Teradyne Inc

NASDAQ: TER

$105.46

Real Time Data Delayed 15 Min.

TER Stock Chart and Intraday Price

TER Stock Data

| Asset Type | Stock |

| Exchange | NASDAQ |

| Currency | USD |

| Country | USA |

| Sector | LIFE SCIENCES |

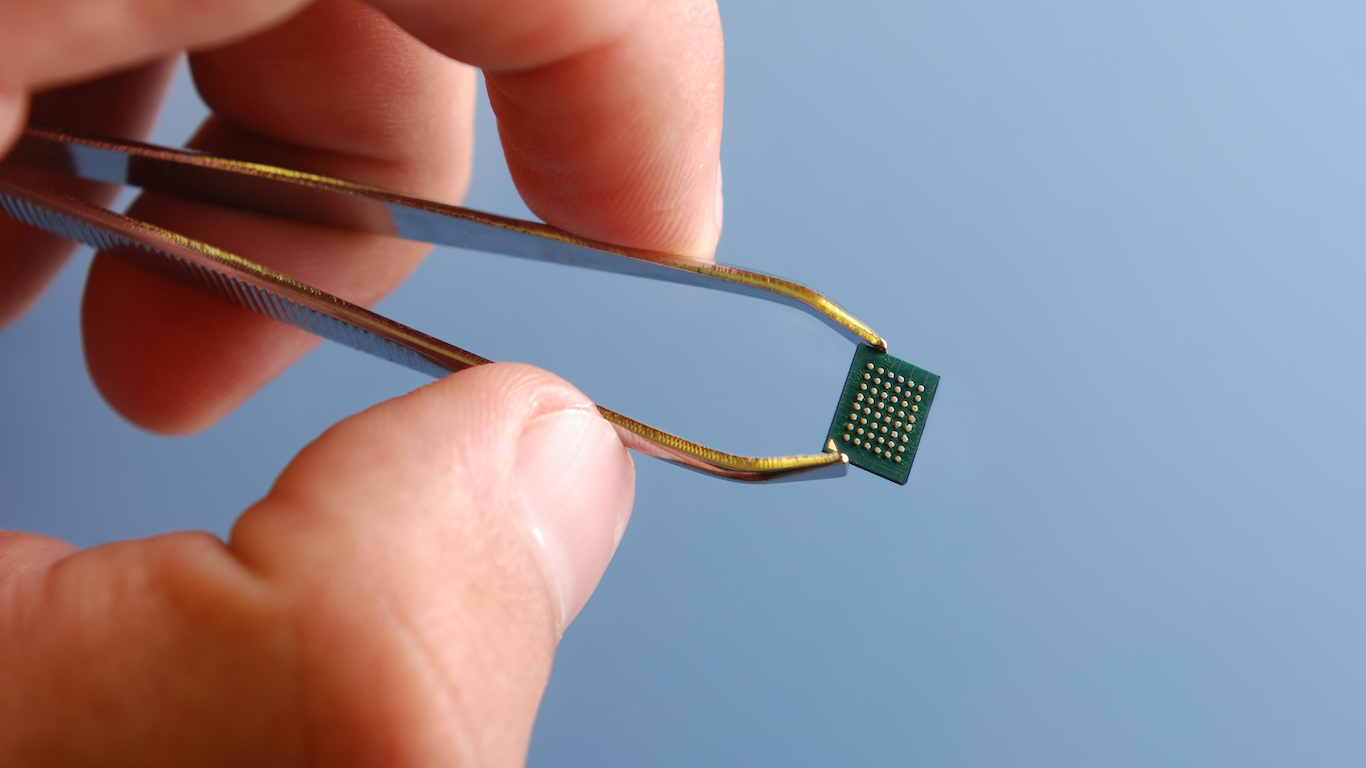

| Industry | INSTRUMENTS FOR MEAS & TESTING OF ELECTRICITY & ELEC SIGNALS |

| Address | 600 RIVERPARK DRIVE, NORTH READING, MA, US |

| Fiscal Year End | December |

| Latest Quarter | 12/31/2023 |

| Market Cap | 16,208.22M USD |

| Shares Outstanding | 153,081,000 |

TER Articles

Wednesday's top analyst upgrades and downgrades included AMC Entertainment, Bumble, Comerica, Dell Technologies, Edwards Lifesciences, Etsy, Fisker, Luminar Technologies, Micron Technology, Opendoor...

Published:

Monday's top analyst upgrades and downgrades included Activision Blizzard, Apple, Bill.com, Chewy, Etsy, Fortinet, General Mills, Las Vegas Sands, MongoDB, Steel Dynamics, Take-Two Interactive...

Published:

Friday's top analyst upgrades and downgrades included AGNC Investment, Biogen, Cano Health, Carnival, Lithium Americas, Meta Platforms, Seagate Technology, Vertiv, VFC and Waste Management.

Published:

Monday’s top analyst upgrades and downgrades included Applied Materials, Autodesk, BJ's Wholesale Club, Bluebird Bio, Domino’s Pizza, eBay, Foot Locker, Kohl's, Nasdaq, Salesforce, Snowflake,...

Published:

Tuesday's top analyst upgrades and downgrades included Canopy Growth, Constellation Brands, Equifax, FedEx, Franklin Resources, Micron Technology, Paramount Global, RH and T-Mobile.

Published:

Semiconductor analysts at Bank of American Global Research have raised their ratings and price objectives on two stocks and lowered ratings and price objectives on four others. Here is why.

Published:

There are companies in the semiconductor equipment industry that do not have triple-digit market caps but do have solid prospects to weather the current storm and emerge as winners in the near future.

Published:

Tuesday's top analyst upgrades and downgrades included American Express, APA, Apple, AT&T, Baker Hughes, CrowdStrike, Dow, D.R. Horton, Kimberly-Clark, Regions Financial, Salesforce, Starbucks,...

Published:

Friday's top analyst upgrades and downgrades included Chevron, Citigroup, Costco, Intel, Kinross Gold, Southwest Airlines, Take-Two Interactive Software, Teladoc, Teradyne, Vale and Workhorse.

Published:

Monday's top analyst upgrades and downgrades included Advance Auto Parts, Agnico-Eagle Mines, Applovin, ChargePoint, Corning, General Dynamics, QuantumScape, STMicroelectronics, Tapestry, Target and...

Published:

After a good start on Wednesday, markets sank in the afternoon. Thursday's opening was indicated to be mixed.

Published:

Tech stocks were moving higher Wednesday morning, and here are the stocks that led the charge, along with one laggard.

Published:

Wednesday's top analyst upgrades and downgrades included Confluent, DraftKings, Fastly, Halliburton, Moderna, Netflix, Southern Company, Splunk, Taiwan Semiconductor, Twilio, ViacomCBS, VMware, Xcel...

Published:

Comcast and these other top companies are expected to lift the dividends they pay to shareholders, and their stocks are rated Buy across Wall Street, making them excellent total return candidates.

Published:

Thursday's top analyst upgrades and downgrades included Avis Budget, Dynatrace, Norfolk Southern, PACCAR, Salesforce.com, Sherwin-Williams, Teradyne and Teva Pharmaceutical.

Published: