The beer business is good, particularly for smaller breweries. While industry giants like Anheuser-Busch InBev S.A./N.V. (NYSE: BUD) press to keep sales of huge brands stable, particularly Budweiser, the number of much more modestly sized brewers is exploding and hit 4,269 in the United States last year.

According to the Brewers Association (BA):

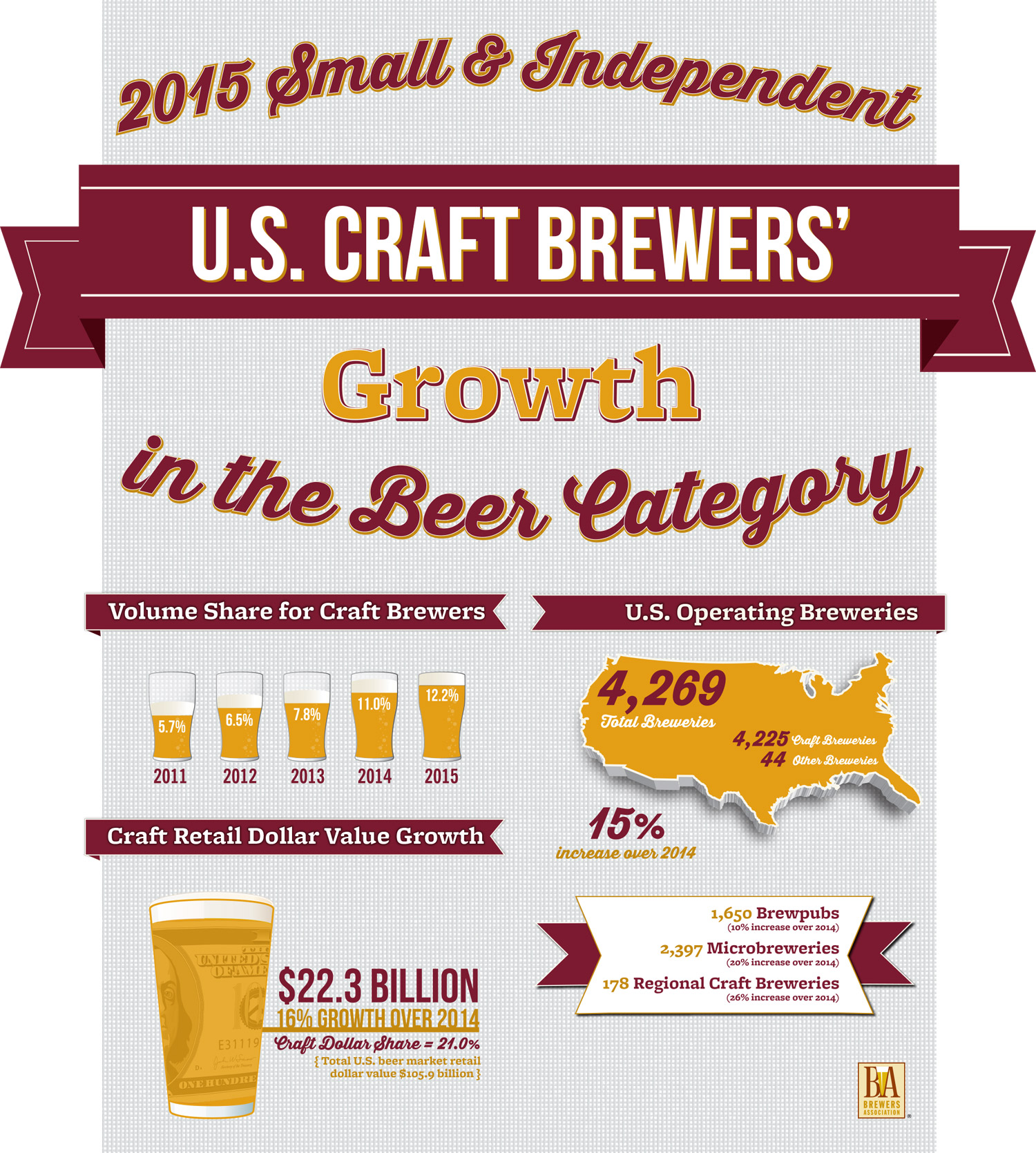

With more breweries than even before, small and independent craft brewers now represent 12 percent market share of the overall beer industry.

In 2015, craft brewers produced 24.5 million barrels, and saw a 13 percent rise in volume3 and a 16 percent increase in retail dollar value. Retail dollar value was estimated at $22.3 billion, representing 21 percent market share.

In total, the industry has a modest but growing place in the economy, and it employs as many people as a large American company:

Small and independent breweries account for 99 percent of the breweries in operation, broken down as follows: 2,397 microbreweries, 1,650 brewpubs and 178 regional craft breweries. Throughout the year, there were 620 new brewery openings and only 68 closings. One of the fastest growing regions was the South, where four states—Virginia, North Carolina, Florida and Texas—each saw a net increase of more than 20 breweries, establishing a strong base for future growth in the region. Combined with already existing and established breweries and brewpubs, craft brewers provided nearly 122,000 jobs, an increase of over 6,000 from the previous year.

It is not clear what the reasons are for the improvement in the four large southern states, except that an increase of 20 net breweries in states with high populations may not mean much.

Travel Cards Are Getting Too Good To Ignore (sponsored)

Credit card companies are pulling out all the stops, with the issuers are offering insane travel rewards and perks.

We’re talking huge sign-up bonuses, points on every purchase, and benefits like lounge access, travel credits, and free hotel nights. For travelers, these rewards can add up to thousands of dollars in flights, upgrades, and luxury experiences every year.

It’s like getting paid to travel — and it’s available to qualified borrowers who know where to look.

We’ve rounded up some of the best travel credit cards on the market. Click here to see the list. Don’t miss these offers — they won’t be this good forever.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.