Companies and Brands

How Beyond Meat May Change the Way Americans Eat

Published:

Last Updated:

The wildly successful public stock offering of Beyond Meat has introduced many Americans to the idea of meat substitutes made from a variety of plant-based components. Meat substitutes are not a brand new development (tofu has been around for centuries), but there’s nothing like star power, and Beyond Meat definitely has that.

Partly that’s a result of being first out of the chute and partly because the success of the company’s products took most investors and consumers by surprise. Beyond Meat’s startling price run-up has led analysts at Barclays to forecast a global market for meat substitutes of $140 billion worldwide in the next 10 years.

In the United States (and in many other developed countries) the projected growth generally is attributed to two factors. First, some consumers believe that plant-based meat substitutes are healthier than traditional meat products. Second, consumers are becoming more aware of the environmental impacts of raising and eating meat. While both are arguable, here we focus on the second factor.

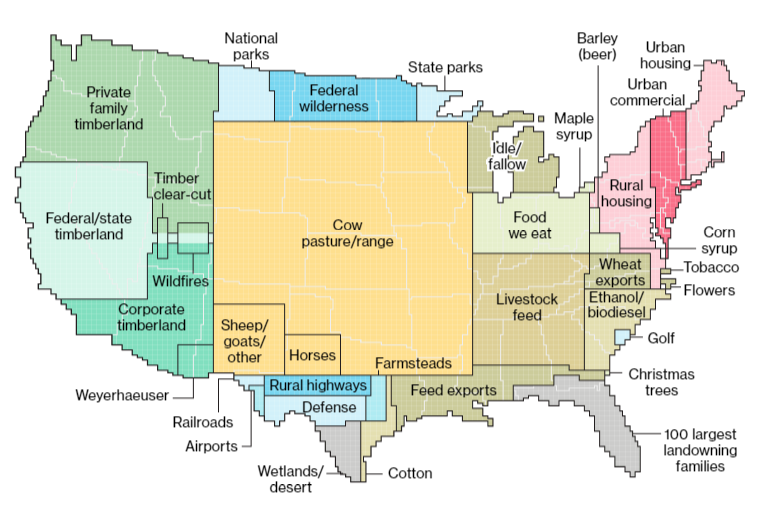

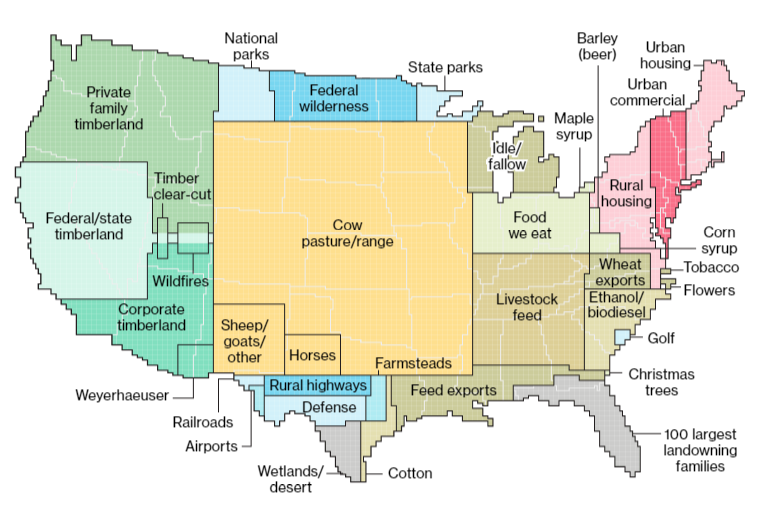

The following map from a Bloomberg report last year on U.S. land use shows just how much land is dedicated to rangeland and pasture. Just over 40% of all the land in the Lower 48 states is used to graze and feed livestock. There’s another large block dedicated to land used to raise feed for livestock and a much smaller block dedicated to land used to grow foods that people eat. Most of the grazing land and land used to grow livestock feed is the result of Americans’ love for beef.

The World Resources Institute, a Washington, D.C.-based nonprofit, noted the intense pressure that raising beef puts on the global environment: “Beef production requires about seven times more land and emits seven times more greenhouse gases as chicken per gram of protein. (A shift toward plant-based foods would be even better for the environment: beef production is 20 times as land- and greenhouse gas-intensive as beans, for example.)”

Beef consumption has declined by about a third since reaching a peak in the mid-1970s, while chicken consumption has doubled. Pork consumption has remained relatively flat. The switch from beef to chicken reduced total U.S. diet-related greenhouse gas emissions by about 10% between 2005 and 2014, according to a study cited by the World Resources Institute.

Now, it’s meat substitute producers like Beyond Meat, Impossible Foods, Beyond the Butcher, Gardein, Boca Foods and MorningStarFarms that are dishing out more punishment to U.S. beef producers. Beyond Meat expects to make some $200 million in sales this year — at least this is what analysts are saying about Beyond Meat after earnings. By 2021, total U.S. retail sales of meat, poultry and meat substitutes are expected to reach $100 billion. Of that amount, a 2018 report from consumer market research firm Packaged Facts estimated that less than $2 billion is expected to come from meat substitutes.

That was before the public sale of Beyond Meats’ stock, though. Established food companies like Tyson Foods, Kellogg, Kraft Heinz, Conagra Brands and Nestlé are now either working on their own meat substitutes or investing in smaller companies that have products in development. More products will be hitting the U.S. market, trying to slipstream on the strong interest in meat substitutes that could evaporate at any moment.

Beyond Meat has done a lot of the marketing heavy lifting, so its followers will be challenged only on the quality of their products and how soon they can get to market. If you want to find a parallel, look at Tesla. The company created an entire global marketplace for all-electric vehicles but is struggling to avoid becoming a victim of its own success, like a few other companies.

Moreover, there is now the question of whether Beyond Meat stock has run too far too fast after that spectacular IPO last month. The shares just earned their first analyst downgrade, and it may not be the last.

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.