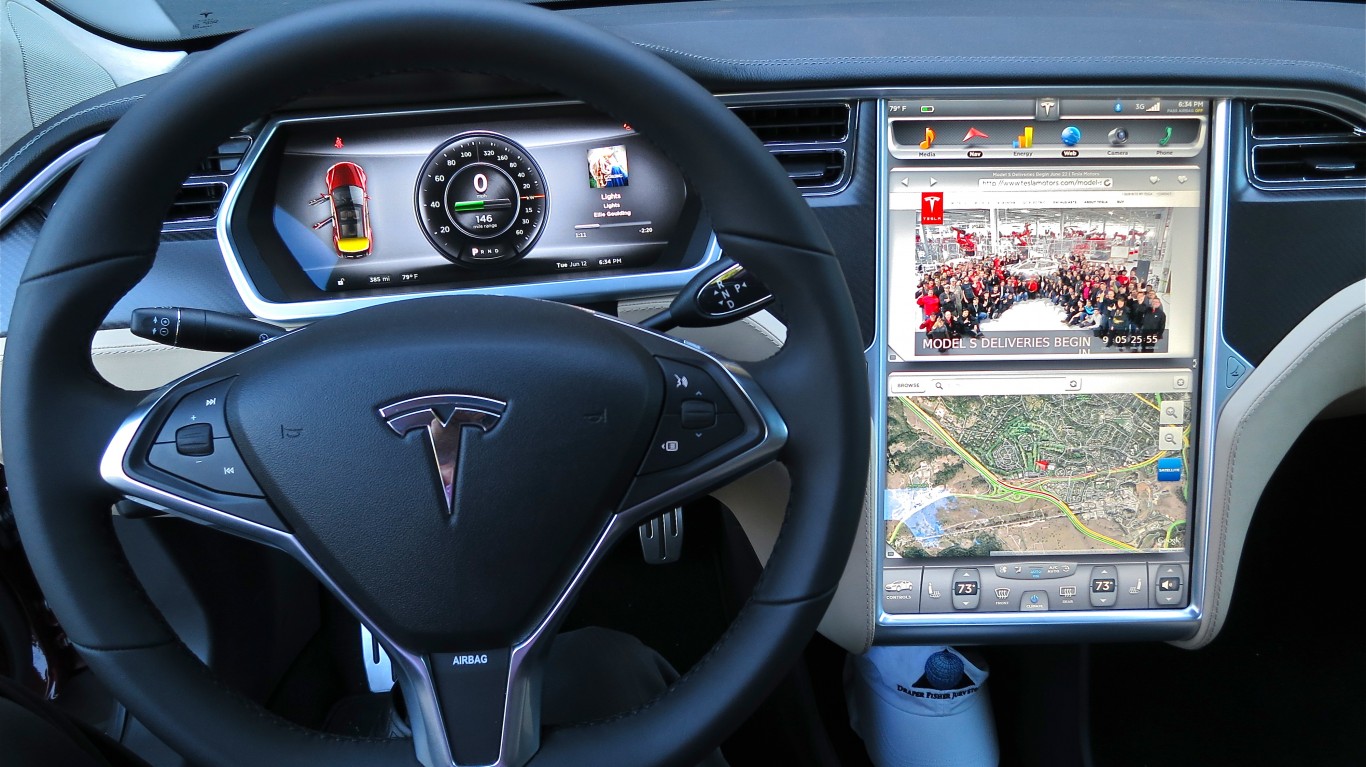

Tesla Inc

NASDAQ: TSLA

$332.89

Closing Price on November 27, 2024

TSLA Articles

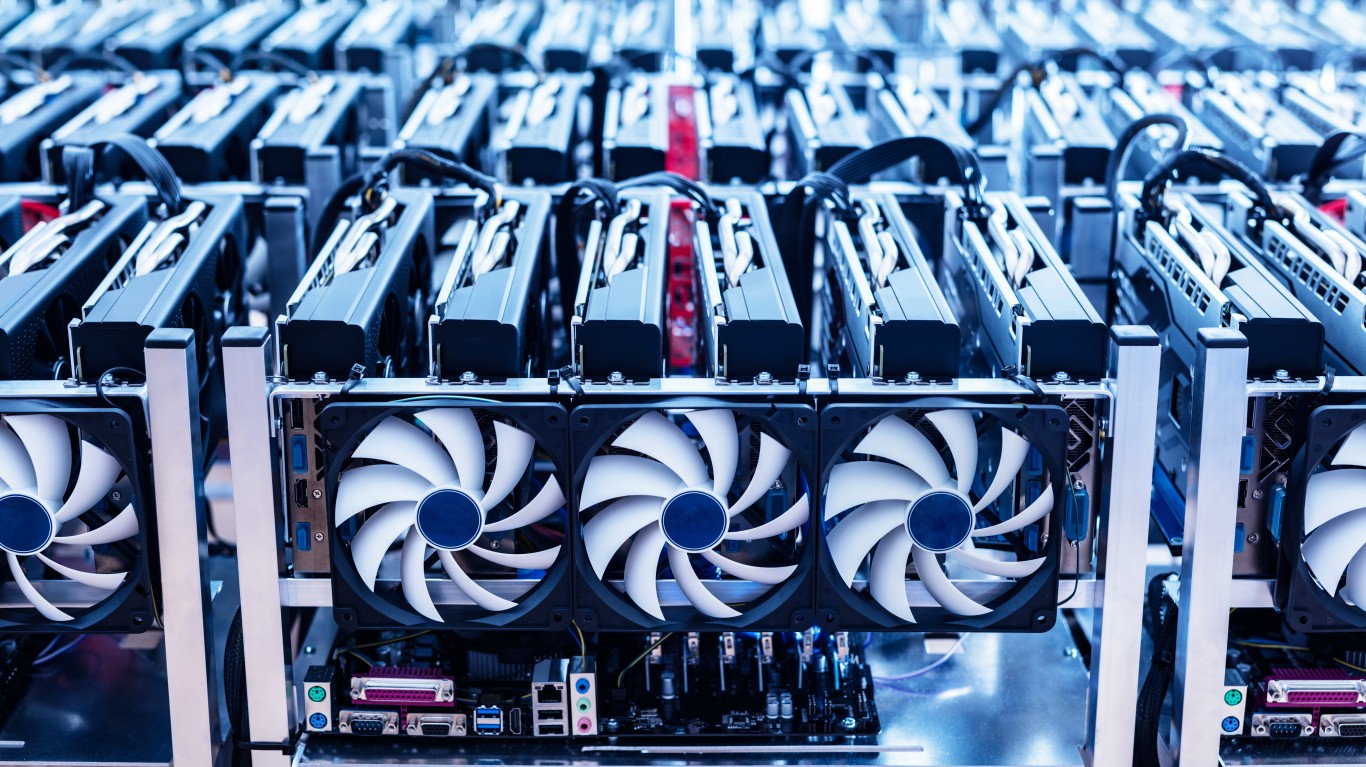

Wednesday’s top analyst upgrades and downgrades included Adobe, Akamai Technologies, BridgeBio Pharma, Ciena, Eqonex, Hilton Worldwide, Paysafe, Riot Blockchain, Shopify, Tesla and Williams-Sonoma.

Published:

Tuesday afternoon's top analyst upgrades and downgrades included EVgo, Luminar Technologies, Tencent Music Entertainment and Tesla.

Published:

A couple of Cathie Wood's ARK Invest exchange-traded funds sold over 55,000 shares of Tesla on December 27.

Published:

Premarket trading Tuesday added a bit to solid gains posted Monday by all three major U.S. stock indexes.

Published:

Hopes are up for a good start to the Santa Clause rally, and a couple of meme stocks are doing their part.

Published:

Autos and heavy equipment were leading markets higher, as investors made a final run pre-holiday run for the Santa Claus rally.

Published:

Tesla CEO Elon Musk is still selling shares and exercising expiring options. He still has more to go before year-end.

Published:

Tesla stock rises despite a new federal safety investigation and AMC stock falls on flagging sentiment.

Published:

Meme stock winners far outnumbered losers on Tuesday, and one of those winners is posting another big gain in Wednesday's premarket.

Published:

U.S. retail investors now own 12 times more stock than do hedge funds, and Americans have a greater percentage of their money in savings and stock portfolios than at any time since 1950.

Published:

Monday's top analyst upgrades and downgrades included Adobe, Arista Networks, AT&T, Bristol-Myers Squibb, Canopy Growth, Deere, Eli Lilly, Invesco, Medtronic, Mosaic, 3M, Roblox, Starbucks, Tesla,...

Published:

One OG meme stock has shot higher Friday, while a recent entry has posted a new low.

Published:

French authorities are investigating an accident in Paris involving a Tesla Model 3 taxi. One person died and another 20 were injured in the incident.

Published:

Markets were waiting with bated breath the FOMC announcement. In the meantime, there are always new Elon Musk tweets to ponder.

Published:

Two venerable meme stocks took a beating on Monday and were off to a weak start Tuesday.

Published: