Some initial public offerings are much more publicized than others. Despite the hype or the hope that can be made ahead of time, some highly anticipated unicorn IPOs flop, and some under-the-radar IPOs show massive gains.

Vital Farms Inc. (NASDAQ: VITL) came public on Friday with a price of $22 apiece for 7,812,500 shares, which was corrected in a second release to be just over 9.3 million shares sold. A $171 million (or $205 million) IPO is not among the smallest deals you see, but that certainly is not among the largest and most publicized IPOs of unicorn companies coming to market in a formal IPO.

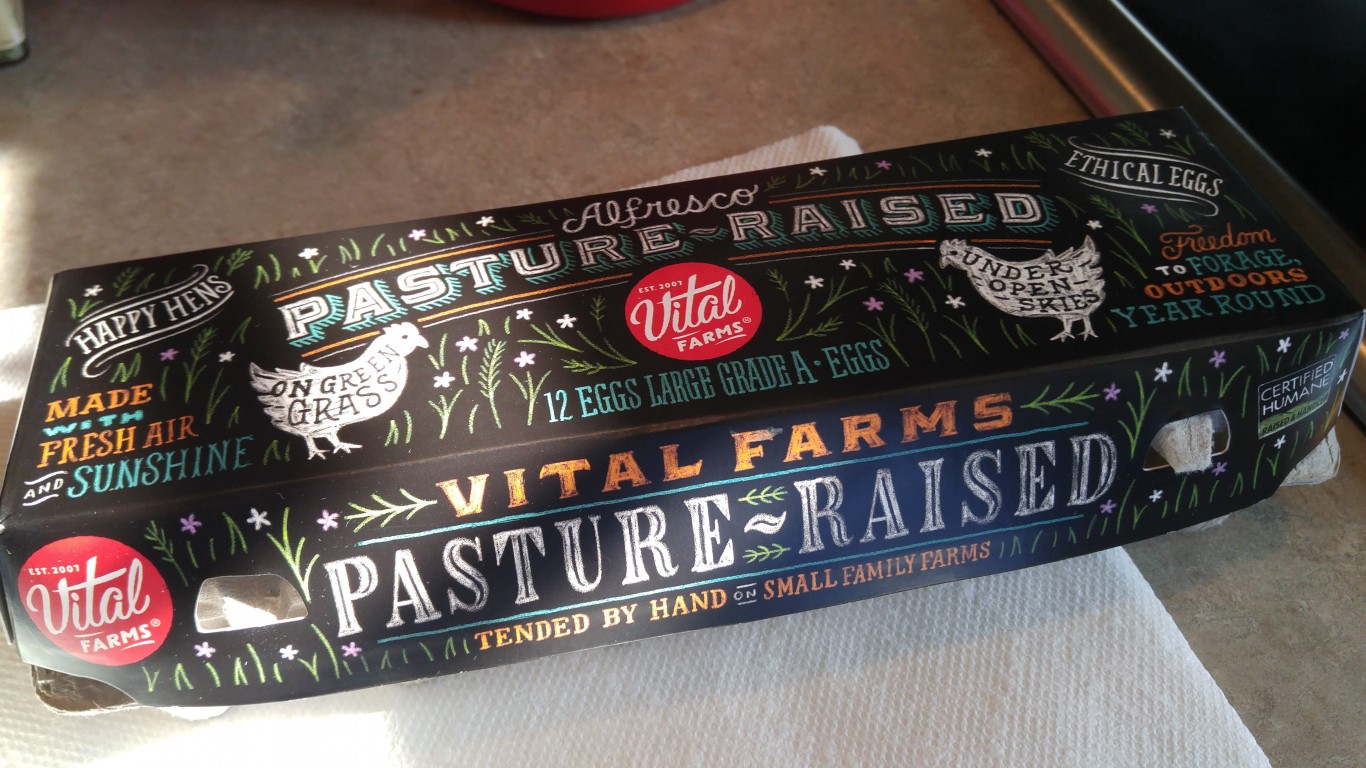

Vital Farms should not have been overlooked at all. The company targets ethically produced food, specifically pasture-raised eggs (shell and liquid) and butter and ghee that are also from pasture-raised animals. Chances are high that you have even seen their egg label in grocery stores. The company’s own release indicated that its products are sold in about 13,000 stores nationwide and its U.S. Securities and Exchange Commission (SEC) filing noted relationships with Albertsons, Kroger, Publix, Target, Walmart and numerous other national and regional food retailers.

A second press release was issued prior to trading. The original indication was that the company itself sold just over 5 million shares of its common stock and the rest (4.263 million) were sold by existing stockholders. Those selling holders also granted the underwriters a 30-day overallotment option to purchase up to an additional 1,395,596 shares. As is the norm, Vital Farms confirmed in its release that the company will not receive any proceeds from those shares that are being sold and may be sold by the selling stockholders.

Vital Farms was not one of the most publicized IPOs, but it was competing against news of the country’s top earnings release from the likes of Apple, Alphabet, Amazon and others. This IPO also happened when the depression-era gross domestic product reading was still front and center in the media. Here is the proof that it should have been given more attention: Vital Farms opened for trading up at $35.00, almost a 50% gain from its formal pricing.

The Austin, Texas-based company had an impressive underwriting group. The joint lead bookrunning managers were listed as Credit Suisse, Goldman Sachs and Morgan Stanley. Other bookrunning managers were BMO Capital Markets, Jefferies and Stifel Nicolaus.

The company’s IPO documentation indicated that 2.5 million households are considered its buyers, with 33% compounded net revenue growth from 2015 to 2019. The SEC filing also indicated that Vital Farms is the number-one pasture-raised egg brand by retail dollar sales ad and that it has a 76% market share in that category. The company has shown that revenues grew steadily each year from $44.6 million in 2015 to $140.7 million in 2019.

As of 12:30 p.m. Eastern Time, Vital Farms had traded 3.6 million shares, with the last price of $35.67.

It’s Your Money, Your Future—Own It (sponsor)

Retirement can be daunting, but it doesn’t need to be.

Imagine having an expert in your corner to help you with your financial goals. Someone to help you determine if you’re ahead, behind, or right on track. With SmartAsset, that’s not just a dream—it’s reality. This free tool connects you with pre-screened financial advisors who work in your best interests. It’s quick, it’s easy, so take the leap today and start planning smarter!

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.