Apple Inc. (NASDAQ: AAPL) has released the new generation of its smartwatch product, which it calls Series 6. It has several features that may get people to upgrade from their current versions, or buy the first Apple Watch they have ever owned. The products need to sell extremely well to lift the growth in sales of the product, which is expected to be far below the global increase in smartwatch sales this year.

[in-text-ad]

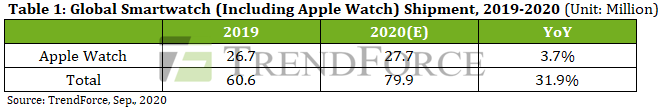

Carefully followed figures from TrendForce, which tracks consumer electronic sales, show that of the 79.9 million smartwatches that will be shipped this year, Apple will sell 27.7 million. Apple’s figure for 2020 will be up only 3.7% from the 2019 level. The global total will be up 31.9%.

In raw numbers, Apple Watch shipments will rise by a million this year compared to last, according to the estimate. Total smartwatch shipments will be up 19.3 million.

While Apple is the industry leader base on units, it has a formidable competitor in Samsung, the world’s largest consumer electronics company. Several smaller companies have modest market share. Most, like FitBit, also have modest financial prospects, but they take market share nevertheless.

Available research gives no reasons for the Apple growth slowdown. The launch of a new model often accelerates sales. Among the causes may be the Apple Watch carries a price at the high end of the industry. Another may be that the smartwatch market is already saturated. Whatever the reason, Apple has started to fall behind in an industry it hopes to dominate.

In 20 Years, I Haven’t Seen A Cash Back Card This Good

After two decades of reviewing financial products I haven’t seen anything like this. Credit card companies are at war, handing out free rewards and benefits to win the best customers.

A good cash back card can be worth thousands of dollars a year in free money, not to mention other perks like travel, insurance, and access to fancy lounges.

Our top pick today pays up to 5% cash back, a $200 bonus on top, and $0 annual fee. Click here to apply before they stop offering rewards this generous.

Flywheel Publishing has partnered with CardRatings for our coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.