Consumer Electronics

Will GoPro Face Real Competition From Polaroid and Other Players?

Published:

The story of GoPro Inc. (NASDAQ: GPRO) has been a fascinating one. The question might not be whether the story may have become too fascinating for investors, but one question does persist: could GoPro be unseated by cheaper rivals? If you can remember back to the 1970s and ’80s, you know what Polaroid is, and now Polaroid wants a piece of GoPro’s market. Could a company like Polaroid and a host of other established players who make action cameras collectively eat into GoPro’s market share?

Polaroid is now selling the Polaroid Cube for $99.99 online and in select stores starting October 1. This recently release may not be the target of many GoPro buyers, but at half price (or one-third to one-fourth of the higher priced GoPro cameras) it could make a dent in the market.

Polaroid’s Cube is arriving in time for the holidays. Still, GoPro already has the established name branding, and it already is in every store that sports and outdoor enthusiasts would go to, whereas Polaroid says “select stores.” Polaroid is trying to differentiate itself, as seen in the press release:

We are expanding the lifestyle action camera market for the family, or everyday user. We’re not all cliff divers or extreme athletes, many of us would like to be able to capture and share a monumental moment such as our child’s first bike ride, a walk in the park with the family dog or a family weekend beach excursion out on the water.

ALSO READ: A Baker’s Dozen of IPOs on Tap for Next Week

The GoPro story (and the rest of the mobile action camera stories) is one that is intertwined with Ambarella Inc. (NASDAQ: AMBA), as it is Ambarella’s components that make up much of the GoPro cameras. Interestingly enough, GoPro’s market cap is now over $10 billion and Ambarella’s market cap is just over $1.2 billion. Ambarella is expected to have around $243 million in sales next year, versus just over $1.5 billion from GoPro. On an earnings comparison, GoPro trades at 100-times current year and 80-times expected next year earnings per share, versus 28-times current year and about 25-times next year earnings for Ambarella.

If you want to know why Ambarella is so important to this picture (no pun intended), it is because the company’s technology is inside so many action cameras. The company has an arms dealer business model, so it is somewhat agnostic when it comes to caring who wins in the action camera market. Here is what Ambarella’s annual report for 2013 shows as its key customers:

[O]ur video processing solutions are designed into products from leading OEMs including GoPro, Robert Bosch GmbH and affiliated entities and Samsung Electronics Co., Ltd., who source our solutions from ODMs including Ability Enterprise Co., Ltd., Asia Optical Co. Inc., Chicony Electronics Co., Ltd., DXG Technology Corp., Hon Hai Precision Industry Co., Ltd. and Sky Light Digital Ltd. In the infrastructure market, our solutions are designed into products from leading OEMs including Harmonic Inc., Motorola Mobility, Inc. (owned by Google, Inc.) and Telefonaktiebolaget LM Ericsson, who source our solutions from leading ODMs such as Plexus Corp.

The long and short of the matter is that this leaves a lot of players that Ambarella sells to. It also leaves component competitors, who sell into other competing systems.

ALSO READ: 8 Analyst Stocks Under $10 With Massive Upside Calls

Polaroid Cube for $99.99 specs are as follows:

GoPro’s Hero3 (white edition) for $199.99 specs are as follows:

It seems hard to imagine that Polaroid would be a complete or total disrupting force to GoPro. That being said, it could eat into many of the sales from those who are less than sports enthusiasts and from some of the consumers not trying to record every aspect of their activities. As far as others who might be competitors as well, Sony has its POV Action Cam for $269.99 and Garmin has its VIRB Action Camera starting at $299.99.

GoPro shares hit an all-time high of $82.40 on Friday. Its IPO priced at $24 this summer, and the stock essentially doubled within the first week of trading. Be advised that the consensus analyst price target is all the way down at about $60, and Thomson Reuters has $78 listed as the highest analyst price target.

ALSO READ: Insider Buying Consistent This Week, Despite Volatile Market

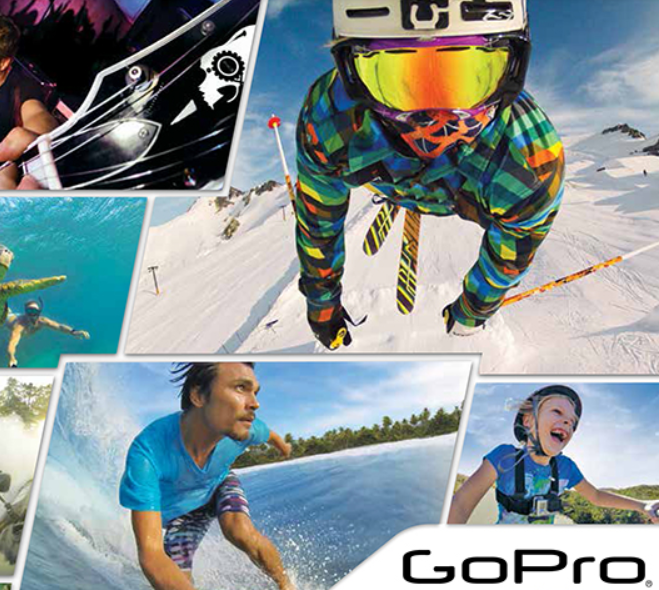

Below are images showing the Polaroid Cube and the GoPro Hero3.

Want retirement to come a few years earlier than you’d planned? Or are you ready to retire now, but want an extra set of eyes on your finances?

Now you can speak with up to 3 financial experts in your area for FREE. By simply clicking here you can begin to match with financial professionals who can help you build your plan to retire early. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.