Tesla Inc

NASDAQ: TSLA

$342.40

Real Time Data Delayed 15 Min.

TSLA Articles

Earnings reports begin next week with one of 2020's hottest stocks and continue early Tuesday with two more.

Published:

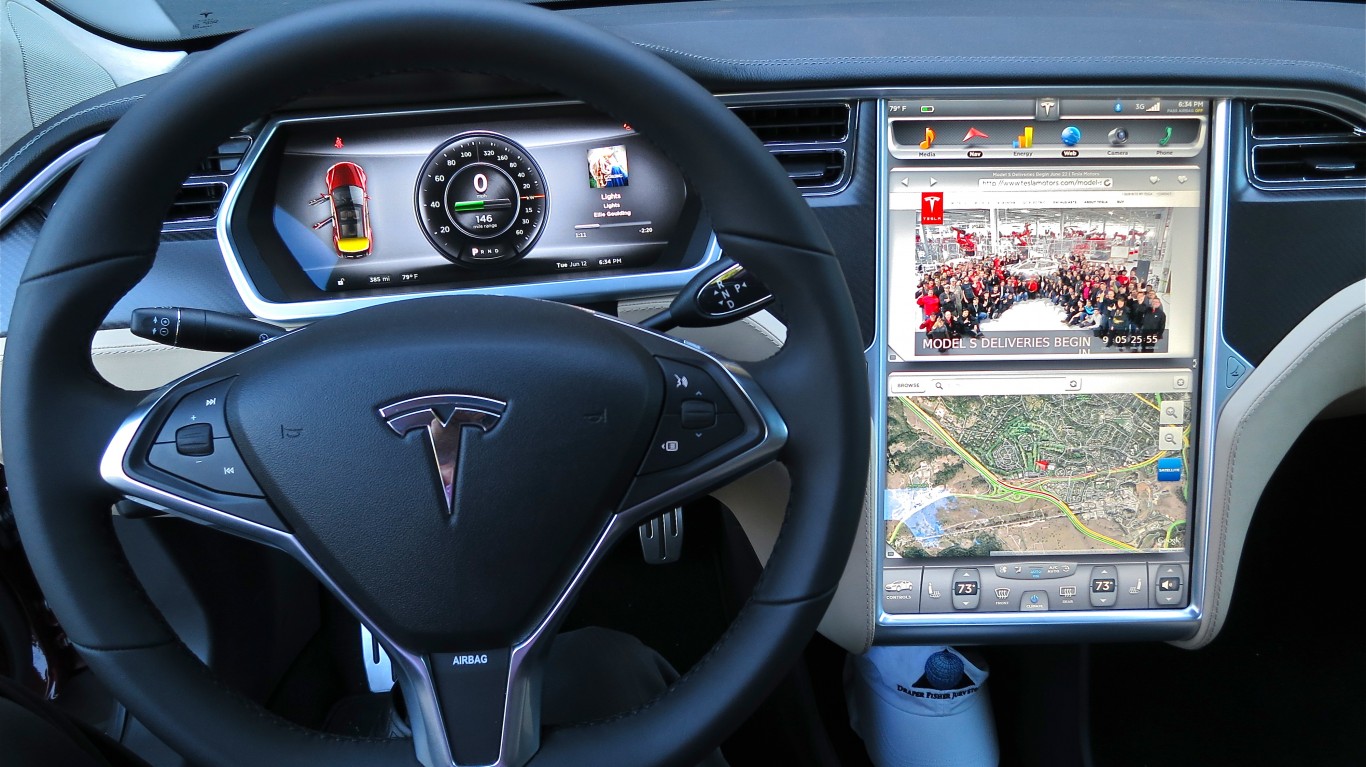

Following a crash in Texas that killed two while the driver's seat was allegedly unoccupied, Consumer Reports has shown how it would be possible for such a thing to have happened.

Published:

Wednesday’s session saw massive buying and selling action in the ARK Innovation ETF, with many big names thrown around in the mix.

Published:

24/7 Wall St. looks at some big analyst calls that we have seen so far on Tuesday, including Chuy’s, CrowdStrike, Tesla, Uber, Wingstop and more.

Published:

A crash near Houston killed two occupants of a Tesla Model S sedan. Authorities are trying to determine if the car's self-driving features were engaged and being used correctly.

Published:

China's Geely on Thursday launched the first EV from its new Zeekr brand. The car is taking aim at higher-end models from Tesla and Nio and will be available in China later this year.

Published:

These are the top holdings across the ARK Invest funds.

Published:

As tech companies continued to be out of favor in March, electric vehicle makers saw short sellers piling into their stocks. Traditional automakers, meanwhile, saw a decline in short interest.

Published:

Tesla saw its short interest rise into the most recent settlement date, as the shares rallied.

Published:

Monday's top analyst upgrades and downgrades included Best Buy, Chipotle Mexican Grill, Exxon Mobil, GameStop, Match, Plug Power, Qualcomm and Tesla.

Published:

The five stocks that the top hedge funds are shorting the most are some of the top companies in their respective sectors. They look like great ideas for aggressive growth traders, especially if they...

Published:

Morgan Stanley analyst Adam Jonas has reiterated the firm's rating and price target on Tesla stock. He also explains why he believes Tesla will snag the lion's share of the benefits for EV makers in...

Published:

Tesla last week reported delivering nearly 185,000 vehicles, a new quarterly record. Can any other automaker challenge the company and when could that happen?

Published:

Monday's top analyst upgrades and downgrades included AMC Entertainment, Caesars Entertainment, Ford, Harley-Davidson, JetBlue Airways, Microsoft, Palo Alto Networks, Spotify and Tesla.

Published:

Chinese EV makers Nio and XPeng have reported first-quarter deliveries while investors wait to hear from Li Auto and market leader Tesla.

Published: