United States Oil Fund

NYSE ARCA: USO

$73.93

Real Time Data Delayed 15 Min.

USO Stock Chart and Intraday Price

USO Stock Data

| Asset Type | ETF |

| Exchange | NYSE ARCA |

USO Articles

It appears that the regulators have decided to go after the United States Oil Fund, the so-called Oil ETF.

Published:

It seems impossible to think that a commodity price could trade below zero. Particularly when you are talking about oil, which still powers most of the world’s transportation at this time. While...

Published:

Investing in commodities like crude oil can be tricky. For investors who can don't mind the risks, here are some funds that may be worth a look.

Published:

Last Updated:

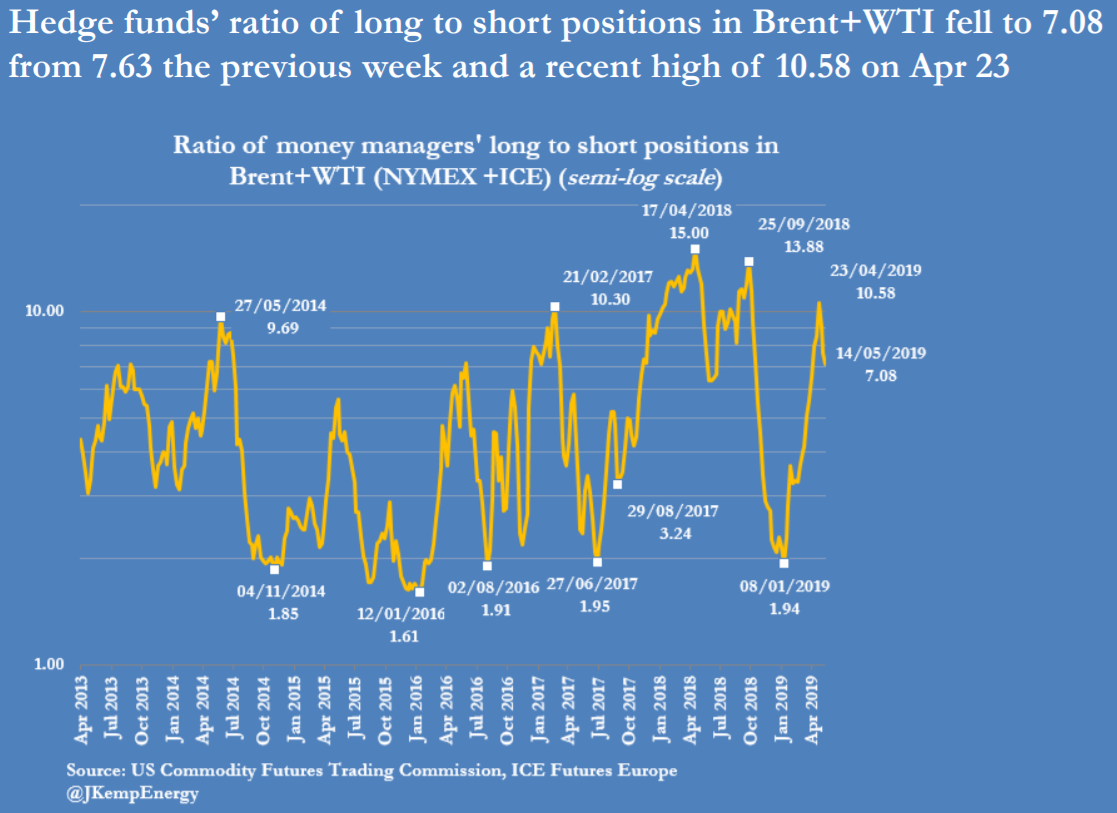

Reported cuts in world crude oil production and encouraging words on the U.S.-China trade talks have overcome significant increases in U.S. petroleum inventories to keep prices about 2% above last...

Published:

Last Updated:

The U.S. crude oil inventory added 1.3 million barrels last week according to the weekly report from the Energy Information Administration.

Published:

Last Updated:

The U.S. crude oil inventory remained virtually unchanged week over week for the week ended on December 28. Crude prices have been rising on reports of fresh trade talks between the United States and...

Published:

Last Updated:

The U.S. commercial crude oil inventory dropped by less than 1 million barrels last week while gasoline and diesel fuel supplies fell as well. The overall inventory drop was not enough to put a...

Published:

Last Updated:

The U.S. commercial crude oil inventory dropped by more than 1 million barrels last week, a far smaller drop than reported Tuesday night by the American Petroleum Institute. The price of crude...

Published:

Last Updated:

The U.S. crude oil stockpile dropped by more than 7 million barrels last week largely due to a big jump in crude oil exports.

Published:

Last Updated:

The U.S. crude oil inventory posted it 10th consecutive weekly rise last week and prices, which had drifted lower Wednesday morning, first dipped lower then steadied.

Published:

Last Updated:

The U.S. commercial crude oil inventory rose more than expected last week. Stockpiles of gasoline and diesel fuel dropped, and U.S. crude oil production remained at all-time highs.

Published:

Last Updated:

The U.S. crude oil stockpile soared by more than 10 million barrels last week according to the latest official report. Inventories have now risen for eight consecutive weeks.

Published:

Last Updated:

The U.S. commercial crude oil inventory rose by nearly 6 million barrels last week while gasoline inventories rose by nearly 2 million barrels. Falling prices will get no boost from this report.

Published:

Last Updated:

The U.S. Energy Information Administration reported Wednesday that U.S. stockpiles of crude oil rose last week while gasoline and diesel fuel inventories declined. Crude production rose to more than...

Published:

Last Updated:

The U.S. commercial crude oil inventory rose by 6.3 million barrels last, slightly less than the prior week's total. Refinery maintenance has lowered utilization to below 90% for the third straight...

Published:

Last Updated: