Companies and Brands

China Trade War Fallout Puts Dark Clouds Over Luxury Goods

Published:

Last Updated:

With an escalation in the trade war between the United States China, the impact is beginning to feel drastic all over again. We have seen these reactions before, but China effectively has devalued its currency to a decade low and recommended that state-owned companies stop buying U.S. agricultural goods. There were even reports over the weekend that Chinese nationals are buying more Huawei smartphones as an act of local patriotism.

The trade war ultimately will hurt everyone, but companies tied to sales of luxury goods are taking it on the chin. Many luxury brands also now manufacture in China, so they may have to deal with tariffs regardless of where they are made. Chinese buyers may opt for domestic brands or even prefer to just buy the so-called knock-offs of those luxury brands, even if the main manufacturing is in China.

24/7 Wall St. has tracked the action and reaction seen in many luxury brands on Monday. The drop has been unilateral and is confirmed by luxury stocks selling off in Europe as well.

Shares of Tiffany & Co. (NYSE: TIF) were trading at $86.92, a drop of $3.16, or 3.5%. Tiffany has mentioned tourist spending and sales to Chinese buyers before, and there is no reason to believe that those trends will not continue as long as the trade war is on.

Ralph Lauren Corp. (NYSE: RL) was down 3.1% at $95.78 a share on Monday. Those Polo shirts and other apparel items may see pressure both ways, from Chinese demand locally and from U.S. tariffs. The stock even hit a 52-week low on Monday.

Tapestry Inc. (NYSE: TPR) is the parent company of Coach, Kate Spade and Stuart Weitzman. Its shares were down 4.7% at $28.36, and the shares almost broke the 52-week range of $27.93 to $54.35.

Sotheby’s (NYSE: BID), the auction-house for anything tied to wealth and extravagance, was down 1.1% at $57.78, despite a proposed sale to BidFair USA (tied to French telecom and media mogul Patrick Drahi) for $57 per share.

Nordstrom Inc. (NYSE: JWN), the upscale department store retailer that is having turnaround woes, was down 3.7% at $29.61, in a 52-week range of $28.23 to $67.75.

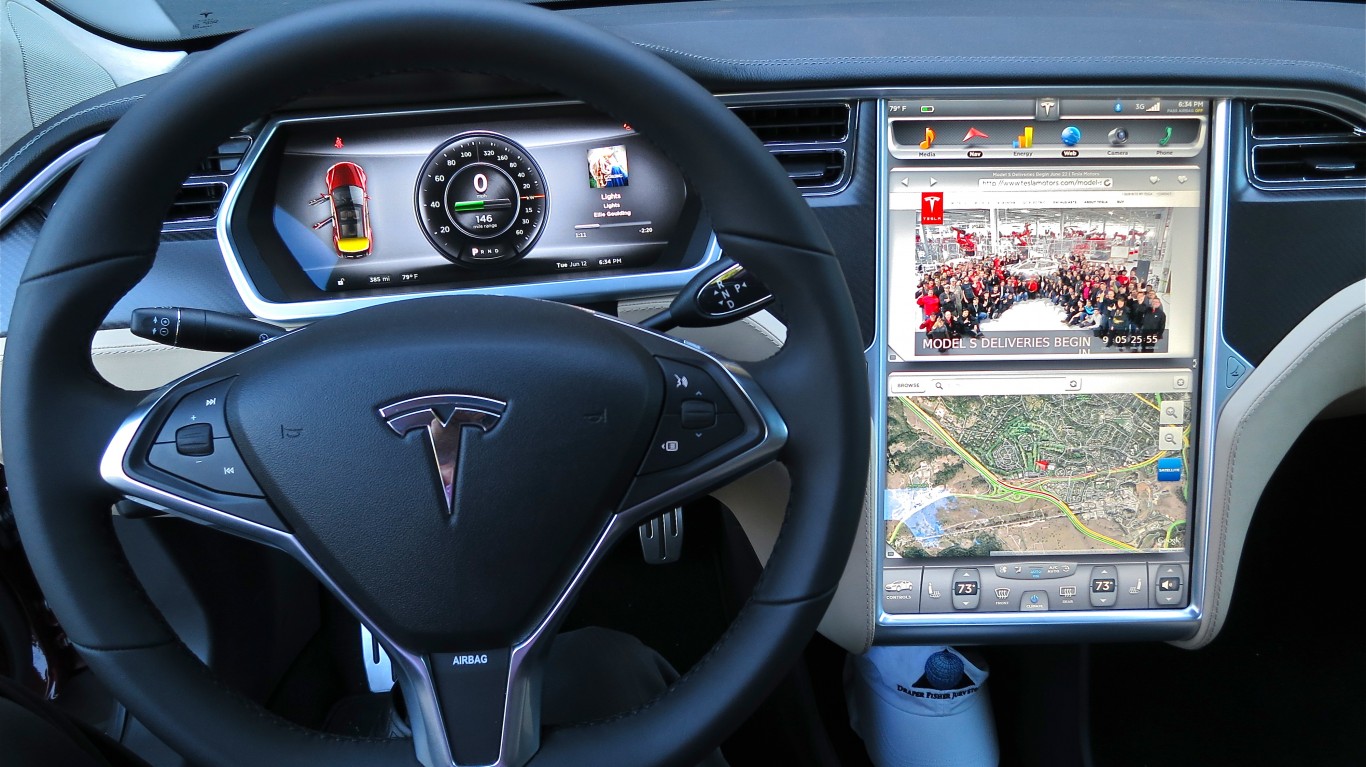

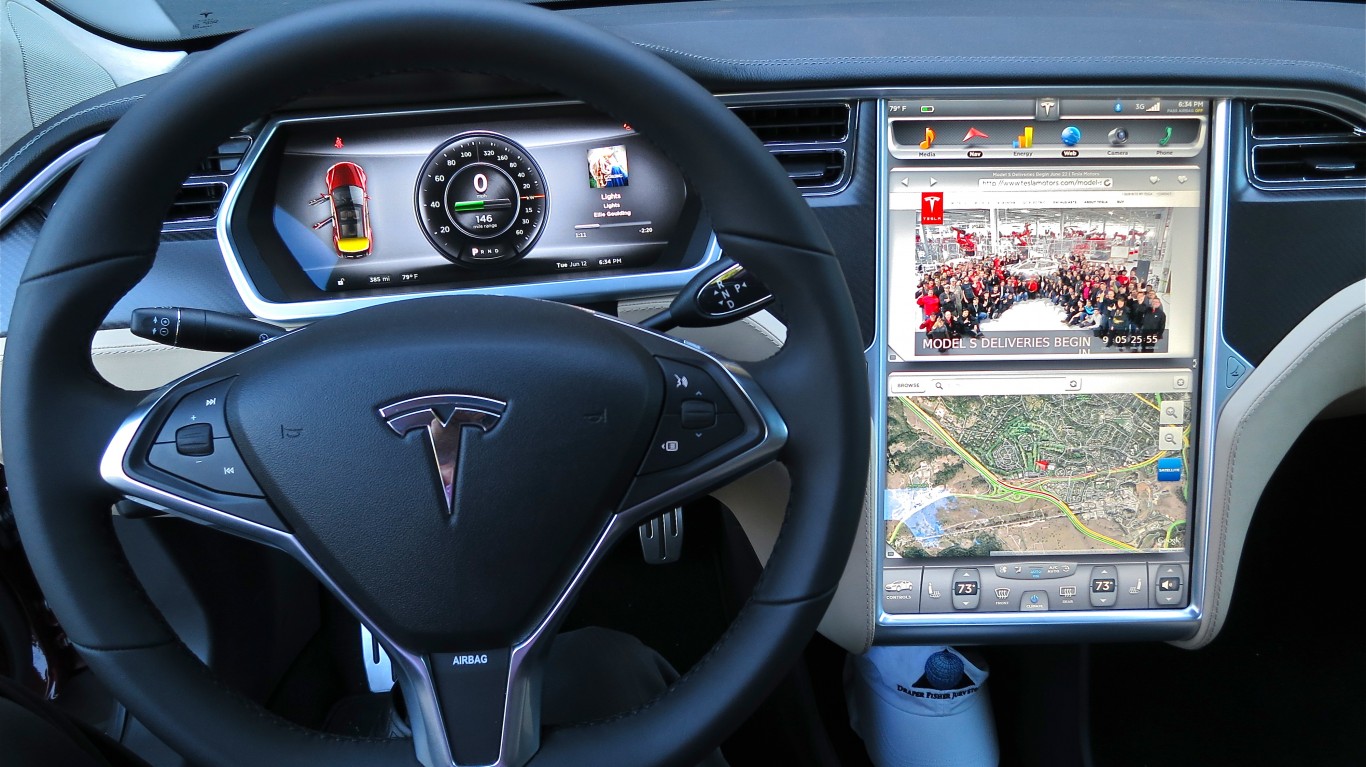

Tesla Inc. (NASDAQ: TSLA) may be growing its U.S. distribution, but if this electric car isn’t considered a luxury in China, compared with the drastically cheaper models made there, then nothing else is really luxury either. Tesla shares were down 3.2% at $226.80, in a 52-week range of $176.99 to $387.46.

Apple Inc. (NASDAQ: AAPL) may be a household company in America, but the iPhone, iPad, Apple Watch and Mac are considered to be premium or luxury goods (or even a status symbol) in China. With locals reportedly buying Huawei as a sign of patriotism in China, what does that mean for the obviously American brand? Shares were down 4% at $195.80, in a 52-week range of $142.00 to $233.47.

Lululemon Athletica Inc. (NASDAQ: LULU) may just be in the “athleisure” category, but go into a Lululemon store and ask yourself if it isn’t a luxury purchase. It has been growing its store count in China already, and the company has already said that it wants to expand further in China. Will the fact that it is actually a Canadian company help it? Lululemon was down 2.5% at $174.50 a share, with a 52-week range of $110.71 to $194.25.

Oxford Industries Inc. (NYSE: OXM), the owner of the Tommy Bahama men’s and women’s apparel brand, was down 22.5% at $67.99. Its 52-week range is $63.50 to $96.35.

To show that the move in luxury isn’t just a hit in the United States, Compagnie Financière Richemont of Switzerland was down almost 7% in Swiss equity trading on Monday. Richemont designs and makes luxury jewelry and watchmakers, clothing and accessories. Its list of brands and stores includes Cartier, Van Cleef & Arpels, Piaget, Montblanc, Dunhill and more.

In France, LVMH Moët Hennessy shares slid lower by 3.8% on Monday. Some of its more widely recognized brands and lines from drinks to apparel are Belvedere, Chandon, Château d’Yquem, Dom Pérignon, Glenmorangie, Hennessy, Krug, Moët & Chandon, Veuve Clicquot, Christian Dior, Fendi, Louis Vuitton, Marc Jacobs, Givenchy, Bvlgari, Fred, Hublot, TAG Heuer and so on.

This is all the brands that might be considered “luxury,” and there are many issues beyond just China to consider. That said, even on a day when the Dow Jones industrials were down 2.1% and the S&P 500 was down 2.2%, the drop in luxury shares should speak for itself.

Credit card companies are pulling out all the stops, with the issuers are offering insane travel rewards and perks.

We’re talking huge sign-up bonuses, points on every purchase, and benefits like lounge access, travel credits, and free hotel nights. For travelers, these rewards can add up to thousands of dollars in flights, upgrades, and luxury experiences every year.

It’s like getting paid to travel — and it’s available to qualified borrowers who know where to look.

We’ve rounded up some of the best travel credit cards on the market. Click here to see the list. Don’t miss these offers — they won’t be this good forever.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.