Consumer Electronics

Apple's iPhone X March Quarter Sales Slipped

Published:

Last Updated:

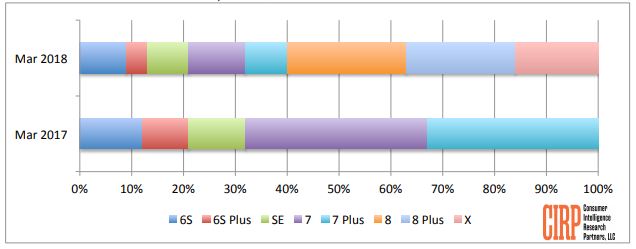

In the fourth calendar quarter of 2017, sales of the iPhone X accounted for 20% of all U.S. iPhone sales. In the first calendar quarter of 2018, the Apple Inc. (NASDAQ: AAPL) flagship smartphone accounted for 16% of all U.S. iPhone sales.

Sales of the iPhone 8 and 8 Plus picked up most of the slack, drawing 44% of first-quarter sales and 41% of fourth-quarter 2017 sales.

According to Josh Lowitz of Consumer Intelligence Research Partners (CIRP), this may not be especially good news for Apple:

This first calendar quarter typically represents baseline demand for iPhones, after the initial launch surge and before any slowdown as buyers begin to anticipate new models. After the initial excitement over the iPhone X features, the highest priced flagship appears to have settled into a smaller share of sales.

This chart from CIRP compares sales by model in the March quarters of 2017 and 2018.

At the end of the March 2017 quarter, the flagship iPhone 7 and 7 Plus phones each accounted for more than 30% of total U.S. sales and nearly 70% of total iPhone sales in the quarter. The two models accounted for nearly 20% of sales in the quarter just ended. CIRP’s Mike Levin noted:

The year-old iPhone 7 and 7 Plus accounted for almost one-fifth of sales, and the two-year old iPhone 6S and 6S Plus had 13% of sales. Even the SE held its own at 8%, down slightly from 11% in the year-ago quarter, and actually up slightly over the December 2017 quarter. With eight models available, and the newest ones costing close to $1,000, consumers appear to want older, cheaper models that have many of the same features.

CIRP calculates that the U.S. weighted average retail price for the March 2018 quarter was $746, down from $766 in the December 2017 quarter but up from $707 in the March 2017 quarter. That indicates that Apple should be reporting a lower average selling price when it reports quarterly earnings on May 1.

Apple stock traded down about 0.5% Monday afternoon, at $164.84 in a 52-week range of $142.20 to $183.50. The 12-month price target on the stock is $192.94.

The Average American Is Losing Momentum on Their Savings Every Day (Sponsor)

If you’re like many Americans and keep your money ‘safe’ in a checking or savings account, think again. The average yield on a savings account is a paltry .4%* today. Checking accounts are even worse.

But there is good news. To win qualified customers, some accounts are paying nearly 10x the national average! That’s an incredible way to keep your money safe and earn more at the same time. Our top pick for high yield savings accounts includes other benefits as well. You can earn up to 3.80% with a Checking & Savings Account today Sign up and get up to $300 with direct deposit. No account fees. FDIC Insured.

Click here to see how much more you could be earning on your savings today. It takes just a few minutes to open an account to make your money work for you.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.