The short version of the story is that accomplishing something, whether it be buying an item or doing work, has risen to the top of mobile app usage growth, far outdistancing the entertainment and games apps that previously led in consumer usage.

Flurry Analytics, a division of Yahoo! Inc. (NASDAQ: YHOO), collected and reported the data, and they include user sessions on Apple Inc. (NASDAQ: AAPL) devices and devices using the Android operating system from Google Inc. (NASDAQ: GOOG). Flurry noted that on Apple’s iOS the lifestyle app category includes more than shopping, and that on Android devices alone, shopping app usage increased by a whopping 220%.

The other app category to post at least a doubling of growth was messaging, with a growth rate of 103% in 2014, slightly below its 115% growth rate in 2013. Music, media and entertainment apps grew at a rate of just 33% and game apps grew at a rate of 30% in 2014.

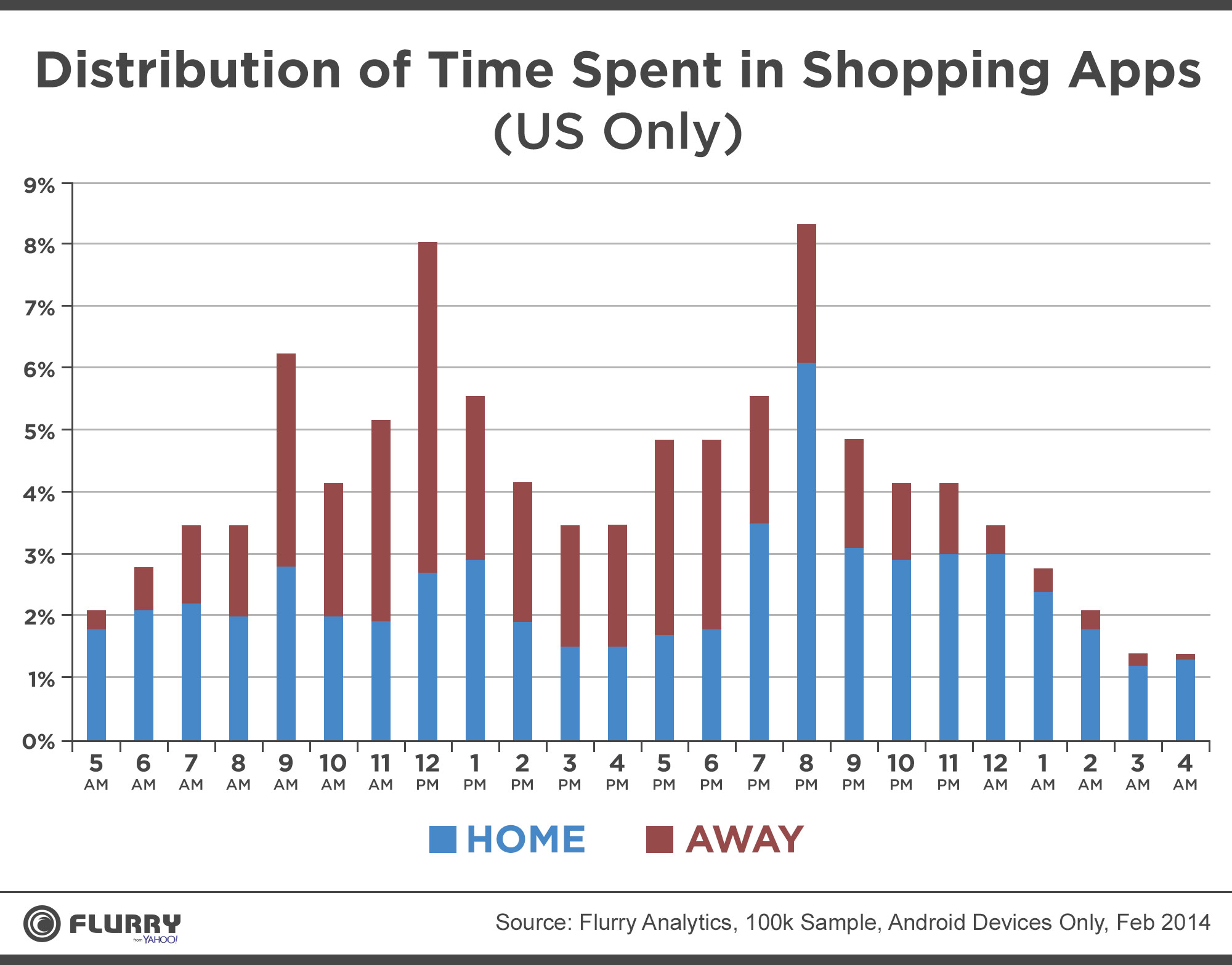

Flurry also produced an interesting chart of time spent in shopping apps among U.S. consumers using Android devices. The chart below illustrates peak shopping app usage when a user is at home or away from home. Flurry observed:

We shop on our phones when we are out and about during the day, with Shopping app use spiking during the commute time of 9 a.m. and lunchtime at noon. We’re focused on things other than shopping in the afternoon hours (perhaps working to support that shopping habit), but mobile shopping spikes again during prime time at 8 p.m., at home.

ALSO READ: Apple Wins Race for Global Holiday Sales

Is Your Money Earning the Best Possible Rate? (Sponsor)

Let’s face it: If your money is just sitting in a checking account, you’re losing value every single day. With most checking accounts offering little to no interest, the cash you worked so hard to save is gradually being eroded by inflation.

However, by moving that money into a high-yield savings account, you can put your cash to work, growing steadily with little to no effort on your part. In just a few clicks, you can set up a high-yield savings account and start earning interest immediately.

There are plenty of reputable banks and online platforms that offer competitive rates, and many of them come with zero fees and no minimum balance requirements. Click here to see if you’re earning the best possible rate on your money!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.