Tesla Inc

NASDAQ: TSLA

$337.42

Real Time Data Delayed 15 Min.

TSLA Articles

The price of a Tesla will rise due to major supply chain price pressure, according to founder Elon Musk. This when competition in the electric vehicle segment seemingly increases by the day.

Published:

Consumer Reports removed its Top Pick rating for Tesla's Model 3 sedan after the automaker announced that new versions of its Autopilot feature would no longer use cameras. The magazine may have...

Published:

Tesla is considering paying in advance for guaranteed delivery of the semiconductors it needs and is toying with the idea of building its own chip fab.

Published:

Short sellers bet on three EV stocks to fall in the two-week short interest reporting period ending May 14. Four of the six EV stocks we watch posted double-digit share price drops during the period.

Published:

New York Times columnist Farhad Manjoo takes Epic's side in the just-concluded trial, and Tesla follows Apple's lead in managing customer data collected in China.

Published:

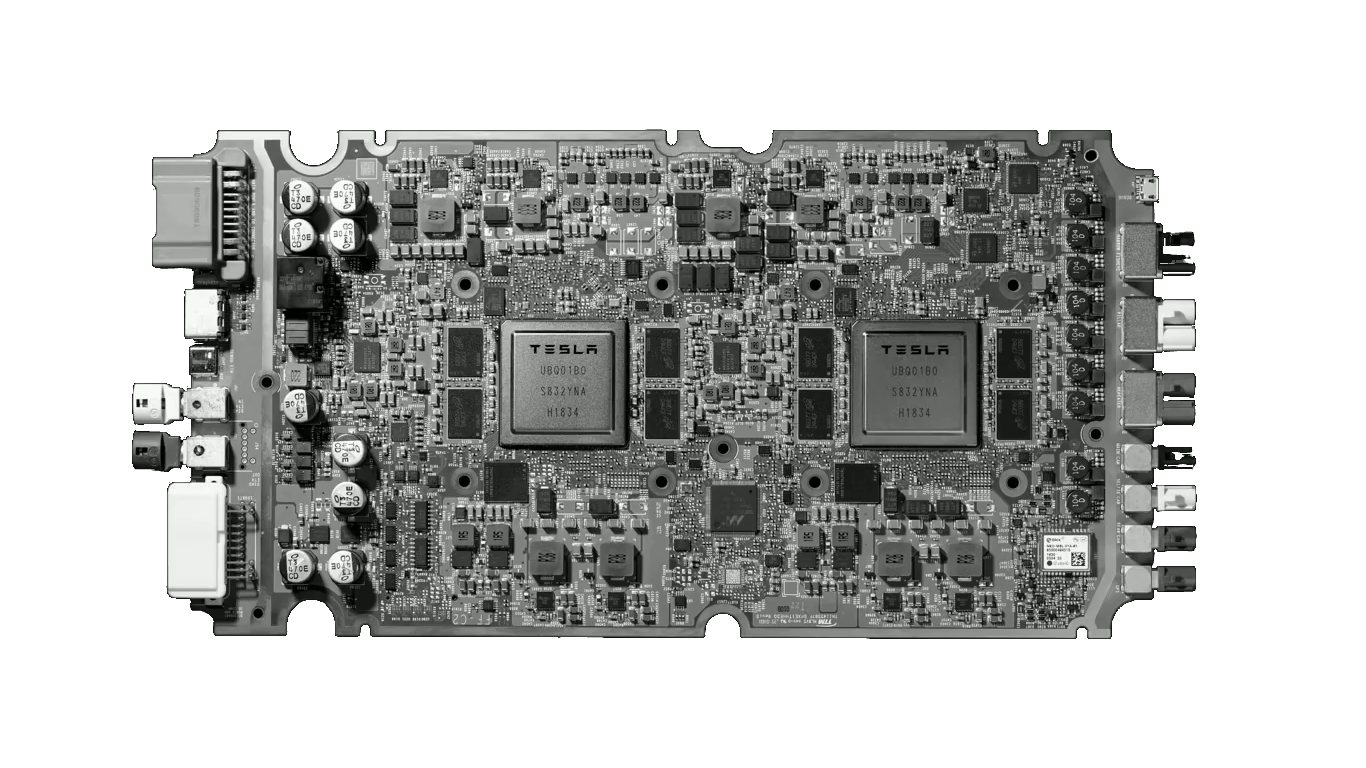

Electric truck maker Lordstown seeks share price collapse while Tesla's computing power for its self-driving features now surpasses the computing power of an F-35 fighter jet.

Published:

The new Ford F-150 Lightning had received nearly 45,000 reservations in the first two days after its launch. Meanwhile, Tesla continues to get nicked with less than good news.

Published:

Tesla has been a focal point for many investors over the past year as the stock has more than doubled in that time. However, the electric vehicle manufacturer could be slowing down, at least...

Published:

Monday's top analyst upgrades and downgrades included Beyond Meat, Campbell Soup, Dick’s Sporting Goods, Dollar General, Foot Locker, HP, Mosaic, Proofpoint and Tesla.

Published:

As cryptocurrencies collapsed on Wednesday, short sellers in electric vehicle stocks, particularly Tesla, made a one-day gain of $1 billion.

Published:

Short interest in EV stocks was mixed in the two-week reporting period ended April 30. Short sellers pulled out of Tesla while piling into one China-based automaker.

Published:

Electric vehicle owners are more than twice as likely to use a smartphone app than owners of conventionally powered vehicles. Tesla's mobile app is an also-ran, according to a new study from J.D....

Published:

24/7 Wall St. looks at some big analyst calls that we have seen so far on Tuesday, including Coinbase, Caesars, DoorDash, Lyft, Tesla and Verizon.

Published:

Short interest in EV stocks rose sharply in the two-week reporting period that ended April 15. Short sellers added to their positions on all but one EV stock.

Published:

Tesla reported its most recent quarterly results after the closing bell on Monday.

Published: