This story was updated for live coverage throughout the day…. with 6 updates…. Groupon Inc. (NASDAQ: GRPN) not only made it to the public market, but it managed to come at a premium. The bulls will say the higher price is a win, but the bears will say this is close to half of what the company wanted to originally be valued at. The social-couponing website priced its shares at $20.00 per share rather than the $16.00 to $18.00 most recent range.

This story was updated for live coverage throughout the day…. with 6 updates…. Groupon Inc. (NASDAQ: GRPN) not only made it to the public market, but it managed to come at a premium. The bulls will say the higher price is a win, but the bears will say this is close to half of what the company wanted to originally be valued at. The social-couponing website priced its shares at $20.00 per share rather than the $16.00 to $18.00 most recent range.

This was, and remains, one of our top 17 IPOs of 2011. Unfortunately, there are caveats here.

The company also added on 5 million more shares due to demand, making for a total of about 35 million shares. Investors need to know that this $700 million raised compares to a valuation of about $12.7 billion. There is also the multi-class issue of common stock that further limit the IPO and after-market investors’ votes and standing.

Groupon claims to have enough cash on hand to fund operations for a year or so, but this has been widely debated. Many feel that the reason it was so set on coming public was because it raised close to $1 billion in venture capital and it now has no choice but to come public.

Some investors have even pointed out that Groupon had a balance of $465.6 million owed to its merchant partners.

Our concerns run far deeper than the market’s regardless of how of a premium this trades at. Groupon did not invent the social networking arena. It did not invent traditional coupons and it did not invent online coupons. It has nothing unique in its model other than having a highly paid salesforce. In short, there are just zero barriers to entry and living by the daily deal is a sword which can cut both ways.

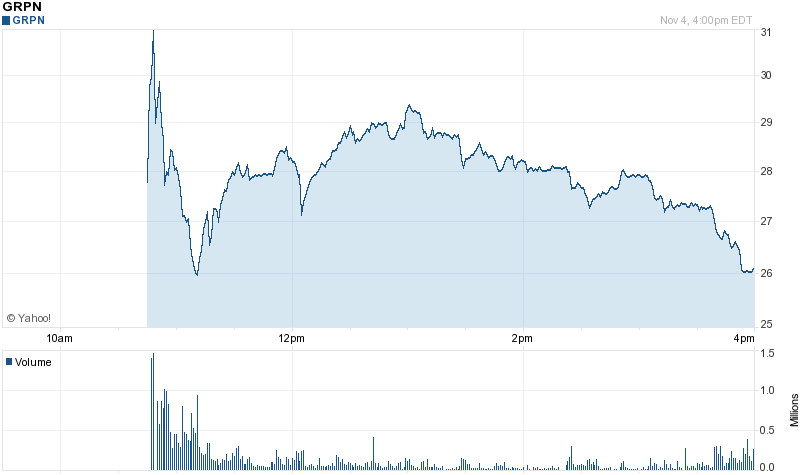

- UPDATED FOR THE CLOSE: Groupon shares closed up $6.11 at $26.11 on more than 49 million shares. Be advised that this means most investors and speculators who bought during the day in the after-market are now down because the low of the day was $25.90 and the close of $26.11 was down from a high above $31.00. See the intraday stock chart from Yahoo! Finance.

- UPDATED at 10:49 AM EST: Shares have opened for trading and we have already seen 9 million shares trade in a range of $27.00 to $31.14 and the last print was just above $30.00. We noted the concerns we have, and those are regardless of the premium this trades at in the after-market. If you were given shares at the IPO, lucky you. If not, let’s just say that Groupon is not exactly a suitable investment for widows and orphans.

- UPDATED at 11:02 AM EST: Groupon has traded 19.1 million shares and the last price seen was $27.21.

- UPDATED at 11:05 AM EST: Go ahead and consider the float as being over 40 million shares rather than the 35 million in the IPO. The underwriters have a 30-day overallotment option to purchase up to an additional 5,250,000 shares of Class A common stock. This premium is large enough and the after-market trading is easily active enough to indicate that this overallotment option is being exercised.

- UPDATED at 11:59 AM EST: Almost the entire original float has traded… 30.7 million shares and the last trade was up at $28.22.

- UPDATED at 1:03 PM EST: Groupon shares are up at $29.26 and we have now seen some 37 million shares trade hands.

The underwriting syndicate is huge. Groupon’s lead book-running managers are Morgan Stanley, Goldman Sachs, and Credit Suisse. Additional book-runners are Allen & Company, BofA Merrill Lynch, Barclays Capital, Citigroup, Deutsche Bank Securities, J.P. Morgan Securities, Wells Fargo Securities, and William Blair & Company. The listed co-managers are Loop Capital Markets, RBC Capital Markets, and The Williams Capital Group.

JON C. OGG

Credit Card Companies Are Doing Something Nuts

Credit card companies are at war. The biggest issuers are handing out free rewards and benefits to win the best customers.

It’s possible to find cards paying unlimited 1.5%, 2%, and even more today. That’s free money for qualified borrowers, and the type of thing that would be crazy to pass up. Those rewards can add up to thousands of dollars every year in free money, and include other benefits as well.

We’ve assembled some of the best credit cards for users today. Don’t miss these offers because they won’t be this good forever.

Flywheel Publishing has partnered with CardRatings for our coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.