Consumer Electronics

BlackBerry Earnings Testify to Turnaround Effort

Published:

Last Updated:

On a GAAP basis the company’s net loss came to $0.39 per share, which the company attributed to a non-cash charge of $167 million for change in the fair value of certain debentures and $33 million in pretax restructuring charges.

BlackBerry’s shares will probably rise on these results, just as a less-awful-than-expected report at the end of the first quarter caused a 10% pop. Investors appear to be recalibrating their expectations of what BlackBerry will become and seem willing to go along for the ride. Shares are up 23% over the past 12 months and up 28% year-to-date. It is only when you look back to mid-2010 and see those $70+ share prices that it becomes clear that BlackBerry’s glory days are behind it.

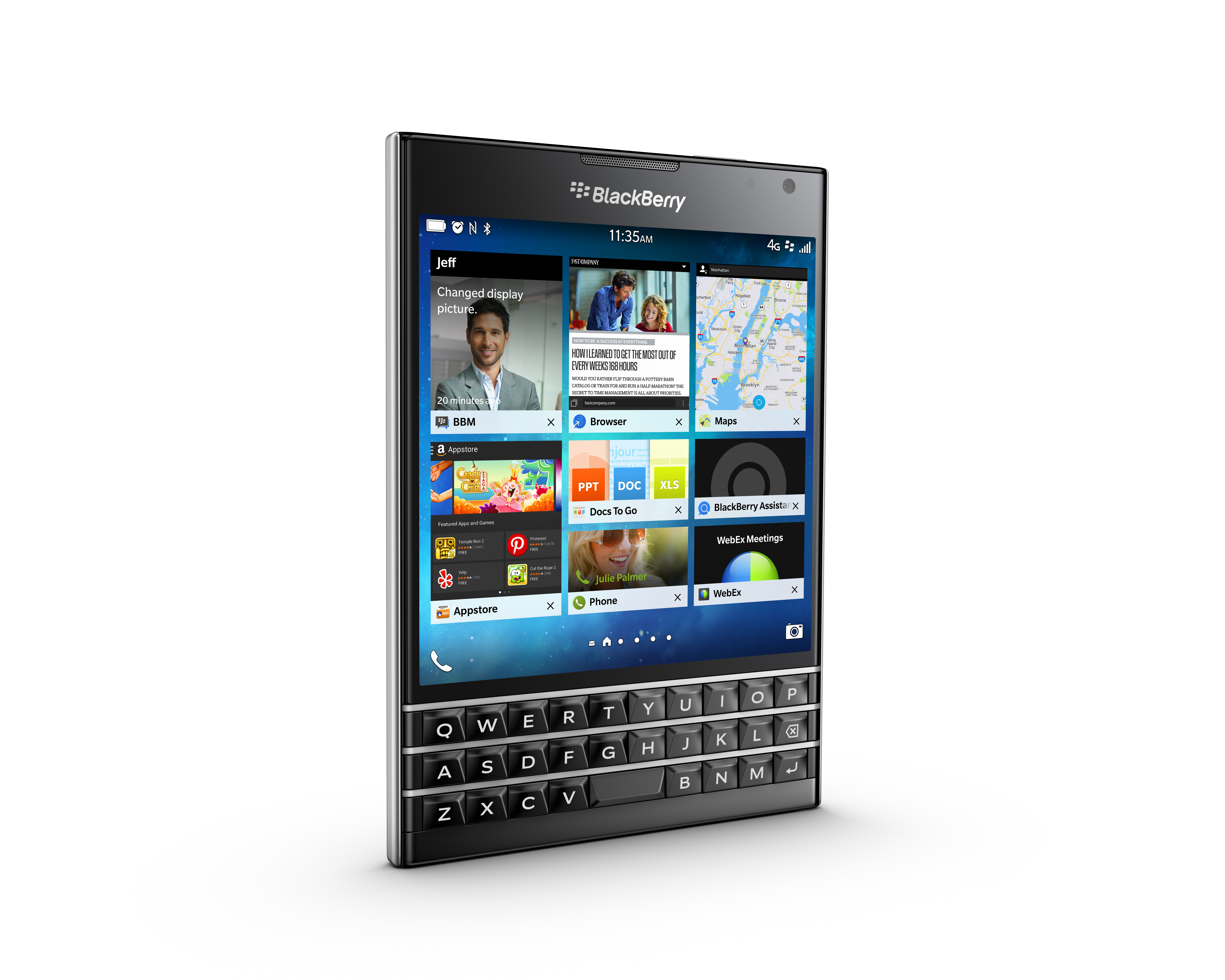

The company sold 2.1 million phones to its distribution channels in the quarter, up from 1.6 million in the prior quarter, and sell through to end-users totaled about 2.4 million units, a total that includes shipments made and recognized prior to the second quarter and that reduced BlackBerry’s channel inventory. The company’s just-released Passport smartphone is BlackBerry’s latest effort to hold onto the tiny market share it still has and, with luck, even expand it.

ALSO READ: The Actual Cost of a New iPhone

Second-quarter revenue was down $50 million sequentially, after dropping $10 million from the fourth fiscal quarter of 2014 to the first quarter of the new year. In the second quarter of the most recent fiscal year, BlackBerry’s revenues totaled $1.57 billion, compared with this quarter’s $916 million. BlackBerry still gets more than 40% of its revenues from its Europe, Middle East and Africa region. North American revenue rose from 28.6% in the May quarter to 32.4% in the May quarter.

Here’s BlackBerry’s outlook statement:

The Company continues to anticipate maintaining its strong cash position, while increasingly looking for opportunities to prudently invest in growth. The Company continues to target break-even cash flow results by the end of fiscal 2015.

That statement is essentially identical to the company’s stated outlook at the end of the prior quarter and the quarter before that.

The consensus estimates for the third quarter call for an EPS loss of $0.16 on revenues of $993.12 million. For the full year, analysts expect an EPS loss of $0.63 on revenues of $3.91 billion.

The company’s CEO, turnaround star John Chen, said:

Our workforce restructuring is now complete, and we are focusing on revenue growth with judicious investments to further our leadership position in enterprise mobility and security, driving us towards non-GAAP profitability during FY16.

Shares were up about 1% in premarket trading, at $9.90 in a 52-week range of $5.44 to $11.65. The consensus analyst price target was $8.55 before the results were announced. The stock closed at $9.80 on Thursday, so the 31 analysts covering the stock are not paying much attention to it.

ALSO READ: The Best Economies in the World

Want retirement to come a few years earlier than you’d planned? Or are you ready to retire now, but want an extra set of eyes on your finances?

Now you can speak with up to 3 financial experts in your area for FREE. By simply clicking here you can begin to match with financial professionals who can help you build your plan to retire early. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.