The short version of the story is that accomplishing something, whether it be buying an item or doing work, has risen to the top of mobile app usage growth, far outdistancing the entertainment and games apps that previously led in consumer usage.

Flurry Analytics, a division of Yahoo! Inc. (NASDAQ: YHOO), collected and reported the data, and they include user sessions on Apple Inc. (NASDAQ: AAPL) devices and devices using the Android operating system from Google Inc. (NASDAQ: GOOG). Flurry noted that on Apple’s iOS the lifestyle app category includes more than shopping, and that on Android devices alone, shopping app usage increased by a whopping 220%.

The other app category to post at least a doubling of growth was messaging, with a growth rate of 103% in 2014, slightly below its 115% growth rate in 2013. Music, media and entertainment apps grew at a rate of just 33% and game apps grew at a rate of 30% in 2014.

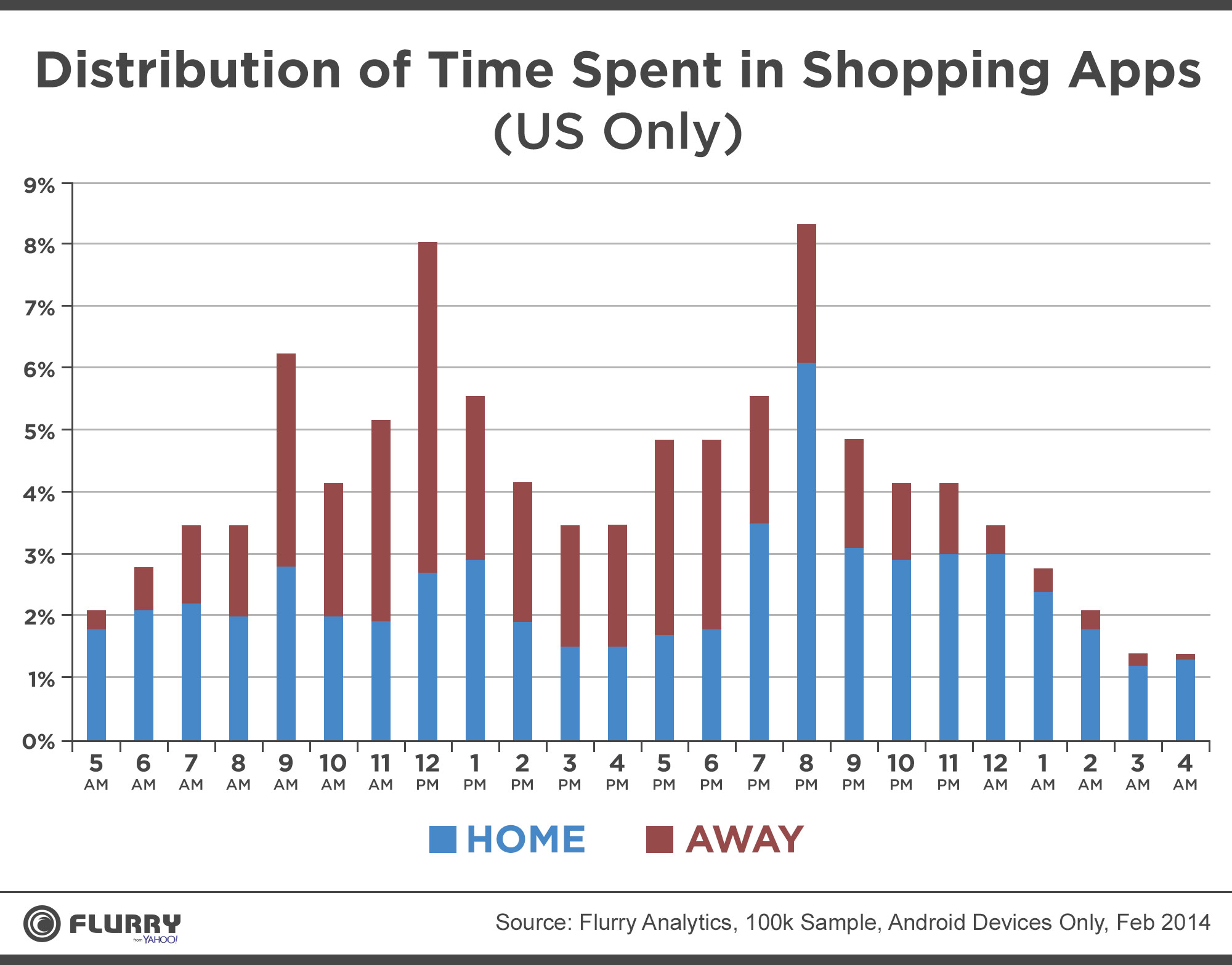

Flurry also produced an interesting chart of time spent in shopping apps among U.S. consumers using Android devices. The chart below illustrates peak shopping app usage when a user is at home or away from home. Flurry observed:

We shop on our phones when we are out and about during the day, with Shopping app use spiking during the commute time of 9 a.m. and lunchtime at noon. We’re focused on things other than shopping in the afternoon hours (perhaps working to support that shopping habit), but mobile shopping spikes again during prime time at 8 p.m., at home.

ALSO READ: Apple Wins Race for Global Holiday Sales

The #1 Thing to Do Before You Claim Social Security (Sponsor)

Choosing the right (or wrong) time to claim Social Security can dramatically change your retirement. So, before making one of the biggest decisions of your financial life, it’s a smart idea to get an extra set of eyes on your complete financial situation.

A financial advisor can help you decide the right Social Security option for you and your family. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you.

Click here to match with up to 3 financial pros who would be excited to help you optimize your Social Security outcomes.

Have questions about retirement or personal finance? Email us at [email protected]!

By emailing your questions to 24/7 Wall St., you agree to have them published anonymously on a673b.bigscoots-temp.com.

By submitting your story, you understand and agree that we may use your story, or versions of it, in all media and platforms, including via third parties.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.