Consumer Electronics

Low-Income Americans Still Lag in Internet, Smartphone Adoption

Published:

Last Updated:

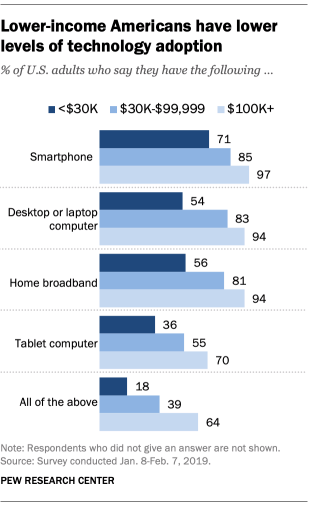

Nearly a third (29%) of Americans with household incomes below $30,000 a year do not own a smartphone, and 44% do not have home broadband service, while 46% don’t own a laptop or desktop computer. Among Americans with annual household incomes of $100,000 or more, more than 90% have all three, with 97% owning a smartphone.

Tablet ownership is lower among all income levels, with 36% of low-income households owning one of the devices compared with 70% of high-income households. Only 18% of low-income households own all four devices, while nearly two-thirds (64%) of high-income households own all four.

The data was reported Tuesday by Pew Research Center and is based on a survey conducted earlier this year of 1,502 adults in all 50 states and the District of Columbia. The following chart represents the results graphically and includes data for households earning between $30,000 and $99,999 in income.

Low-income Americans rely more heavily on their smartphones than do households with middle and high incomes. More than a quarter (26%) of low-income households own only a smartphone and do not have broadband access in their homes. That percentage has more than doubled since 2016, when only 12% of low-income households owned a smartphone but had no broadband service. Only 5% of high-income households in 2019 own only a smartphone and have no broadband access, compared with 4% in 2013.

Partly that rising difference among low-income households may be due to the increasing power of smartphones that can now handle many of the tasks once limited to traditional computers. A 2014 Pew Research survey found that low-income smartphone users are significantly more likely (32% compared to 7% of high-income households) to use their smartphones to search and apply for jobs. More than half (51%) used their smartphones for online banking, compared with 62% of households with incomes greater than $75,000.

The so-called digital divide between low-income and high-income households is closing slowly. As smartphones have become more powerful and versatile (and cheaper), the devices are replacing traditional computers that require not only a relatively expensive piece of hardware but a broadband connection. On top of that, computers and broadband connections are not terribly portable.

If a household can afford just one device, a smartphone is a logical choice, even among households with school-age children, where a Pew Research study completed in 2016 found that 35% of low-income households did not have broadband access. However, an equal percentage uses public library computers and internet connections.

Federal Communications Commission (FCC) chair Ajit Pai has committed the agency to bringing broadband internet access to low-income and rural communities, but how low-income Americans will pay for that and the hardware necessary to use it is unclear. Pai’s also proposed expanding 4G/LTE wireless coverage to “all parts of the country.” That’s a good thing, certainly, and is likely to drive even higher the percentage of low-income Americans who own only a smartphone.

Retirement planning doesn’t have to feel overwhelming. The key is finding expert guidance—and SmartAsset’s made it easier than ever for you to connect with a vetted financial advisor.

Here’s how it works:

Why wait? Start building the retirement you’ve always dreamed of. Click here to get started today!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.