies are on deck to report quarterly earnings.

Published:

Ford's investor day proved to be a good day for investors--in Tesla stock.

Published:

UBS upgraded lithium miner Albemarle and boosted the stock's price target. The analysts are seriously bullish.

Published:

After U.S. markets close on Wednesday, a Dow Jones industrial company and one of the world's largest lithium miners are set to release quarterly results.

Published:

Bed Bath & Beyond has finally answered the question of when it would file for bankruptcy, and Chile is sticking its nose into the lithium business.

Published:

Here is a look at what to expect when these three companies report quarterly results after markets close on Wednesday.

Published:

Here is what analysts expect to hear when these four companies report quarterly results Wednesday or Thursday.

Published:

Here are seven U.S.-traded firms that are looking to help meet the expected demand for lithium through the rest of this decade and maybe beyond. Some are established and others are in development.

Published:

Two leading brokerages have downgraded three lithium stocks to Sell. Two of the rating cuts were down to valuation and expected industry demand. The other was a response to an election outcome.

Published:

Five U.S.-traded lithium stocks have had a good week, as prices are rising again and the industry is about to expand.

Published:

Another lithium mining company entered the lists Monday. Canada-based Sigma Lithium plans to begin production next year at its Grota do Cirilo project in Brazil.

Published:

Here's a brief look at Lithium Americas and three more lithium stocks.

Published:

Thursday's top analyst upgrades and downgrades included Aerojet Rocketdyne, Avis Budget, Carnival, Chipotle Mexican Grill, Expedia, Home Depot, Lowe's, MGM Resorts, Stratasys, Square and Walmart.

Published:

Wednesday's top analyst upgrades, downgrades and initiations included Amazon.com, Boeing, Broadcom, Cisco Systems, IBM, Netflix, Rio Tinto, Tesla, Verizon, Visa and Xerox.

Published: