Texas Instruments Inc

NASDAQ: TXN

$198.00

Closing Price on November 22, 2024

TXN Articles

The top analyst upgrades, downgrades and initiations seen on Wednesday included Bank of America, Danaher, Lyft, Netflix, Qualcomm, Tesla, Texas Instruments, Aurora Cannabis, Canopy Growth and...

Published:

Last Updated:

Since December of 2013, the Jefferies Franchise list of stocks has brought home some huge winners for the firm's clients. The current list has five sector-leading stocks that look especially good now.

Published:

Last Updated:

Shares of Alphabet, IBM and other tech giants recently have seen their 50-day moving averages cross above the 200-day averages, which is often seen as a bullish sign.

Published:

Last Updated:

These five solid growth stocks all pay reliable dividends and have backed up to much more reasonable entry points, offering investors good upside potential to the Jefferies price targets.

Published:

Last Updated:

These top tech stocks were eviscerated in the October and November selling, but for investors able to look past the rubble, there could be tremendous short-term and longer-term opportunities.

Published:

Last Updated:

These stocks have been hit so hard that multiples and valuations have been knocked to the lowest levels in some time, and the industry could provide a solid Santa Claus rally trade.

Published:

Last Updated:

After a big stock market sell-off and a subsequent snap-back rally, it’s always interesting to see how corporate directors are acting toward their own shares. It’s no secret that corporate...

Published:

Last Updated:

Micron, Texas Instruments, Freeport-McMoRan and DXC Technology all sank to new 52-week lows Wednesday.

Published:

Last Updated:

These were five of the top analyst calls showing caution in the semiconductor stocks from Tuesday, September 24, 2018.

Published:

Last Updated:

The top analyst upgrades, downgrades and initiations seen on Tuesday include Barrick Gold, Blackstone, Chesapeake Energy, Dollar Tree, Intel, Qualcomm, Sirius XM, Texas Instruments and Vale.

Published:

Last Updated:

Apple is right on the brink of becoming the first $1 trillion market cap company, and supply chain vendors that stay in the good graces of the tech behemoth could be in good shape for years to come.

Published:

Last Updated:

24/7 Wall St. has put together a preview of Alphabet, Amazon, Intel and some of the other large tech companies that are about to report their quarterly results.

Published:

Last Updated:

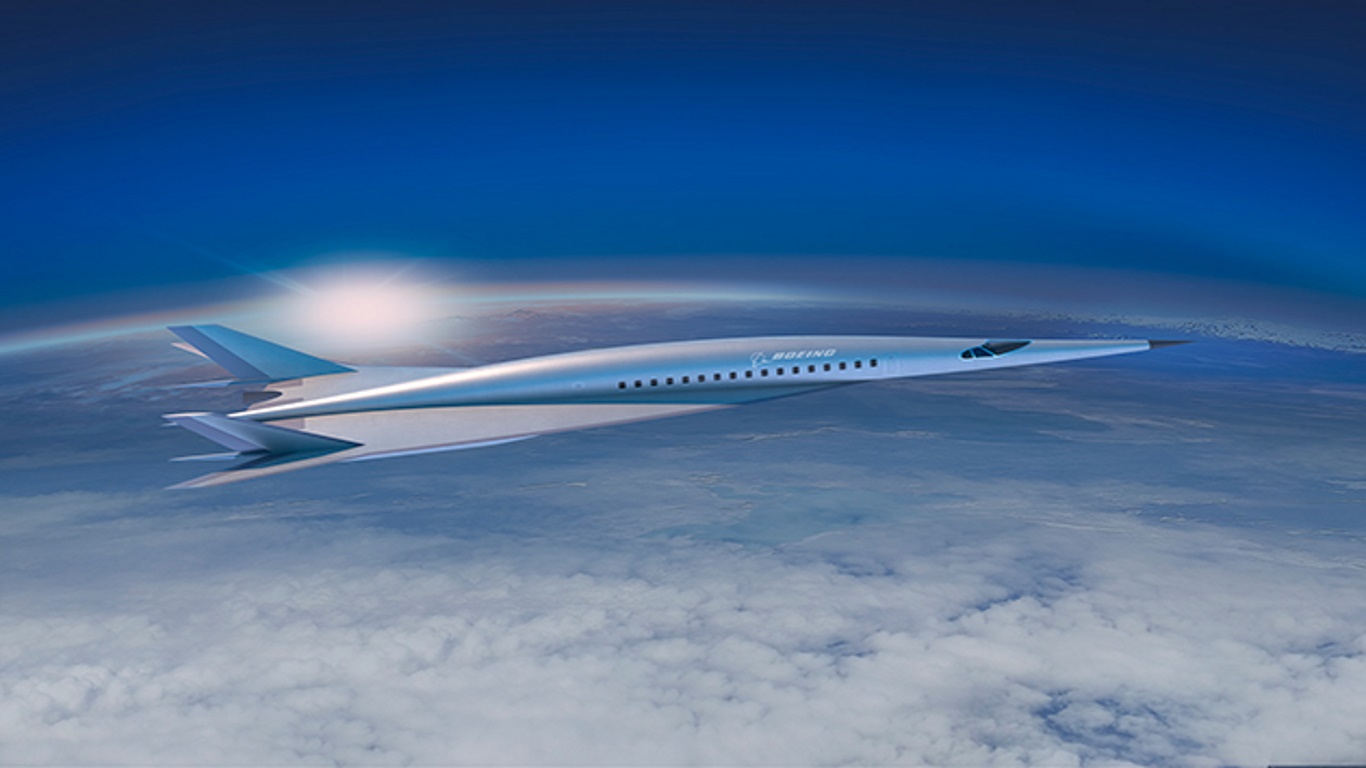

The CEO of Texas Instruments has resigned, Boeing sets deal to build Air Force One, Google faces massive fine from the European Union, and other important business headlines.

Published:

Last Updated:

The top analyst upgrades, downgrades and other research calls from Wednesday include AT&T, Comcast, Hess, Netflix, Petrobras, Sirius XM, Texas Instruments, Verizon and Walt Disney.

Published:

Last Updated:

It’s been an outstanding run for technology, and especially semiconductors. Given the important role the industry plays in our economy, it probably has legs.

Published:

Last Updated: